The yen appreciated to the high end of the JPY 155 range this week as the Bank of Japan raised its key policy rate by 25 basis points, lifting it to 0.5%, the highest level since 2008. This upward move, supported by rising inflation—Japan’s core CPI hit 3.6% year-on-year in December—and expectations of wage growth, signaled further monetary tightening ahead. While the BoJ’s hawkish stance highlights growing confidence in Japan’s economic momentum, it also points to potential headwinds for exporters and broader market volatility as global monetary policies diverge.

⏱️ Global Markets in 10 Seconds:

🇺🇸 S&P 500 +3.7% as AI spending fuels optimism 🚀

🇪🇺 Eurozone PMI 50.2 signals manufacturing rebound 📈

🇯🇵 BoJ hikes rates to 0.5%, yen strengthens to 155 range 🎯

🇨🇳 Youth unemployment 15.7%, recovery shows mixed signals ⚠️

🇮🇳 Manufacturing PMI 58, fastest expansion in 6 months 🏭

🔍 The Big Picture

A mixed global picture emerges this week as inflationary pressures, monetary policies, and economic momentum continue to diverge. Central banks are making bold moves, yet growth signals remain fragile in key regions, with stark contrasts between developed and emerging economies.

United States: The S&P 500 rallied 3.7% this week as AI spending announcements boosted optimism, while manufacturing PMI edged up to 50.1, signaling its first expansion in six months. However, consumer sentiment dropped to 71.1, reflecting inflation worries—suggesting confidence remains fragile despite market gains.

International: The Eurozone PMI rose to 50.2, driven by renewed optimism in services, while manufacturing contracted at a slower pace. Meanwhile, the ECB hinted at further rate cuts, reinforcing the region’s need for policy support amid weak demand and sluggish growth.

Emerging Markets: India’s Manufacturing PMI surged to 58, its fastest pace in six months, as new orders and export demand rebounded. Meanwhile, China’s youth unemployment fell to 15.7%, but weak factory activity and lingering trade concerns point to a slower recovery ahead.

⭐️ Research of the week:

Why Diversification Drives Reliability in Capturing Factors

This research from Dimensional Fund Advisors examines how diversification influences the reliability of capturing factor premiums—such as size, value, and profitability—within investment portfolios. It addresses a key question: How does broad diversification improve the consistency of outcomes in an unpredictable market environment?

Why This Analysis Matters:

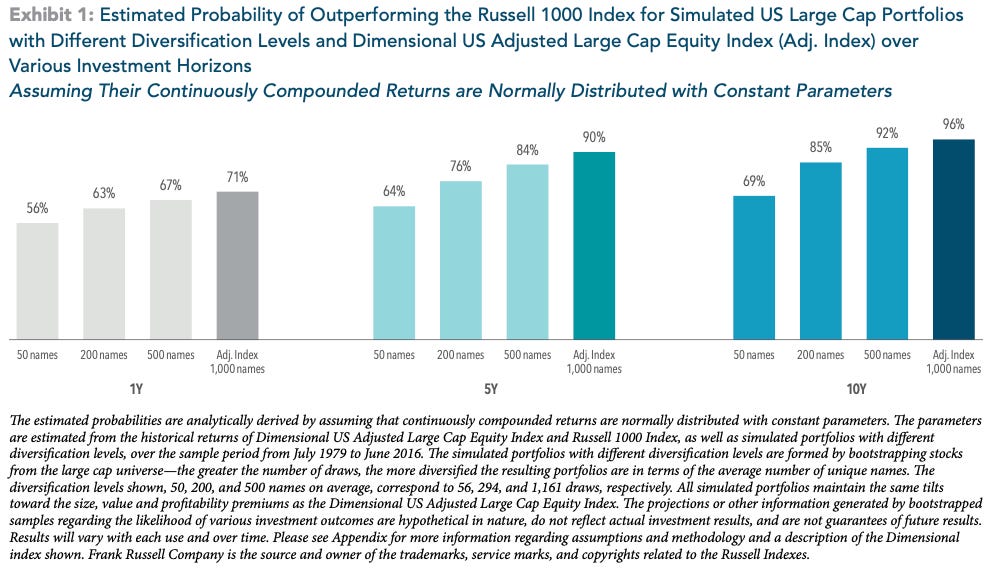

Framework for Reliability: The study uses a probabilistic model to evaluate the likelihood of outperforming the Russell 1000 Index across portfolios with varying levels of diversification, illustrating how broad exposure increases reliability in capturing factor returns.

