US Markets Slide as Consumer Inflation Expectations Hit 6%

Week Ending February 28, 2025

Stock markets retreated this week with the S&P 500 falling 1.2%. This decline, in part driven by The Conference Board's Consumer Confidence Index registering its largest monthly drop since August 2021 (7 points to 98.3), came as inflation expectations surged from 5.2% to 6.0%. As the Expectations Index fell below the critical 80-point threshold that typically signals a recession ahead, investors are increasingly concerned that persistent inflation combined with new tariff threats could significantly impact both consumer spending and corporate earnings in the coming quarters.

⏱️ Global Markets in 10 Seconds:

🇺🇸 Consumer confidence drops 7 points to 98.3, worst since August 2021 ⚠️

🇨🇦 GDP grows 2.6% in Q4, beating expectations 🚀

🇪🇺 German economy -0.2% in Q4, France contracts -0.1% 🏭

🇨🇳 Manufacturing PMI rises to 50.2 as stimulus takes effect 📈

🇯🇵 Retail sales +3.9% fastest growth since February 2024 💼

🔍 The Big Picture

This week revealed a clear disconnect between deteriorating consumer sentiment and resilient economic output across major economies. Tariff concerns and persistent inflation expectations overshadowed otherwise steady growth figures, creating significant market volatility. The contrast between North American economic resilience and European contraction highlights diverging regional paths heading into spring.

United States: Consumer confidence dropped by a steep 7 points to 98.3 in February, the largest monthly decline since August 2021, while inflation expectations surged to 6%. Despite this pessimism, the economy still grew at a steady 2.3% in Q4, with consumer spending increasing at a healthy 4.2% - creating a puzzling gap between what consumers say versus what they actually do.

International: Europe's economic struggles continue with Germany contracting 0.2% and France shrinking 0.1% in Q4, highlighting the region's persistent growth challenges. Meanwhile, Japan showed unexpected consumer resilience with retail sales jumping 3.9% year-over-year in January, its fastest growth in nearly a year, suggesting stronger domestic demand despite global uncertainties.

Emerging Markets: China's manufacturing sector returned to expansion territory with February's PMI rising to 50.2, signaling that stimulus measures are finally gaining traction. In contrast, India's economy accelerated to 6.2% growth in Q4, maintaining its position as the fastest-growing major economy while demonstrating remarkable resilience to global headwinds affecting other emerging markets.

⭐️ Research of the week:

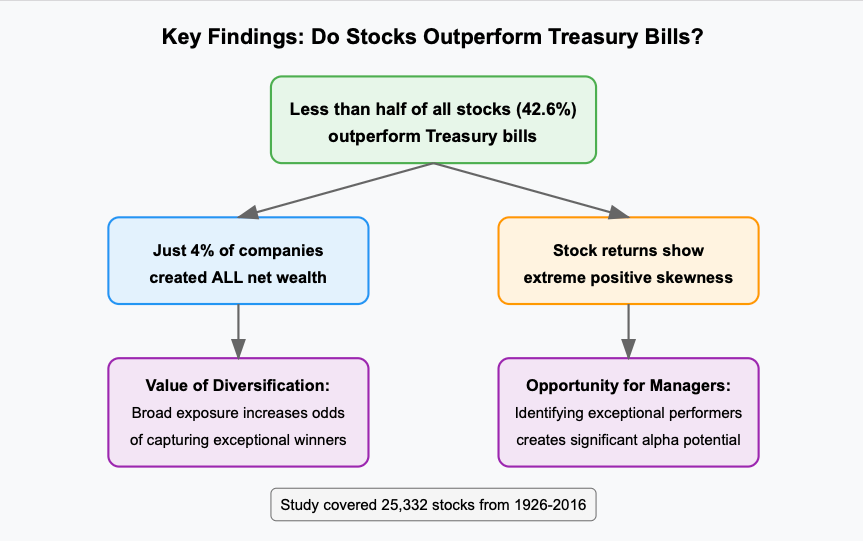

The Market's Most Important 4% and Today's Magnificent 7

Arizona State professor Hendrik Bessembinder's seminal research on stock market wealth creation provides crucial context for understanding the current market dominance of the Magnificent 7 stocks. His findings challenge the widespread assumption that most individual stocks outperform Treasury bills over their lifetimes, when in fact less than half actually do, mirroring today's top-heavy market structure.

