US Job Growth Slows to 143K as Tariff Fears Hit Markets

Week Ending February 7, 2025

U.S. stocks slid this week as job growth slowed to 143,000 in January, falling short of expectations and reinforcing concerns about a cooling labor market. This weakness, paired with renewed tariff threats from the White House and softer services activity, pushed investors toward Treasuries, sending yields lower across the curve. While a resilient unemployment rate at 4.0% suggests underlying stability, rising trade uncertainty and slowing consumer demand point to growing economic fragility as 2025 unfolds.

⏱️ Global Markets in 10 Seconds:

🇺🇸 Job growth slows to 143K as hiring cools, yields drop 📉

🇪🇺 Eurozone inflation rises to 2.5% while BoE cuts rates 🏦

🇨🇳 Lunar New Year spending +7% but PMI weakens ⚠️

🇨🇦 76K jobs added, unemployment dips to 6.6% 🚀

🇯🇵 Yen strengthens to 151/USD as BoJ signals more hikes 💰

🔍 The Big Picture

Markets faced shifting economic signals this week, with U.S. job growth slowing, European inflation ticking higher, and China’s recovery showing mixed signals. Trade policy uncertainty added a new layer of risk, while central banks remained divided—the Bank of England cut rates, but the Fed held steady. Investors are weighing whether these trends mark the start of a broader economic slowdown or just a temporary adjustment.

United States: 143K jobs added, missing estimates, while unemployment dipped to 4.0%. The slowdown in hiring and rising jobless claims point to a cooling labor market, reinforcing expectations for a Fed rate cut later this year. Meanwhile, Treasury yields fell as markets priced in weaker growth ahead.

International: Eurozone inflation rose to 2.5%, keeping the ECB cautious, while the Bank of England cut rates to 4.5%. Sticky core inflation (2.7%) and slow economic growth continue to challenge policymakers, as Germany’s industrial production dropped to its lowest level since 2020.

Emerging Markets: China’s Lunar New Year spending rose 7%, but manufacturing activity softened, with PMI slipping to 50.1. While consumer demand remains strong, weaker factory output and rising job losses highlight Beijing’s challenge in sustaining economic momentum.

⭐️ Research of the week:

The Profitability Edge in Value Investing

This week, we examine Robert Novy-Marx's groundbreaking 2011 research, The Other Side of Value, which challenges traditional value investing frameworks by demonstrating that gross profitability has similar predictive power for stock returns as the famous book-to-market ratio. This finding questions the common assumption that value stocks outperform primarily because they are riskier, distressed companies.

Why This Analysis Matters:

The research introduces a powerful analytical tool by focusing on gross profits-to-assets rather than bottom-line earnings, demonstrating how "cleaner" accounting measures better capture economic reality and predict future returns

It challenges the traditional dichotomy between value and growth investing by showing that profitable "growth" companies can generate superior returns despite higher valuations—contradicting classic value theory

Portfolio construction benefits significantly when combining profitability and value metrics, as these seemingly opposing factors work together to enhance risk-adjusted returns

Key Evidence :

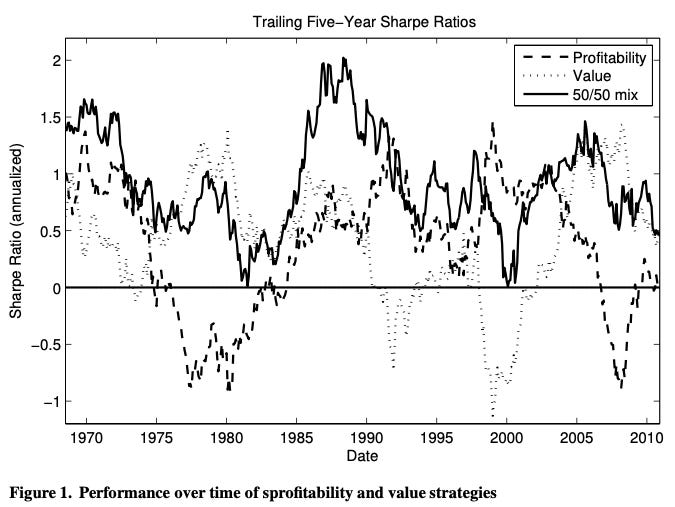

Historical data shows that high-profitability firms outperformed low-profitability ones despite having higher valuations and larger market caps, demonstrating that the effect persists even among the most liquid stocks

A four-factor model including profitability alongside market, value, and momentum factors better explains various market anomalies, suggesting profitability captures a fundamental aspect of expected returns

The gross profitability metric predicted long-term growth in earnings, cash flows, and payouts, while combining profitability with value strategies reduced portfolio volatility despite increased exposure to risky assets

Bottom Line:

Novy-Marx's research fundamentally reshapes our understanding of value investing by revealing profitability as a crucial missing piece in factor-based investing. Rather than viewing value and growth as opposing forces, investors can enhance their process by identifying companies that are both cheap and productive, creating more resilient portfolios that capture multiple return premiums.

