U.S. Stocks Hit Record Highs as Inflation Surprises and China Struggles with Stimulus

Week Ending October 11, 2024

Welcome to this week’s global macro update! 🌍📊 U.S. stocks soared to new heights as the earnings season kicked off with stronger-than-expected results. However, inflation surprised to the upside, dampening hopes for a larger Fed rate cut. Meanwhile, European markets are grappling with mixed economic data, and China’s stimulus efforts have yet to reignite growth. Let’s break down how these key developments are impacting markets and what they could mean for investors moving forward.

🔍 Takeaway

This week’s global macroeconomic landscape revealed a mix of earnings-driven optimism in U.S. markets, inflation concerns, and mixed international growth signals. China’s stimulus efforts continue to struggle to gain traction, while Europe faces economic challenges but hopes for quicker monetary easing.

United States: U.S. markets hit record highs as the earnings season kicked off strong, with banking giants like JPMorgan and Wells Fargo reporting better-than-expected results. However, inflation came in slightly higher than forecasted, complicating the Federal Reserve's decision-making for rate cuts.

International: Europe experienced mixed signals, with Germany's economy set to contract for a second consecutive year amid plunging factory orders. Meanwhile, expectations for European Central Bank rate cuts are rising as inflation trends downward.

Emerging Markets: In China, stimulus measures have not yet delivered the desired boost, as equity markets struggled and consumer spending remained below pre-pandemic levels. Investors should remain cautious, keeping an eye on China’s longer-term structural risks.

⭐️ Post of the week

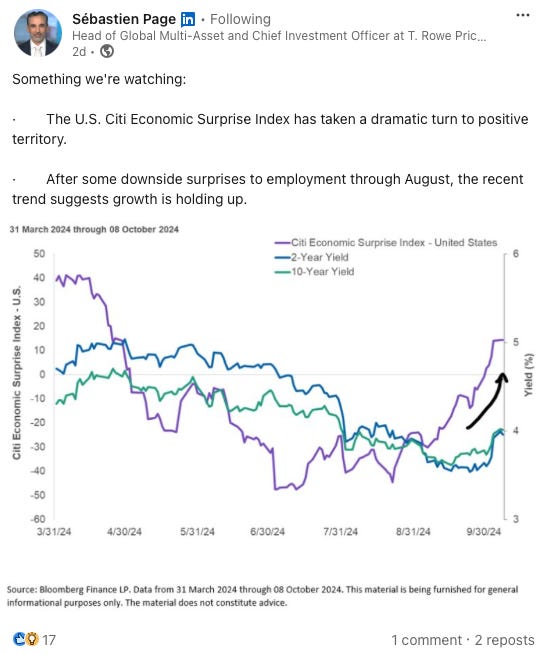

This week's chart highlights an important shift in the U.S. economic landscape, with the Citi Economic Surprise Index turning sharply into positive territory. This index tracks how economic data compares to expectations, and its recent upward movement signals that growth is holding up better than anticipated.

In recent months, economic surprises have been driven by stronger-than-expected employment data, especially after downside surprises earlier in the year. While inflation and Fed policy have been major concerns, this trend suggests that underlying economic strength is more resilient than previously thought.

What does this mean for investors? The positive shift in the Economic Surprise Index, combined with rising 2-year and 10-year Treasury yields, indicates that growth is still strong enough to influence bond markets and broader market sentiment. Keeping an eye on this index can provide key insights into market expectations and help identify potential shifts in economic momentum.

For investors, this is a reminder to stay informed and flexible. Economic data surprises can quickly shift market dynamics, and indicators like this offer valuable signals to navigate both opportunities and risks in the current environment.

Source: Sebastien Page - LinkedIn

💼 Market Indicators

SPY Performance

Performance and Valuations by Region

Source: MSCI

Momentum performance by Style

Source: MSCI

S&P 500 Earnings Per Share

Source: Yardeni Research

🇺🇸 United States: Earnings-Driven Market Gains Amid Inflation Concerns

Earnings Season: U.S. stocks hit record highs, driven by better-than-expected earnings from JPMorgan and Wells Fargo, while growth stocks like NVIDIA outperformed.

Inflation: Core inflation rose by 0.3% in September, with the annual rate increasing to 3.3%, complicating expectations for the Fed's next move.

Treasury Yields: The 10-year U.S. Treasury yield reached 4.12%, its highest since July, as inflation concerns mounted.

🌐 International: Growth Challenges and Policy Adjustments

🇨🇦 Canada:

Employment: Canada added 46,700 jobs in September, surpassing expectations, with the unemployment rate ticking down to 6.5%.

Wage Growth: Hourly wage growth eased to 4.6%, marking a slowdown from previous months.

🇪🇺 Euro Area:

Factory Orders: Germany’s factory orders plunged by 5.8% in August, signaling continued economic challenges.

ECB Outlook: Officials hinted at a potential rate cut in October, as inflation is expected to hit the 2% target by year-end.

🇬🇧 United Kingdom:

GDP: The British economy expanded by 0.2% in August, supported by gains in manufacturing and construction sectors.

🌏 Emerging Markets: Diverging Economic Signals

🇨🇳 China:

Stock Market Decline: Chinese stocks fell, with the Shanghai Composite down 3.56%, as optimism around stimulus measures faded.

Consumer Spending: Spending over the holiday season lagged pre-pandemic levels, raising concerns about domestic demand.

🇮🇳 India:

RBI Decision: The Reserve Bank of India held its policy rate at 6.5% amid signs of slowing economic growth.

Inflation: India’s inflation ticked up to 3.65% in August, driven by rising food prices.

🇰🇷 South Korea

Rate Cut: The Bank of Korea cut its base rate by 25 bps to 3.25%, marking the first reduction since 2020, citing weakening economic output.

🇹🇼 Taiwan:

Inflation: Taiwan’s inflation rate eased to 1.82% in September, with food and health costs showing signs of cooling.

Stay tuned for next week's updates! Feel free to share your thoughts or questions below.