Why This Research Is Critical For Understanding Today's Market

Bessembinder's methodology reveals that just 4% of companies account for all net wealth creation in the US stock market since 1926, a concentration pattern that continues with the Magnificent 7 (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla) now representing over 33% of the S&P 500.

The positive skewness in historical returns helps explain the current market dynamic where the Magnificent 7 have contributed approximately 50% of the S&P 500's returns in 2024.

Just as Bessembinder identified Apple, Microsoft, and Exxon Mobil among the five greatest wealth creators in market history, we're witnessing the same concentration effect in real-time, with today's tech giants accounting for a disproportionate share of market capitalization growth

The Supporting Evidence Connects Past and Present

The historical pattern of five companies accounting for 10% of all wealth creation since 1926 is echoed by recent performance where Nvidia alone contributed over 20% of the S&P 500's returns in 2024.

Bessembinder's research showed most individual stocks (57.88%) destroy shareholder value over their lifetimes, which explains why equal-weighted indexes have significantly underperformed cap-weighted indexes during the Magnificent 7's rise

The concentration in the Magnificent 7 represents the continuation of the market's winner-take-most dynamics, with network effects and scale advantages in technology creating the same wealth concentration Bessembinder documented throughout market history

Bottom Line

Bessembinder's work suggests that the current concentration in the Magnificent 7 is not an anomaly but a continuation of the market's fundamental wealth creation pattern. The challenge for investors isn't just whether these seven stocks are overvalued, but whether they can identify which companies among thousands will join the crucial 4% that will generate the majority of future market returns.

Source: Do Stocks Outperform Treasury Bills?

