This week, we dive into significant economic events across the U.S., International markets, and Emerging Markets. There are new developments in inflation, manufacturing, and GDP growth, setting the stage for a dynamic economic outlook.

🔍 Takeaway

This week’s global economic developments were marked by optimism as China unveiled robust stimulus measures, boosting market sentiment and driving record highs in U.S. stocks. The combination of supportive fiscal and monetary policies in China, alongside a cooling inflationary outlook in the U.S., contributed to stronger investor confidence.

United States: The S&P 500 and Dow Jones Industrial Average hit record highs, driven by China’s stimulus plans and optimism in the technology sector. Chipmakers like NVIDIA and Micron led the gains, buoyed by reports of rising AI demand. Meanwhile, the U.S. core PCE inflation rate edged up by just 0.1% in August, signaling that inflation is nearing the Fed’s target, reinforcing hopes for a continued slowdown in price pressures.

International: European markets rebounded, with Germany’s DAX surging 4.03% as investors anticipated rate cuts amid slowing business activity. The Eurozone’s Composite PMI fell to 48.9, indicating a contraction in economic activity, while UK business activity expanded for the 11th consecutive month, albeit at a slower pace.

Emerging Markets: China’s sweeping stimulus package, including a 50bps cut in the reserve requirement ratio and further rate reductions, fueled a historic rally in Chinese stocks, with the CSI 300 gaining 15.7%. However, longer-term growth concerns persist despite the short-term boost.

⭐️ Post of the week

This week's chart highlights the global liquidity index, which has recently begun to rebound after a period of significant contraction. The index suggests a cyclical pattern, as evidenced by the long-term liquidity cycle, which continues to shape global financial conditions.

For investors, the resurgence of global liquidity has notable implications. The recent rate cuts by central banks, including the Fed, ECB, and BoC, have injected liquidity into the markets, potentially supporting risk assets in the near term. However, with this influx of liquidity comes the risk of heightened inflationary pressures and market volatility. As global liquidity continues to rise, market participants must balance the appeal of stronger liquidity conditions with the potential for economic overheating and the eventual tightening of monetary policy down the road.

In this dynamic environment, closely monitoring global liquidity trends will be essential in navigating both opportunities and risks as we approach the next phase of the market cycle.