Source: The Other Side of Value: The Gross Profitability Premium

💼 Market Indicators

SPY Performance

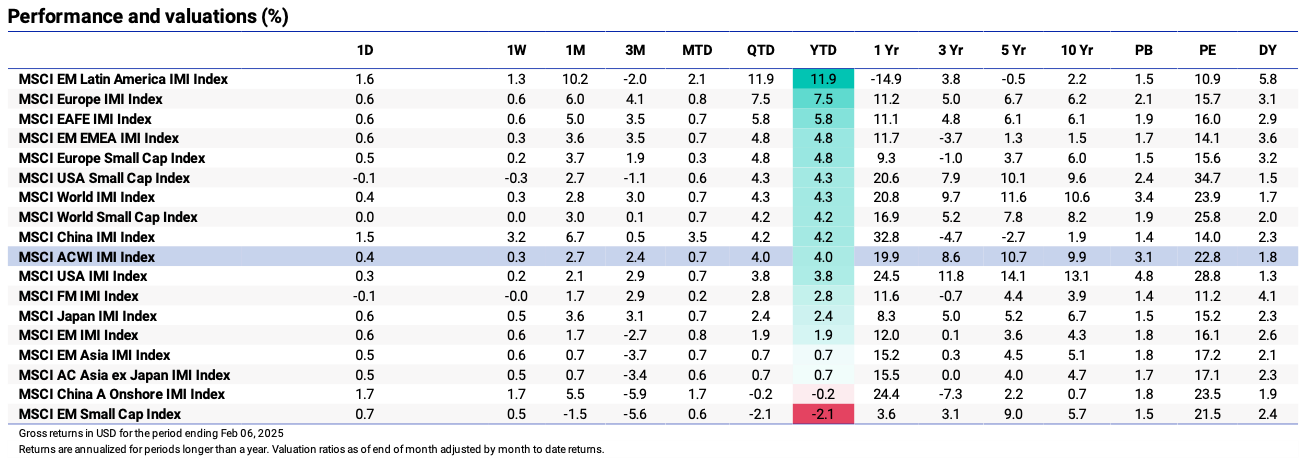

Performance and Valuations by Region

Source: MSCI

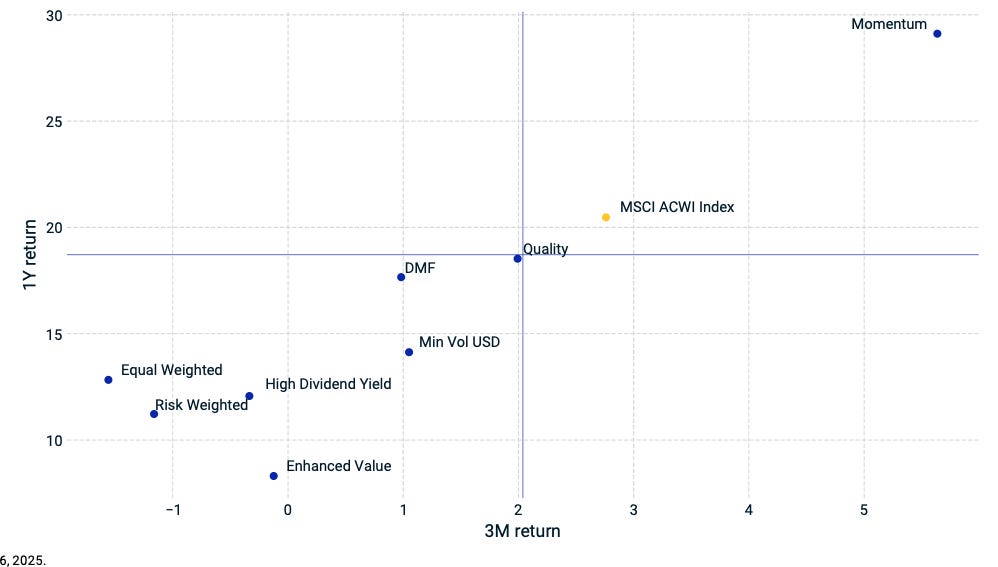

Momentum performance by Style

Source: MSCI

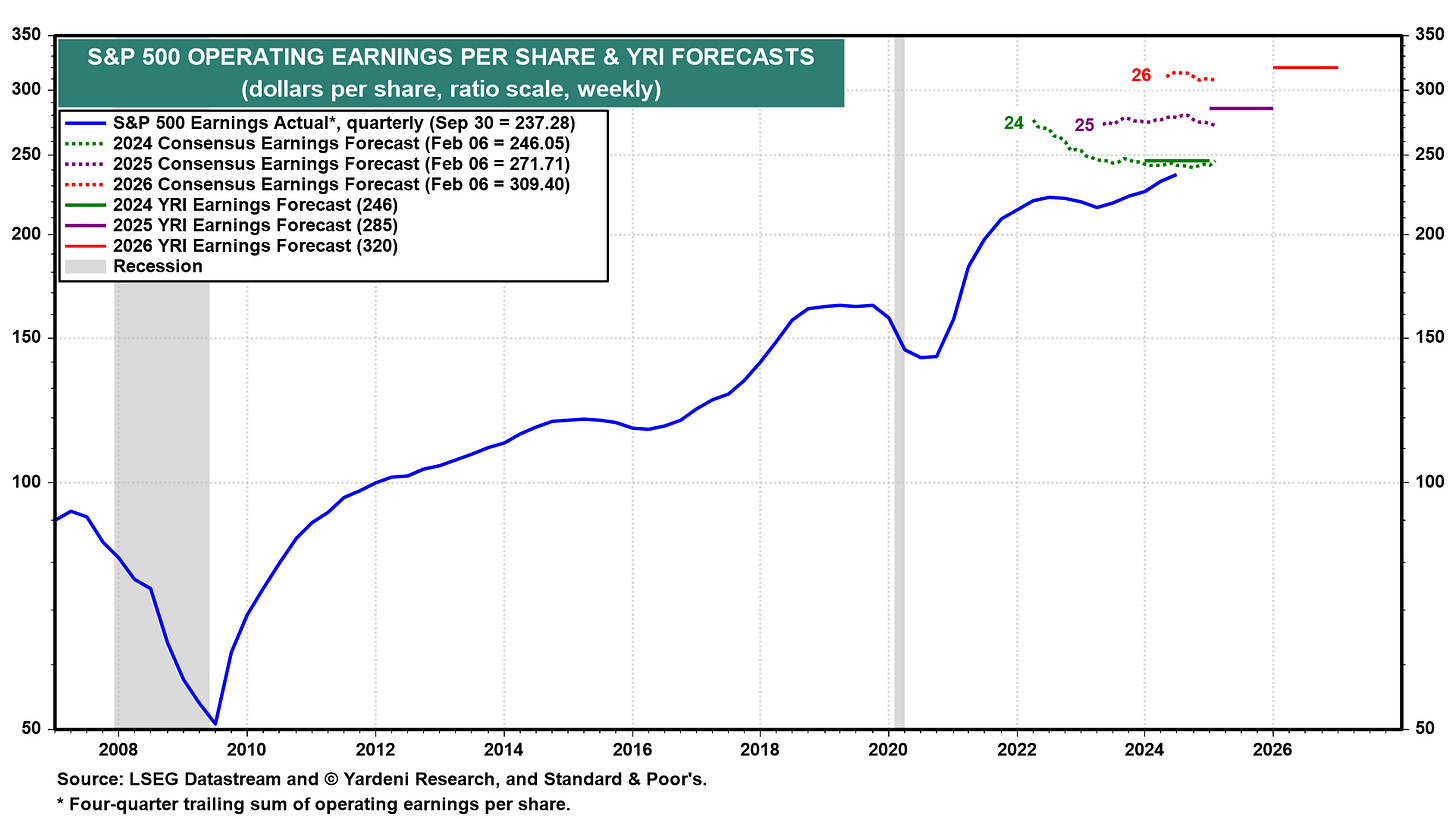

S&P 500 Earnings Per Share

Source: Yardeni Research

🗺️ Around the World in Detail

🇺🇸 United States: Cooling Jobs, Rising Uncertainty

143K jobs added in January, missing expectations of 170K. This marks a sharp slowdown from December’s 307K gain, reinforcing signs that the labor market is gradually cooling. While the unemployment rate unexpectedly dipped to 4.0%, job openings fell to a three-month low of 7.6 million, pointing to softer hiring ahead.

Manufacturing expands for the first time in over two years. The ISM Manufacturing PMI rose to 50.9, finally crossing into expansion territory after 26 straight months of contraction. However, supply chain pressures and looming tariffs remain key risks.

Treasury yields drop as markets price in rate cuts. Weak job data pushed investors toward bonds, driving yields lower across most maturities. Markets are now betting the Fed will need to ease policy sooner rather than later, with rate cut expectations pulling forward to mid-2025.

🌐 International Markets: Growth, Inflation, and Rate Cuts

Canada 🇨🇦

76K jobs added in January, triple the forecast. Full-time hiring surged, pushing unemployment down to 6.6% instead of the expected 6.8%. The strong labor market complicates the Bank of Canada’s rate cut timeline, as policymakers remain cautious about inflation risks.