💼 Market Indicators

SPY Performance

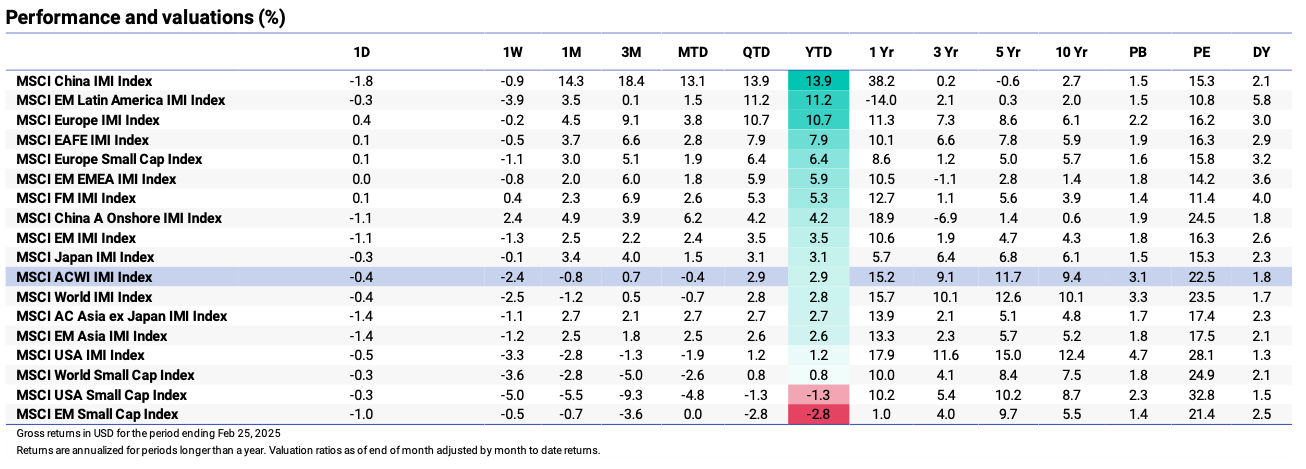

Performance and Valuations by Region

Source: MSCI

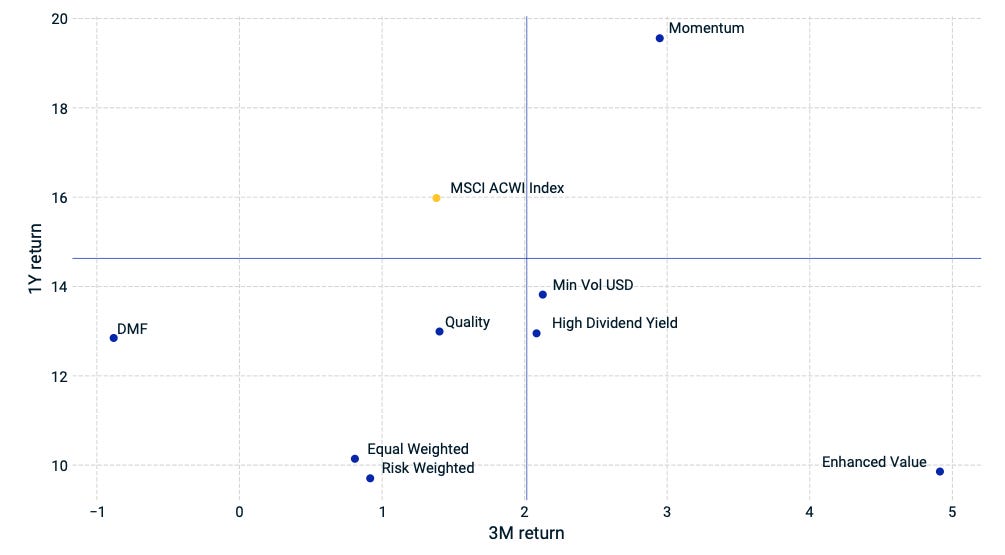

Momentum performance by Style

Source: MSCI

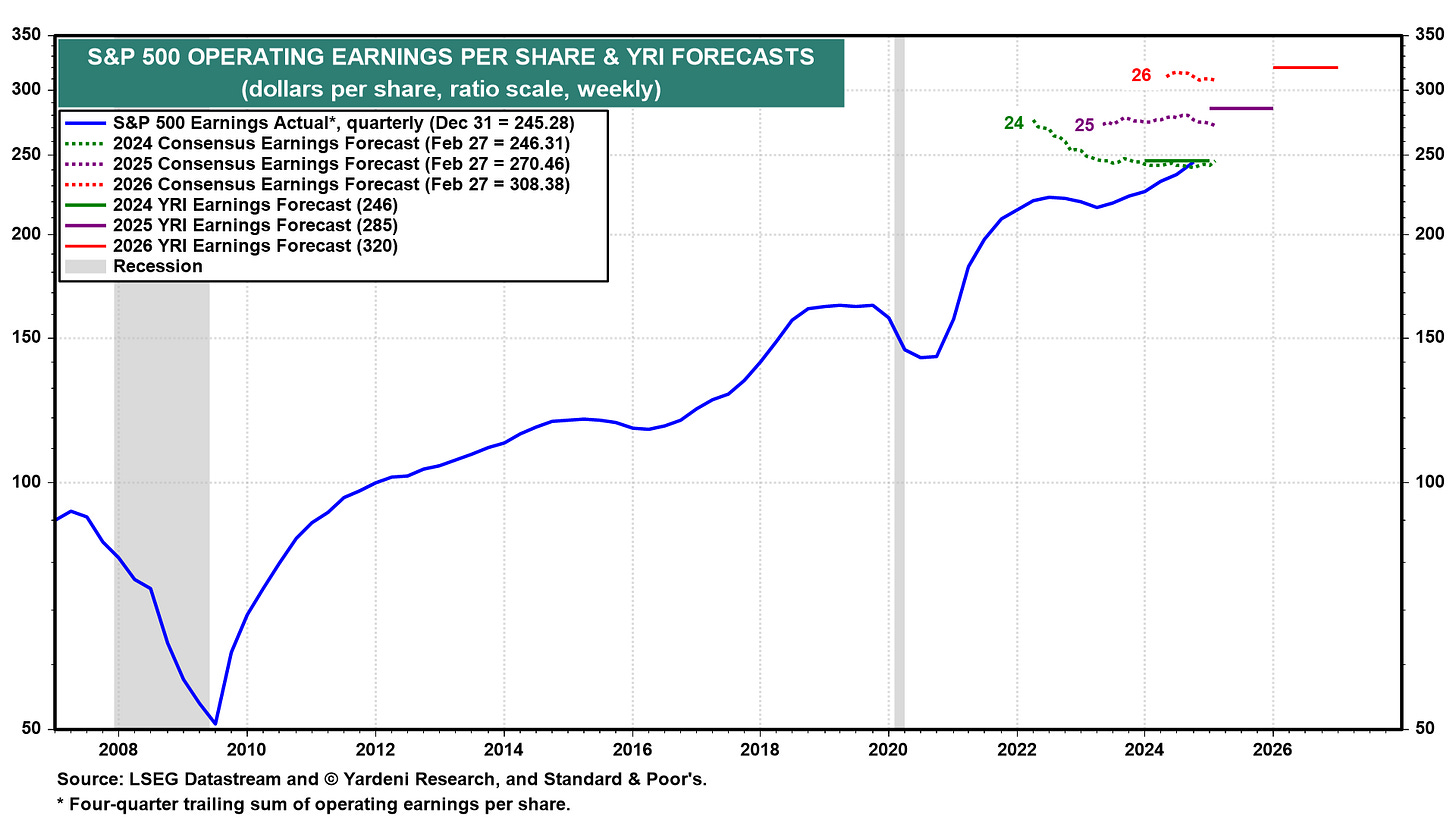

S&P 500 Earnings Per Share

Source: Yardeni Research

🗺️ Around the World in Detail

🇺🇸 United States: Consumer Confidence Crumbles

The Conference Board's Consumer Confidence Index dropped a steep 7 points to 98.3 in February, marking the largest monthly decline since August 2021 and clearly signaling growing pessimism about the economic outlook.

Consumer inflation expectations surged from 5.2% to 6% in February, suggesting households are increasingly concerned about persistent price pressures despite the Federal Reserve's aggressive rate hikes over the past two years.

Despite worsening sentiment, actual economic data shows resilience with Q4 2024 GDP holding steady at 2.3% and consumer spending increasing at a robust 4.2% during the period – highlighting an intriguing disconnect between perception and behavior.

🌐 International Markets: Mixed Growth, Policy Uncertainty

Canada 🇨🇦

GDP expanded a stronger-than-expected 2.6% (annualized) in Q4 2024, the strongest growth since Q1 2023, driven by a 1.4% increase in household spending despite persistent inflation concerns.

The economic strength was broad-based with rising exports (1.8%) and business investment in non-residential structures (0.7%), suggesting a more resilient economy than many analysts had projected.

Europe 🇪🇺

Germany's economy contracted 0.2% in Q4 2024 while France's shrank 0.1%, confirming the economic struggles of the eurozone's largest economies despite the ECB's initial rate cuts.

Inflation readings across Europe painted a mixed picture, with German inflation holding at 2.8% (above expectations), while France's fell to a four-year low of 0.9%, creating policy challenges for the ECB.

ECB minutes revealed ongoing inflation concerns with some policymakers arguing for "greater caution" on further rate cuts despite weakening economic performance.

United Kingdom 🇬🇧

House prices rose by a stronger-than-expected 0.4% in January, fueled by falling borrowing costs and buyers rushing to finalize deals before a tax increase on some properties at the end of March.

