US Sovereign Risk Jumps 38% as Market Recovery Defies Logic

Week Ending May 4, 2025

U.S. sovereign default risk surged 38% in April as investors priced in growing concerns about political interference with the Federal Reserve, even as major stock indices staged a remarkable recovery to end the month flat. This divergence between rising sovereign risk and resilient equity markets, driven by the administration's threats to replace Jerome Powell and subsequent policy reversals on tariffs, presents a market contradiction that challenges conventional economic relationships. The combination of deteriorating economic fundamentals—evidenced by Q1's 0.3% GDP contraction—with S&P 500 companies reporting Q1 earnings that exceed analyst estimates by an average of 8.6%, creates a market environment where traditional indicators and price action appear disconnected as May trading begins.

⏱️ Global Markets in 10 Seconds:

🇺🇸 Economy contracts 0.3% Q1 first decline since 2022 ⚠️

🇺🇸 S&P 500 up 2.92% for week defying economic headwinds 📈

🇪🇺 Eurozone GDP doubles to 0.4% exceeding expectations 🚀

🇨🇳 Manufacturing PMI falls to 49.0 worst since December 2023 🏭

🇯🇵 BoJ maintains rates at 0.5% amid global trade concerns 🏦

🔍 The Big Picture

In a financial world increasingly defined by contradictions, this week delivered a masterclass in market psychology over economic fundamentals. The tension between policy uncertainty and investor optimism created some of the strangest market dynamics we've seen in years, with risk indicators flashing warning signs while stock indices continued their improbable climb.

United States: The economy just shrank by 0.3% in Q1—its first contraction since 2022—while employers still added a robust 177,000 jobs in April. Strong corporate earnings (beating estimates by 8.6% on average) continue to power markets forward despite deteriorating economic fundamentals.

International: Europe is experiencing the economic equivalent of swimming upstream and actually making progress, with Eurozone GDP doubling to 0.4% when analysts expected just 0.2%. Even more striking is how this growth occurred with Spain (+0.6%) and Italy (+0.3%) leading the charge while traditional powerhouses Germany and France merely returned to minimal growth, suggesting a potential reshuffling of Europe's economic deck.

Emerging Markets: China's manufacturing sector contracted sharply with its PMI falling to 49.0, its worst reading since December 2023, yet the government is signaling potential trade talks with Washington. This economic temperature drop comes at a critical moment when China has already started exempting some U.S. goods from tariffs covering roughly $40 billion worth of imports.

