Weekly Economic Highlights

Week Ending August 10, 2024

Welcome back to MacroQuant Insights! This week, we’re diving into the most impactful economic events across the globe.

🔍 Takeaway

This week’s economic data paints a mixed picture across major economies:

United States: The US shows signs of a cooling labor market with rising unemployment and a moderate rebound in services activity, though inflationary pressures persist.

International: Central banks in Japan and the UK are making cautious adjustments to monetary policy amid mixed economic signals, while the Euro Area experiences modest growth with persistent inflationary pressures.

Emerging Markets: China sees a modest rise in inflation and a slowing trade surplus, while Taiwan shows rising inflationary pressures despite growth, and India's central bank maintains its policy stance to manage inflation.This week’s economic data paints a mixed picture across major economies:

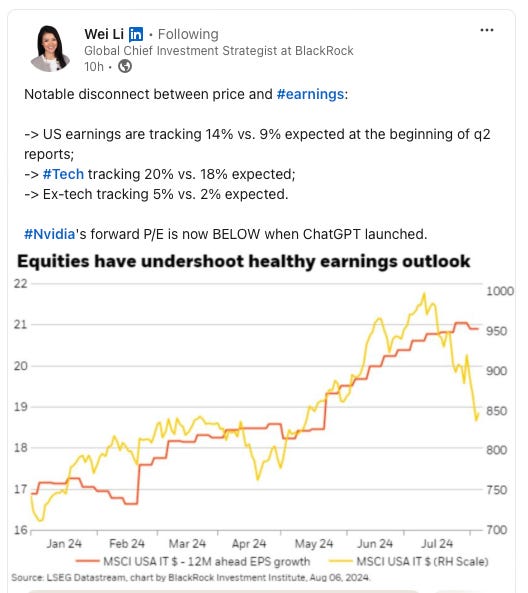

⭐️ Post of the week

Source: Wei Li - LinkedIn

💼 Market Indicators

SPY Performance

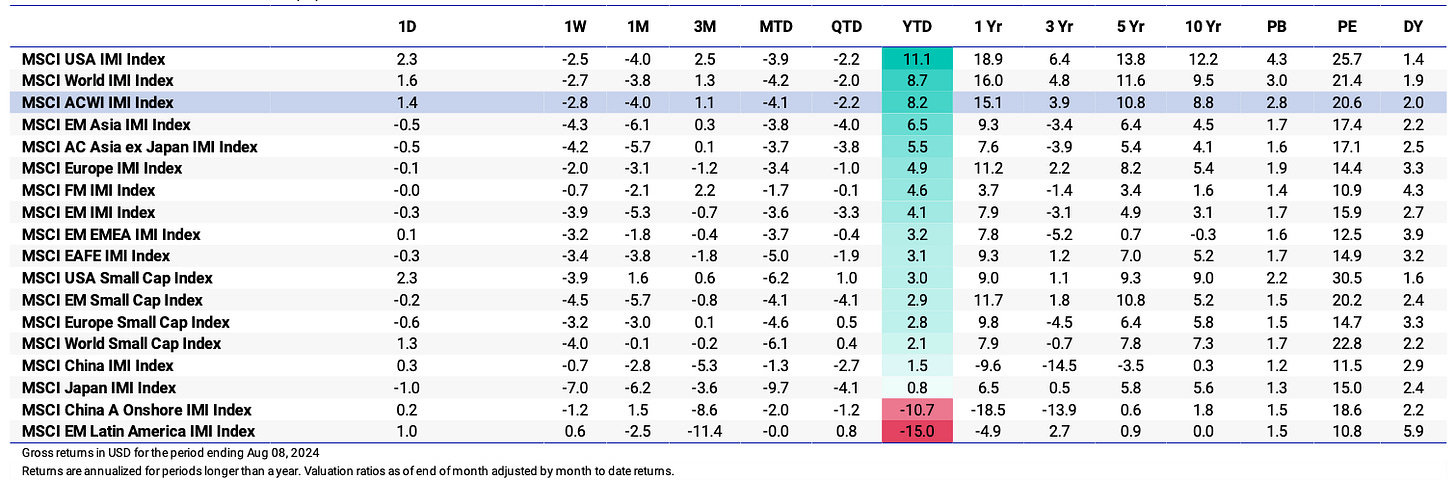

Performance and Valuations by Region

Source: MSCI

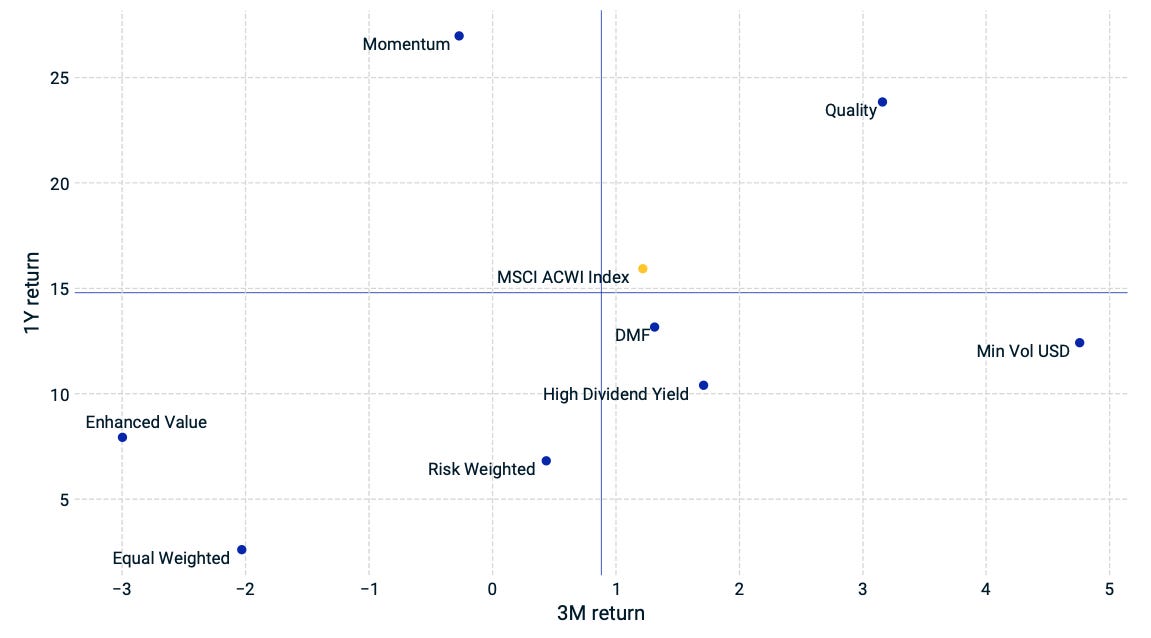

Momentum performance by Style

Source: MSCI

🇺🇸 United States: Recovery Amidst Softening Labor Market

ISM Services PMI: Rose to 51.4 in July 2024, rebounding from 48.8 in June, signaling a moderate recovery in services activity. New orders surged (52.5 vs. 47.3), and employment levels rose (51.1 vs. 46.1).

Unemployment Claims: Fell by 17K to 230K for the week ending August 3rd, below expectations, yet remaining above this year’s average. Continued claims increased to 1,875K, the highest since

🌐 International: Mixed Economic Signals Across Major Economies