Manufacturing PMI falls to 51.6, expansion slows. Export sales picked up as U.S. clients frontloaded orders ahead of potential tariffs, but overall sentiment declined, with businesses growing more cautious about trade policy uncertainty.

Europe 🇪🇺

Eurozone inflation edges up to 2.5%, pressuring the ECB. Core inflation held at 2.7%, driven by services costs, making it harder for the European Central Bank to justify rate cuts. Markets are now questioning whether the ECB will ease policy as aggressively as previously expected.

Germany’s factory orders surge 6.9%, but industrial production drops 2.4%. The split suggests volatile demand, with strong capital goods orders offset by a 10% decline in auto manufacturing.

United Kingdom 🇬🇧

The BoE’s rate cut reflects slowing growth, not easing inflation. The central bank now expects inflation to remain above target until 2027, despite weaker GDP projections. The risk? A slower policy response than markets anticipate.

FTSE 100 rises 0.31%, defying global weakness. The index outperformed amid expectations that UK borrowing costs will keep falling, supporting equities despite broader market uncertainty.

Japan 🇯🇵

Nikkei 225 falls 2.0% as yen strengthens. The yen rose to 151/USD, as the Bank of Japan signaled potential rate hikes ahead. A stronger currency weighed on export-heavy industries, particularly autos and tech.

Wage growth accelerates, supporting the BoJ’s tightening stance. December saw a sharp rise in nominal wages, boosting expectations that inflationary pressures will persist in 2025.

🌏 Emerging Markets: Mixed Signals

China 🇨🇳

Lunar New Year spending jumps 7%, but manufacturing slows. 501 million domestic trips and a record $94.4B in travel spending highlight strong consumer demand, yet factory activity weakened, with the Caixin PMI slipping to 50.1. Beijing faces an uneven recovery as services thrive while industry lags.

Consumer inflation climbs to 0.5%, highest in six months. Food prices rebounded, but overall price pressures remain weak, keeping expectations for further policy easing on the table.

India 🇮🇳

RBI cuts rates to 6.25%, first reduction since 2020. With growth slowing, policymakers moved to support the economy, revising 2025 GDP projections down to 6.7%. The cut signals a shift toward stimulus, even as inflation concerns linger.

Manufacturing PMI remains strong at 57.7, but services slow. Factory activity is expanding at its fastest pace in six months, but services PMI dipped to 56.5, showing uneven momentum in Asia’s fastest-growing economy.

South Korea 🇰🇷

Manufacturing PMI climbs back to expansion at 50.3. This marks the first return to growth in five months, helped by strong export orders. However, input costs are rising sharply, raising concerns about profitability.

Inflation ticks up to 2.2%, delaying rate cut bets. A weaker won pushed import prices higher, prompting the Bank of Korea to hold rates at 3% instead of cutting. Markets now expect easing to be pushed back further into 2025.

Taiwan 🇹🇼

Manufacturing PMI slows to 51.1, weakest in three months. While still expanding, output and new orders softened, raising concerns about global tech demand. Exporters remain cautious, with U.S. trade policy a growing risk.

🔑 Key Takeaway

This week’s data highlights the growing divergence between slowing labor markets, resilient inflation, and shifting monetary policies. In the U.S., job growth cooled to 143K, reinforcing expectations for Fed rate cuts, while Treasury yields dropped in response. Meanwhile, Eurozone inflation ticked up to 2.5%, keeping the ECB cautious, even as the Bank of England cut rates to 4.5% to support slowing growth. In China, Lunar New Year spending surged 7%, but weak manufacturing PMI (50.1) and falling employment underscore lingering economic fragility.

Novy-Marx’s insights on profitability as a key return driver offer an important lens here: as markets recalibrate around slower growth and higher uncertainty, investors should look beyond simple valuation metrics and focus on fundamental productivity and economic resilience to navigate the evolving landscape.

The content provided on MacroQuant Insights is for informational and educational purposes only and does not constitute financial advice. While every effort is made to ensure accuracy and reliability, all data, analysis, and opinions are based on sources believed to be trustworthy but are not guaranteed for completeness or timeliness. The views expressed are solely those of the author and do not reflect endorsements or recommendations for any specific investment, strategy, or action.

Investing involves inherent risks, including the potential loss of principal. Past performance is not indicative of future results. We strongly encourage readers to conduct their own research and consult with a qualified financial advisor or professional before making any financial decisions. MacroQuant Insights and its contributors disclaim all liability for investment decisions based on the information provided and make no warranties regarding the content’s accuracy or reliability.

Remember, all investments carry risks, and it is essential to understand these risks fully before acting on any information presented. Users are responsible for their own investment decisions. MacroQuant Insights assumes no responsibility for any outcomes resulting from the use of this information. Content is subject to change without notice.