Source: Aswath Damodaran - https://aswathdamodaran.blogspot.com

💼 Market Indicators

SPY Performance

Performance and Valuations by Region

Source: MSCI

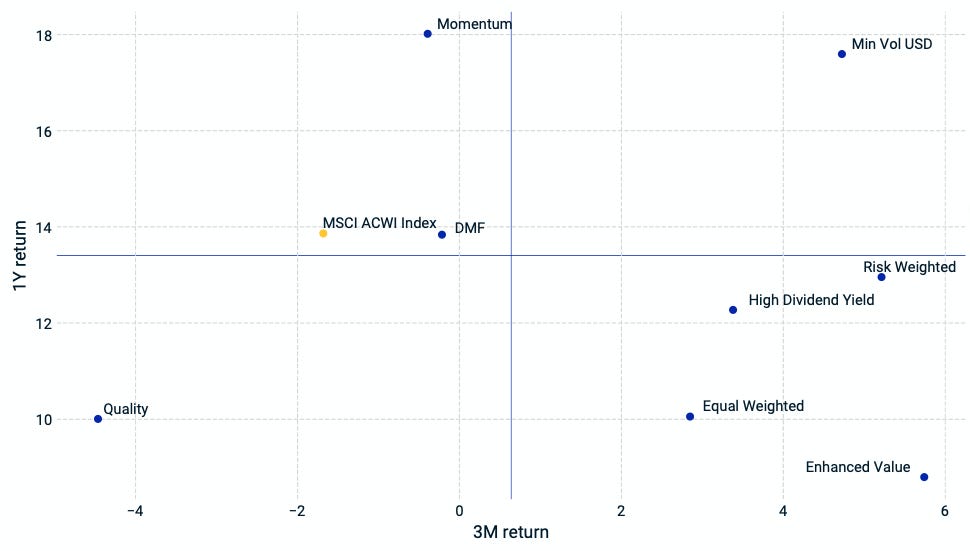

ACWI Momentum performance by Style

Source: MSCI

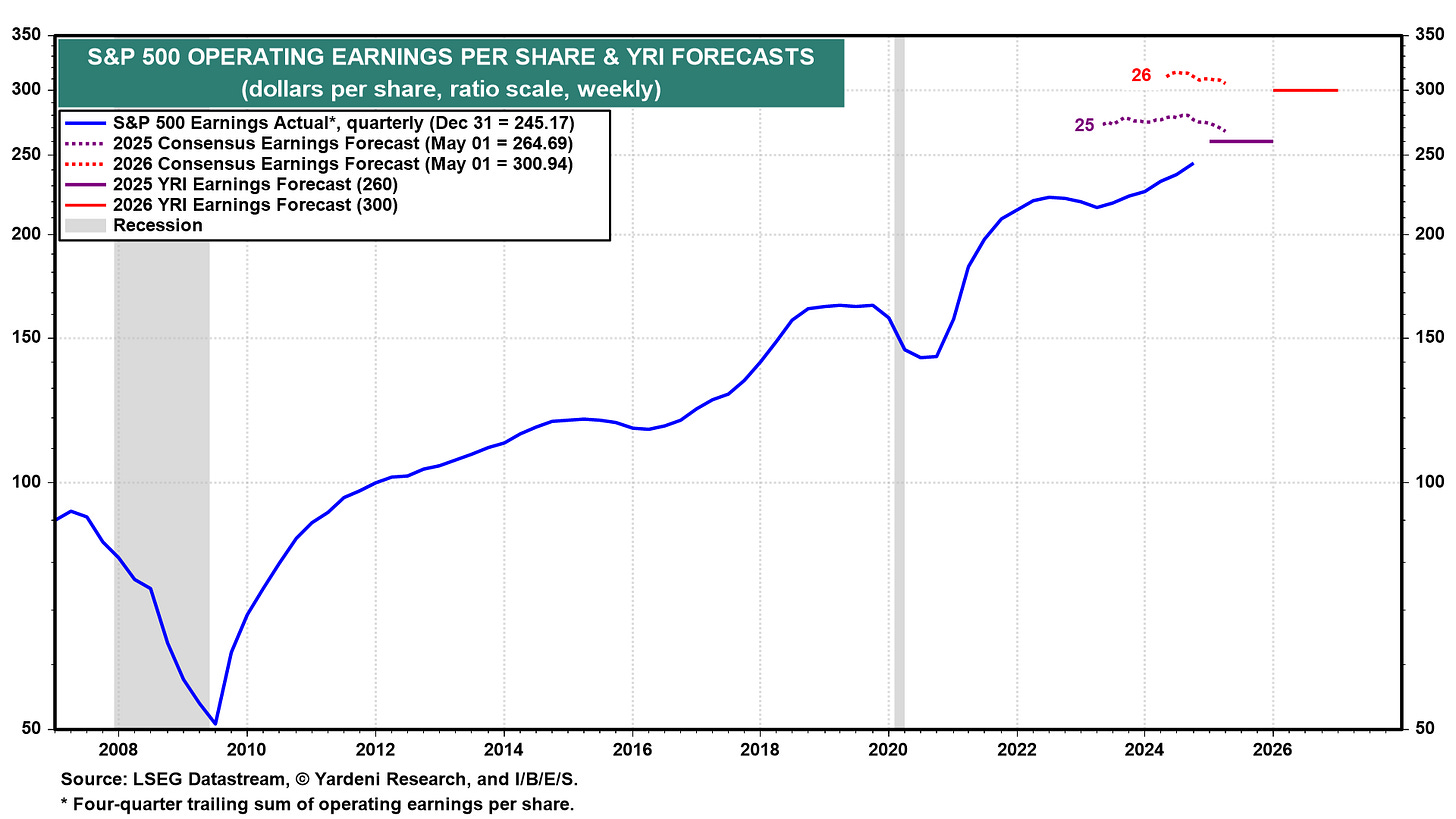

S&P 500 Earnings Per Share

Source: Yardeni Research

Source: FactSet

🗺️ Around the World in Detail

🇺🇸 United States: Defying Economic Gravity

The U.S. economy contracted by 0.3% in Q1 2025, its first negative reading since 2022, yet employers still added 177,000 jobs in April, significantly outpacing expectations of 135,000.

Job openings fell to 7.2 million in March, down from 7.5 million in February and hitting their lowest level since September. Companies are becoming more selective in hiring but haven't halted recruitment completely.

The S&P 500 finished with its ninth straight positive session on Friday, logging two consecutive weeks of gains for the first time since January. Markets continue to show remarkable resilience despite economic headwinds.

Corporate earnings are telling a surprisingly robust story with 76% of S&P 500 companies beating estimates and aggregate earnings coming in 8.6% above expectations. This strength in corporate performance stands in stark contrast to the broader economic contraction.

🌐 International Markets: Unexpected Strengths

Canada 🇨🇦

Manufacturing activity decreased to 45.3 in April, its lowest reading since May 2020, as U.S. tariff policies weighed heavily on Canadian factories. Trade uncertainties continue to impact production decisions.