Source: Christoph Sporer - LinkedIn

💼 Market Indicators

SPY Performance

Performance and Valuations by Region

Source: MSCI

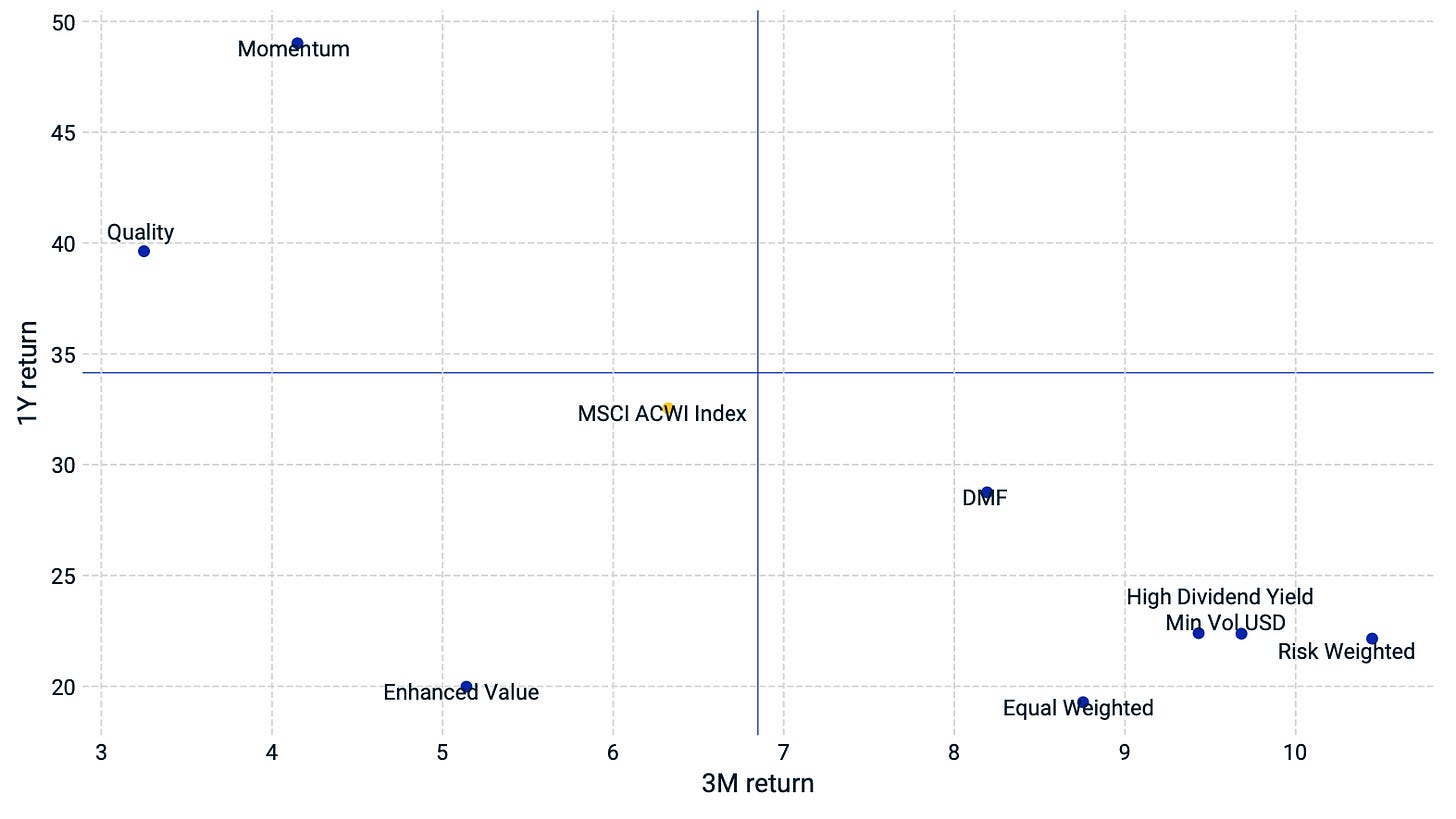

Momentum performance by Style

Source: MSCI

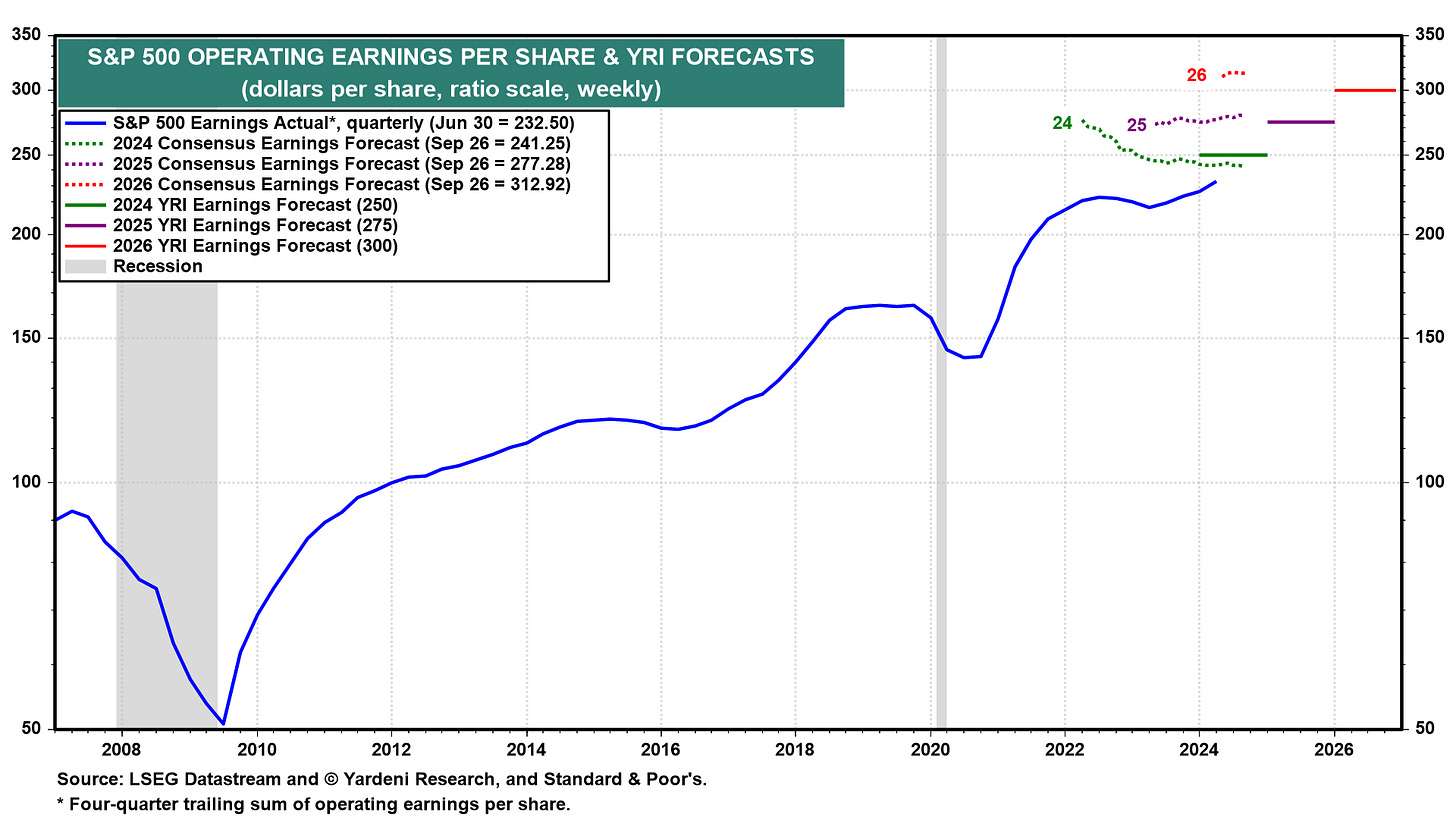

S&P 500 Earnings Per Share

Source: Yardeni Research

🇺🇸 United States: Steady Growth Amid Cooling Inflation

Durable Goods Orders: New orders for manufactured durable goods were flat in August 2024, defying expectations of a 2.6% drop. Excluding transportation, orders rose 0.5%.

GDP Growth: The U.S. economy grew at a solid 3% annualized rate in Q2 2024, higher than the 1.6% growth in Q1, bolstered by federal spending and inventory investments.

Inflation: The core PCE price index, the Fed’s preferred inflation gauge, rose by just 0.1% MoM in August, supporting expectations of aggressive rate cuts ahead.

🌐 International: Mixed Growth Across Major Economies

🇨🇦 Canada:

GDP Growth: August GDP is projected to remain flat, following a 0.2% rise in July, driven by the retail and public sectors, despite negative impacts from wildfires.

🇪🇺 Euro Area:

PMI: The Eurozone Composite PMI dropped to 48.9, the lowest since January, signaling contraction in private sector activity. Manufacturing remained weak, especially in Germany and France.