Japan 🇯🇵

Retail sales jumped 3.9% year-over-year in January, the fastest growth since February 2024, suggesting Japanese consumer spending remains resilient despite global uncertainties.

The Japanese yen logged significant gains in February on expectations the Bank of Japan will raise interest rates again this year as headline inflation remains above target and wage growth remains strong.

🌏 Emerging Markets: Divergent Trajectories

China 🇨🇳

Official NBS Manufacturing PMI climbed back into expansion territory at 50.2 in February from 49.1 in January, as companies resumed activities after the Lunar New Year break and various stimulus measures bolstered the economy.

Markets remain focused on China's upcoming "Two Sessions" political event starting March 4-5, where Beijing is expected to unveil a GDP growth target of "around 5%" for the third straight year, along with a record high fiscal deficit ratio of 4%.

India 🇮🇳

GDP grew 6.2% year-over-year in Q4 2024, accelerating from 5.6% in the previous quarter, underscoring India's position as the fastest-growing major economy despite global headwinds.

Growth was boosted by stronger private consumption (6.9% vs 5.9%) and public expenditures (8.3% vs 3.8%), while exports surged 10.4% – demonstrating the economy's broad-based momentum.

South Korea 🇰🇷

The Bank of Korea cut its base rate by 25 basis points to 2.75% in February, marking the third reduction in four months as policymakers revised their growth forecast downward to 1.5% for 2025.

The central bank maintained its inflation forecast at 1.9%, suggesting the rate-cutting cycle will remain measured despite the growth downgrade.

Taiwan 🇹🇼

Taiwan's Q4 2024 GDP growth was revised sharply upward to 2.9% from an initial estimate of 1.84%, driven by a remarkable 19.2% surge in gross capital formation and strong export growth of 8.9%.

Authorities have cut the 2025 GDP growth forecast to 3.14% from 3.29% amid concerns over U.S. tariff policies, highlighting the export-dependent economy's vulnerability to trade tensions.

🔑 Key Takeaway

This week's data highlights a fundamental disconnect between deteriorating consumer sentiment and the market's powerful concentration dynamics. The steep 7-point plunge in Consumer Confidence (to 98.3) – the worst since August 2021 – contrasts sharply with continued economic resilience shown in Canada's surprising 2.6% GDP growth and U.S. consumer spending rising at 4.2% in Q4. This divergence between what consumers say versus what they do occurs against the backdrop of Bessembinder's landmark research showing just 4% of stocks drive all market wealth creation – a pattern reinforced by today's Magnificent 7 stocks now representing over 33% of the S&P 500.

While inflation expectations surged to 6% and Europe's largest economies contracted (Germany -0.2%, France -0.1%), China's manufacturing returned to expansion territory and India accelerated to 6.2% growth, underscoring how radically different regional performances further complicate the global picture. The growing gap between consumer perception and spending behavior, combined with the extreme market concentration Bessembinder documented, suggests investors face a challenging environment where broad economic indicators may mask the winner-take-all reality of actual market returns.

The content provided on MacroQuant Insights is for informational and educational purposes only and does not constitute financial advice. While every effort is made to ensure accuracy and reliability, all data, analysis, and opinions are based on sources believed to be trustworthy but are not guaranteed for completeness or timeliness. The views expressed are solely those of the author and do not reflect endorsements or recommendations for any specific investment, strategy, or action.

Investing involves inherent risks, including the potential loss of principal. Past performance is not indicative of future results. We strongly encourage readers to conduct their own research and consult with a qualified financial advisor or professional before making any financial decisions. MacroQuant Insights and its contributors disclaim all liability for investment decisions based on the information provided and make no warranties regarding the content’s accuracy or reliability.

Remember, all investments carry risks, and it is essential to understand these risks fully before acting on any information presented. Users are responsible for their own investment decisions. MacroQuant Insights assumes no responsibility for any outcomes resulting from the use of this information. Content is subject to change without notice.