Hello MacroQuants! Welcome back to another edition of MacroQuant Insights, where we break down the key economic developments from the past week. This time, we're exploring some significant shifts in inflation, central bank decisions, and market trends that shaped the economic landscape globally. Let's dive in!

🔍 Takeaway

This week’s economic data highlights strong rebounds in U.S. stocks, easing monetary policies in Europe, and continued inflationary pressures in China. Investors are keeping a close watch on potential central bank policy adjustments as global economic conditions evolve.

United States: U.S. stocks rebounded, with the S&P 500 recovering from last week’s losses, driven by strong growth in technology stocks, including NVIDIA. Core inflation ticked up slightly to 0.3% in August, but headline inflation fell to 2.5%, its lowest since early 2021. Treasury yields fell to year-to-date lows, while housing data showed slight improvement, with mortgage rates easing.

International: The ECB cut rates by 25 bps to 3.5% to combat weaker economic growth and slowing inflation in the Eurozone. Japan revised its Q2 GDP growth lower to 2.9% as consumption and capital expenditure weakened. In the UK, the economy stalled for the second month in a row, but unemployment dropped to 4.1%.

Emerging Markets: China’s inflation rose slightly to 0.6%, but core inflation slowed to 0.3%, signaling weak demand. Exports surged by 8.7% in August, but a lower-than-expected rise in imports raised concerns about domestic consumption. India’s inflation increased to 3.65%, driven by higher food prices, while Taiwan and South Korea reported no significant developments this week.