🇨🇦 Canada:

Unemployment Rate: Held steady at 6.4% in July 2024, defying expectations of a rise, though labor market softness persists.

Employment Data: A marginal decline of 2.8K jobs, with part-time employment down by 64K but full-time roles increasing by 62K.

Ivey PMI: Eased to 57.6 in July, marking slower economic growth and a dip in the prices index to 59.2.

🇯🇵 Japan:

Bank of Japan Rate Hike: Raised the key short-term interest rate to 0.25%, signaling a shift toward normalizing monetary policy. GDP growth forecast for 2024 was cut to 0.6%.

🇬🇧 United Kingdom:

S&P Global UK Services PMI: Rose slightly to 52.5 in July 2024, indicating ongoing expansion in the services sector, driven by strong demand and increased employment.

🇪🇺 Euro Area:

Retail Sales: Fell by 0.3% in June 2024, reflecting weaker consumer demand, especially in food and non-food products.

HCOB Eurozone Services PMI: Dropped to 51.9 in July 2024, the slowest growth in services activity since March, with softer domestic demand and slowed job creation.

🌏 Emerging Markets: Varied Economic Performance

🇨🇳 China:

Inflation: Climbed to 0.5% in July 2024, the highest since February, driven by food prices stabilizing and sustained increases in non-food categories.

Trade Surplus: Widened to USD 84.65 billion in July 2024, despite slower-than-expected export growth (7% YoY).

🇮🇳 India:

RBI Policy: Held the repo rate at 6.5%, aligning with efforts to manage inflation, which accelerated to 5.08% in June 2024, and sustained economic growth forecasts.

🇹🇼 Taiwan:

Inflation Rate: Increased to 2.52% in July 2024, with food prices and housing costs driving the highest inflation rate since February.

Stay tuned for next week's updates! Feel free to share your thoughts or questions.