🇬🇧 United Kingdom:

PMI: The UK Composite PMI fell to 52.9 in September, reflecting weaker service and manufacturing sectors, although the economy continues to grow modestly.

🇯🇵 Japan:

PMI: The Japan Composite PMI fell to 52.5 in September, marking the 8th consecutive month of expansion, but growth in new orders softened.

🌏 Emerging Markets: Policy Shifts and Economic Slowdowns

🇨🇳 China:

Interest Rates: The PBoC cut the one-year policy loan rate to 2.0% and introduced further stimulus measures to support the economy.

Trade Data: Exports surged by 8.7% in August, but weak domestic demand resulted in a sluggish 0.5% increase in imports.

🇮🇳 India:

PMI: India’s Composite PMI slipped to 59.3 in September, reflecting a slowdown in both manufacturing and services sectors, though the pace remains strong.

🇰🇷 South Korea

Consumer Sentiment: The Consumer Sentiment Index fell to 100.0, as future spending expectations weakened amid concerns over the domestic economy.

🇹🇼 Taiwan:

Unemployment: The seasonally adjusted unemployment rate rose slightly to 3.36%, while industrial production grew 13.42% YoY in August, marking continued strength in the manufacturing sector.

Stay tuned for next week's updates! Feel free to share your thoughts or questions below.