According to advance estimates, Canada's GDP increased by a modest 0.1% in March, suggesting a 0.4% expansion for Q1 2025 despite February's 0.2% contraction. The economy appears to be maintaining minimal forward momentum.

Europe 🇪🇺

Eurozone GDP growth doubled to 0.4% in Q1 from 0.2% in the previous quarter, significantly outpacing the consensus estimate of 0.2%. This unexpected acceleration comes despite persistent headwinds.

Spain's economy grew by 0.6% and Italy by 0.3%, exceeding forecasts, while traditional powerhouses Germany and France merely returned to growth with small increases. A notable shift in regional economic performance is emerging.

Inflation remained steady at 2.2% in April, just above the ECB's target, but core inflation climbed to 2.7% from March's three-year low of 2.4%. Price pressures remain a concern for policymakers.

UK 🇬🇧

The housing market showed signs of losing momentum with the Nationwide Building Society's house price index falling 0.6% in April. Property markets appear to be cooling after previous strength.

Business sentiment deteriorated sharply in April, with Lloyds Bank's business barometer falling by 10 points to 39%, its lowest level since January. Confidence among British businesses continues to erode amid global uncertainties.

Japan 🇯🇵

The Bank of Japan held interest rates steady at 0.5% and downgraded its forecasts for economic growth and inflation. The central bank maintains a cautious approach amid growing concerns about global trade tensions.

Manufacturing sector conditions continued to weaken in April while both industrial production and retail sales underwhelmed in March. Key economic indicators suggest persistent challenges for the Japanese economy.

🌏 Emerging Markets: Cooling Momentum

China 🇨🇳

Manufacturing PMI fell more than expected to 49 in April from 50.5 in March, marking the worst contraction since December 2023. Factory activity has reversed its previous expansion amid new challenges.

India 🇮🇳

While specific Indian data wasn't provided in our dataset, the country remains a relative bright spot in emerging markets based on previous trends. India continues to exhibit resilience when compared to regional peers.

South Korea 🇰🇷

Retail sales declined by 0.3% month-on-month in March, reversing February's 1.9% gain, signaling weakening consumer spending. This pullback suggests growing caution among Korean consumers.

Inflation held steady at 2.1% year-on-year in April, matching March's reading and meeting market expectations. Price stability persists despite global uncertainties.

Taiwan 🇹🇼

Taiwan's economy expanded by an impressive 5.37% in Q1 2025, dramatically exceeding market expectations of 3.3%. This strong performance highlights Taiwan's continued economic dynamism.

Private consumption rose 1.22% while gross capital formation jumped 14.72%, fueled by higher investment in machinery, construction, and intellectual property products. Investment and technology sectors continue to drive Taiwan's impressive growth.

🔑 Key Takeaway

This week's data reveals a fundamental disconnect between market performance and economic reality, challenging conventional wisdom about how economies and investments interact. The paradox is striking: while the U.S. economy contracted 0.3% and sovereign risk rose 38%, equity markets staged their ninth consecutive positive session with the S&P 500 gaining 2.92% for the week. As Damodaran points out in his analysis, the divergence between these signals represents a profound tension between sentiment and fundamentals, with market psychology seemingly prevailing over economic data.

The global picture further complicates this narrative, with Eurozone growth doubling expectations to 0.4% while China's manufacturing PMI slid to 49.0. What emerges is a pattern of market resilience that defies traditional correlations—a phenomenon Damodaran describes as "a shift in sentiment back to the forces that have borne markets upwards for the last few years." Most telling is his observation that sovereign CDS spreads rose not during the market's initial collapse but during its recovery, suggesting we're witnessing not just volatility but a fundamental reassessment of trust in institutions and government stability. Investors navigating this environment face an unusual challenge: determining whether the market's confidence or the economy's contraction represents the true leading indicator of what's to come.

The content provided on MacroQuant Insights is for informational and educational purposes only and does not constitute financial advice. While every effort is made to ensure accuracy and reliability, all data, analysis, and opinions are based on sources believed to be trustworthy but are not guaranteed for completeness or timeliness. The views expressed are solely those of the author and do not reflect endorsements or recommendations for any specific investment, strategy, or action.

Investing involves inherent risks, including the potential loss of principal. Past performance is not indicative of future results. We strongly encourage readers to conduct their own research and consult with a qualified financial advisor or professional before making any financial decisions. MacroQuant Insights and its contributors disclaim all liability for investment decisions based on the information provided and make no warranties regarding the content’s accuracy or reliability.

Remember, all investments carry risks, and it is essential to understand these risks fully before acting on any information presented. Users are responsible for their own investment decisions. MacroQuant Insights assumes no responsibility for any outcomes resulting from the use of this information. Content is subject to change without notice.