Challenges Common Assumptions: The findings question the assumption that concentrated portfolios are inherently superior, showing that broader diversification reduces tracking error and increases the likelihood of achieving factor-driven returns.

Deeper Analytical Takeaway: Diversification is not solely about reducing volatility—it is a mechanism for improving the consistency of capturing factor premiums across a wide range of securities.

Main Takeaways :

Increasing Probabilities with Diversification: Simulations show that a portfolio with 50 stocks has a 56% chance of outperforming the benchmark over 1 year, compared to 71% for a portfolio with 1,000 names. Over 10 years, this probability increases to 96% for fully diversified portfolios.

Diversification Reduces Noise: Tracking error steadily declines as portfolios include more stocks, enabling more stable exposure to factors like size, value, and profitability.

Factors Require Broad Coverage: Factor premiums are driven by different stocks at different times, meaning under-diversification increases the risk of missing key contributors to returns and reduces reliability.

Bottom Line:

Dimensional’s research underscores the analytical case for diversification as a critical tool for enhancing reliability in capturing factor-driven returns. Rather than focusing narrowly on specific securities, the findings highlight the role of broad and methodical portfolio design in aligning with long-term objectives.

Source: Dimensional Fund Advisors - How Diversification Impacts the Reliability of Outcomes

💼 Market Indicators

SPY Performance

Performance and Valuations by Region

Source: MSCI

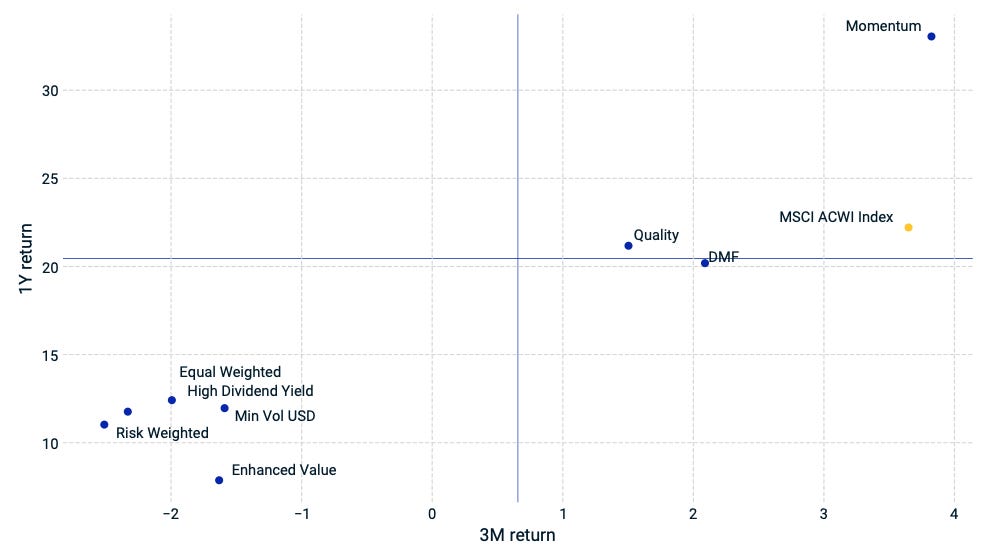

Momentum performance by Style

Source: MSCI

S&P 500 Earnings Per Share

Source: Yardeni Research

🗺️ Around the World in Detail

🇺🇸 United States: Manufacturing Under Pressure

S&P 500 rallies 3.7%: AI-driven optimism and softer trade rhetoric boosted markets, pushing growth stocks to outperform value for the first time this year.

Manufacturing PMI rises to 50.1: After six months of contraction, manufacturing returned to slight expansion, signaling cautious optimism in the sector. This is a key shift that might suggest supply chain issues are stabilizing.

Consumer Sentiment drops to 71.1: The first decline in six months highlights rising inflation expectations and unemployment concerns, hinting at potential pressure on consumer spending.