⭐️ Post of the week

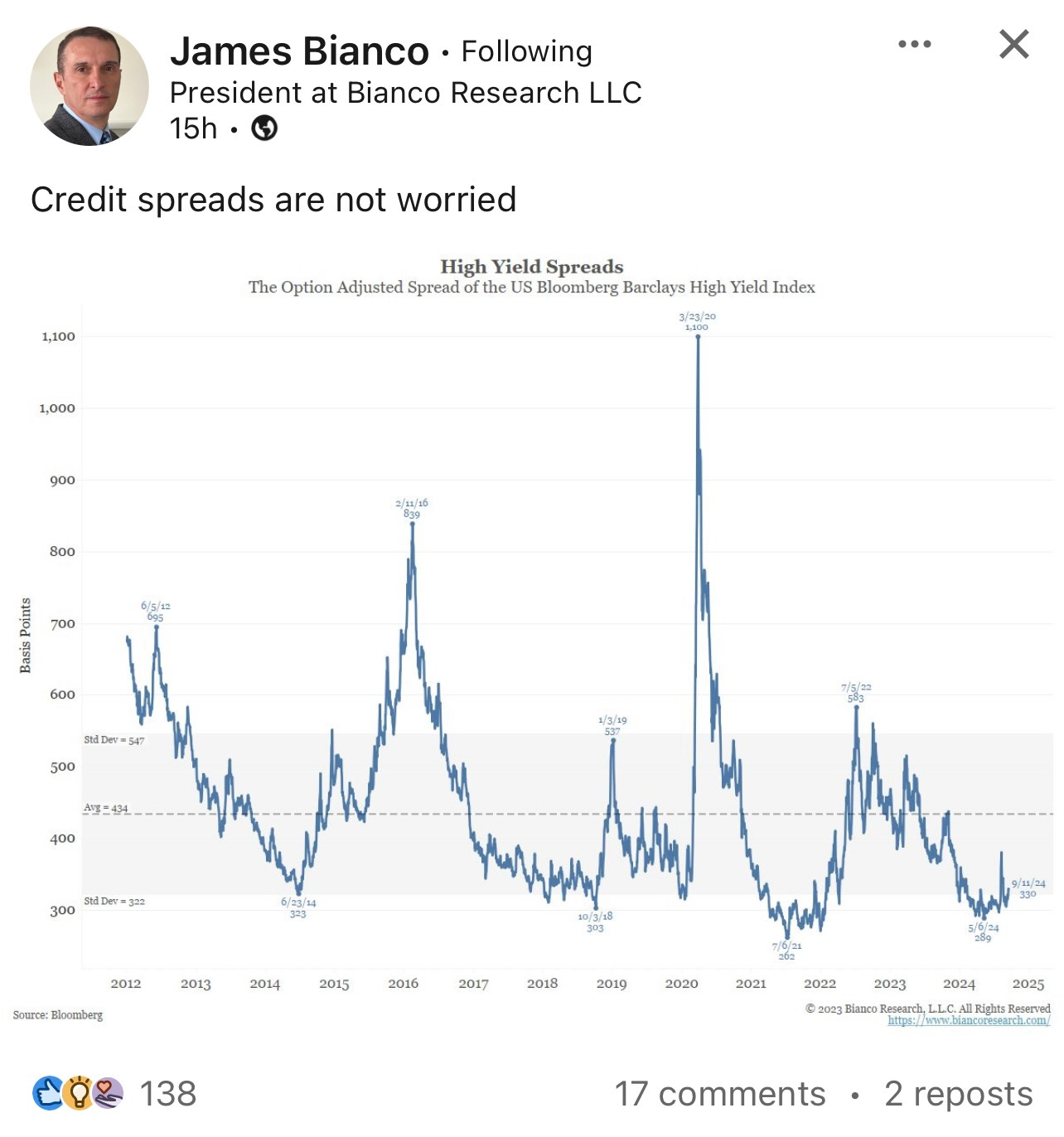

This week's chart focuses on high yield spreads, revealing their current position at historically low levels. This trend highlights the persistent demand for risk assets, even as broader economic uncertainties persist.

For investors, these compressed spreads carry significant implications. While indicative of robust credit market confidence, they also suggest potentially reduced returns and heightened vulnerability to economic shocks. The Federal Reserve's likely initiation of its cutting cycle next week adds another layer of complexity to this landscape. This impending policy shift could reshape risk perceptions and, by extension, spread dynamics. In this environment, investors must carefully weigh the trade-offs between yield-seeking behavior and the need for caution, particularly as monetary policy enters a new phase.

Source: James Bianco - LinkedIn

💼 Market Indicators

SPY Performance

Performance and Valuations by Region

Source: MSCI

Momentum performance by Style

Source: MSCI

S&P 500 Earnings Per Share

Source: Yardeni Research

🇺🇸 United States: Cooling Inflation Amid Mixed Signals

Core Inflation: Core CPI stayed at 3.2% in August, a three-year low, with shelter costs rising 5.2%.

Headline Inflation: Fell to 2.5%, its lowest since February 2021, as energy costs dropped.

Consumer Sentiment: The University of Michigan index climbed to 69, the highest since May, reflecting improving consumer buying conditions.

🌐 International: Central Banks Act and Growth Slows

🇯🇵 Japan:

GDP Growth: Japan’s GDP grew by 0.7% in Q2 2024, supported by strong wage gains and recovery in the automotive sector.

Business Investment: Business investment rose 0.8%, slightly below the preliminary estimate of 0.9%.

🇪🇺 Euro Area:

Interest Rates: The ECB cut its deposit rate by 25 bps to 3.5%, signaling continued monetary easing.

Inflation Projections: ECB inflation projections remain steady at 2.5% for 2024, but core inflation is expected to decline to 2.0% by 2026.

🇬🇧 United Kingdom:

Unemployment Rate: The UK’s unemployment rate dropped to 4.1% between May and July 2024, driven by a 265K surge in full-time employment.

GDP Growth: The British economy stalled in July 2024, remaining flat for the second consecutive month, below expectations of a 0.2% increase.

🇨🇦 Canada:

No major updates this week.

🌏 Emerging Markets: Mixed Signals in Growth and Inflation

🇨🇳 China:

Inflation: Annual inflation in China edged up to 0.6% in August, driven by a sharp rebound in fresh vegetable prices (+2.8%).

Retail Sales: Retail sales slowed to 2.1% YoY in August, missing market expectations of 2.5% due to weather-related disruptions.

🇮🇳 India:

Inflation: India’s inflation rate increased to 3.65% in August, with food prices rising 5.66%, largely due to higher costs for pulses and vegetables.

CPI: The monthly Consumer Price Index remained flat in August, compared to July's slight rise.

🇰🇷 South Korea & 🇹🇼 Taiwan:

No major updates this week.

Stay tuned for next week's updates! Feel free to share your thoughts or questions below.