🌐 International Markets: Diverging Paths

Canada 🇨🇦

Inflation eases to 1.8%: The slowest price growth since September 2022 has solidified expectations for further BoC rate cuts, providing a tailwind for the housing market and retail sectors.

Retail sales rise 1.6%: December’s rebound, the largest since May 2022, shows resilience in consumer spending, particularly in motor vehicles and fuel.

Europe 🇪🇺

Eurozone PMI ticks up to 50.2: Modest growth in services offset a slowing manufacturing sector, suggesting the region is stabilizing, albeit at a sluggish pace.

ECB hints at rate cuts: Policymakers signaled easing measures to address weak demand, reinforcing expectations of gradual rate reductions into 2025.

German confidence stabilizes: Business sentiment improved after six months of declines, reflecting optimism that the worst of the industrial downturn may be over.

United Kingdom 🇬🇧

Unemployment climbs to 4.4%: The labor market softened with the sharpest payroll drop since November 2020, raising questions about the resilience of consumer spending.

Services PMI edges to 51.2: A marginal improvement in services highlights resilience, but falling new orders suggest underlying challenges.

Japan 🇯🇵

BoJ hikes rates to 0.5%: The third increase this year pushed rates to a 17-year high, signaling the central bank’s confidence in economic momentum and wage growth.

🌏 Emerging Markets: Recovery and Risks

China 🇨🇳

Youth unemployment falls to 15.7%: Gradual recovery in the labor market hints at improving confidence, though weak factory activity and export orders point to lingering challenges.

Non-Manufacturing PMI rises to 52.2: The strongest reading since March reflects government stimulus starting to yield results, albeit unevenly.

India 🇮🇳

Manufacturing PMI surges to 58: Factory activity saw its fastest growth in six months, driven by strong domestic and export orders, signaling robust economic momentum.

Input cost inflation retreats: Eased price pressures indicate a more sustainable environment for production growth.

South Korea 🇰🇷

GDP expands 0.1% QoQ: Steady growth despite global challenges was supported by higher semiconductor exports, reaffirming Korea’s resilience in a tech-driven rebound.

Construction investment declines 3.2%: Weakness in building activity raises concerns about the broader economic recovery.

Taiwan 🇹🇼

Retail sales grow 2.9% YoY: Stronger consumer spending on electronics and pharmaceuticals reflects Taiwan’s economic adaptability amidst global uncertainty.

Youth unemployment drops to 11.23%: The lowest rate since 2008 suggests improving job prospects for younger workers, boosting household confidence.

🔑 Key Takeaway

This week’s data highlights the growing importance of diversification as global markets navigate contrasting economic signals. U.S. markets rallied (+3.7% for the S&P 500) on AI-driven optimism and a slight rebound in manufacturing (PMI 50.1), even as consumer sentiment slipped, reflecting inflation concerns.

Meanwhile, Europe’s modest PMI uptick (50.2) was overshadowed by weak demand and the ECB’s signals for further rate cuts, emphasizing policy-driven market movements.

In Asia, Japan’s bold rate hike to 0.5% and China’s gradual recovery underscore the uneven recovery paths in emerging and developed markets.

Dimensional’s research on diversification reinforces the takeaway: capturing factor-driven returns reliably across these varied regional dynamics requires broad exposure and a long-term perspective.

The content provided on MacroQuant Insights is for informational and educational purposes only and does not constitute financial advice. While every effort is made to ensure accuracy and reliability, all data, analysis, and opinions are based on sources believed to be trustworthy but are not guaranteed for completeness or timeliness. The views expressed are solely those of the author and do not reflect endorsements or recommendations for any specific investment, strategy, or action.

Investing involves inherent risks, including the potential loss of principal. Past performance is not indicative of future results. We strongly encourage readers to conduct their own research and consult with a qualified financial advisor or professional before making any financial decisions. MacroQuant Insights and its contributors disclaim all liability for investment decisions based on the information provided and make no warranties regarding the content’s accuracy or reliability.

Remember, all investments carry risks, and it is essential to understand these risks fully before acting on any information presented. Users are responsible for their own investment decisions. MacroQuant Insights assumes no responsibility for any outcomes resulting from the use of this information. Content is subject to change without notice.