This week showed us how quickly market sentiment can shift. Treasury yields pushed up to 4.20% (↑10bps), enough to end Wall Street's impressive six-week rally. While Europe struggles with a contracting economy (PMI: 49.7), China's making moves we've never seen before - cutting their five-year loan rate to 3.6%. Let's see what all this means for investors.

🔍 Takeaway

Global markets are giving us quite a story this week. U.S. yields are testing new levels, Europe can't seem to find its growth momentum, and Asia's showing us two very different economic pictures. These aren't just numbers - they're changing how investors think about where to put their money.

United States: Talk about a split economy - services are thriving with a PMI of 55.3 while manufacturing sits at 47.8. Even durable goods tell us the same story: overall orders down 0.8% to $284.8 billion, but core business spending still grew 0.5%. Companies are spending, just very selectively.

International: Europe's PMI at 49.7 tells us growth is hard to come by, especially in powerhouses France and Germany. Consumer confidence did tick up to -12.5, the best in almost two years, but that's coming from a pretty low bar.

Emerging Markets: Asia's giving us two completely different stories. China's cutting rates to levels we've never seen (3.6%), while India's economy keeps surprising everyone with PMIs above 57. It's rare to see such a clear contrast in the same region.

⭐️ Post of the week

Look at these numbers: tech's biggest players are about to make it rain in the AI world. The "hyperscalers" (Microsoft, Google, Amazon, and Meta) are ramping up their spending from $91 billion in 2020 to a massive $318 billion by 2029. That's a 252% jump!

Here's what caught my eye in Sebastian Page's analysis:

2024 is shaping up to be the big year - we're talking about a 39% surge in AI investments

After that? Growth doesn't stop, but it sure slows down - dropping to 14% in 2025

By 2029, we're looking at a more modest 11% growth rate

What this means for investors:

Companies riding the AI wave have had a great run thanks to this massive spending

2024 might be as good as it gets for growth rates

Post-2024, the challenge will be finding companies that can still deliver strong earnings even as spending growth normalizes

The bottom line? AI isn't going anywhere, but that hockey-stick growth in spending probably is. Smart investors might want to start thinking about which companies can thrive even when the spending spree cools off.

Source: Sebastian Page - LinkedIn

💼 Market Indicators

SPY Performance

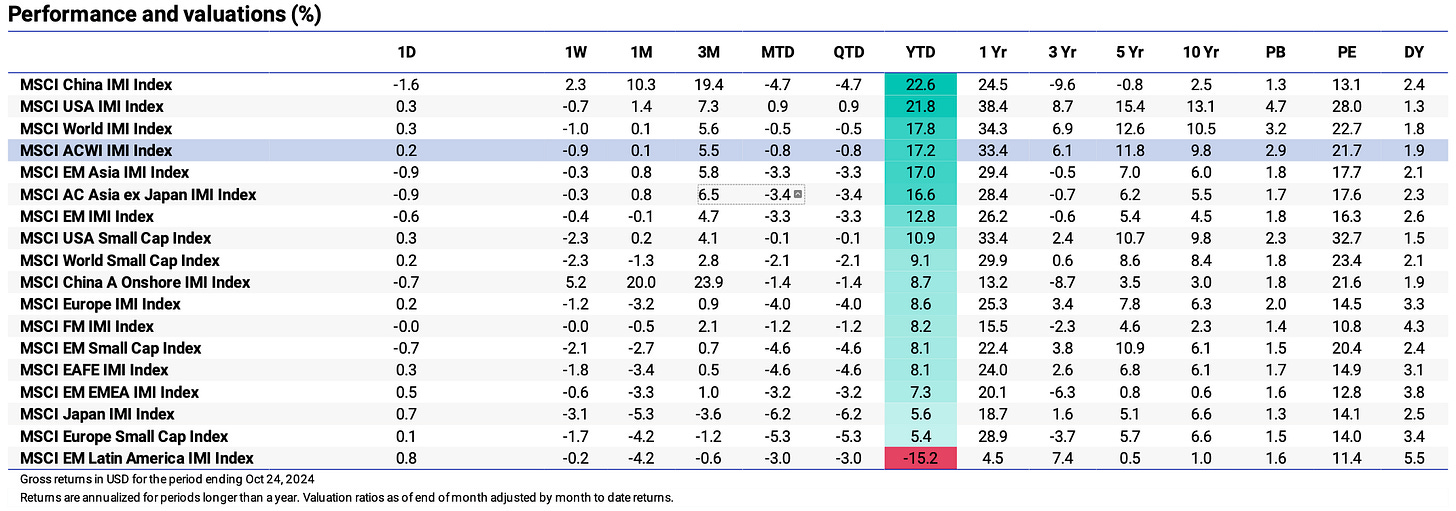

Performance and Valuations by Region

Source: MSCI

Momentum performance by Style

Source: MSCI

S&P 500 Earnings Per Share

Source: Yardeni Research

🗺️ Around the World in Detail

United States 🇺🇸: A Tale of Two Economies

Services are leading the way with a strong PMI of 55.3 - consumers are still spending on experiences despite those higher rates everyone's talking about.

Manufacturing isn't joining the party, with PMI at 47.8. Four months of decline tells us this isn't just a temporary dip.

The durable goods story gets interesting - overall orders down 0.8%, but look at core business spending: up 0.5%. Companies are still willing to invest, just selectively.

International 🌐: Rate Cuts and Easing Inflation Across Europe

Canada 🇨🇦

The Bank of Canada just went big - a 50bps rate cut to 3.75%. That's twice the size of recent cuts, telling us they're getting serious about supporting growth.

Inflation finally dropped below target to 1.6%. After three years of above-target inflation, this is exactly what the central bank wanted to see.

Euro Area 🇪🇺

Services PMI slowed to 51.2 - still growing, but barely. New orders are dropping, which isn't what you want to see heading into winter.

Manufacturing improved a bit to 45.9, but let's be real - anything under 50 still means contraction. European factories need a boost in demand.

Consumer confidence hit -12.5, the best since early 2022. Still not great, but Europeans are feeling less pessimistic about their economic future.

United Kingdom 🇬🇧

Services sector PMI at 51.8 shows growth, but it's slowing down. Businesses are getting nervous about what the Autumn Budget might bring.

Manufacturing barely holding at 50.3 - one small slip and we're in contraction territory. Export orders aren't helping either.

Japan 🇯🇵

Services PMI dropped to 49.3, dipping into contraction for the first time since June. Looks like domestic demand is finally cooling off.

Manufacturing PMI at 49.0 marks the fourth straight month of decline. The weak yen isn't providing the export boost many hoped for.

Emerging Markets 🌏: A Region of Extremes

China 🇨🇳

Loan rates just hit a historic low of 3.6%. When China sets records like this, it's worth paying attention to what they're seeing in their economy.

Youth unemployment improved to 17.6% - better than last month's record high, but still a major concern for Beijing.

That 700 billion RMB liquidity injection isn't small change. China's showing us they're ready to support growth with real money.

India 🇮🇳

Manufacturing PMI jumped to 57.4, with export orders surging. India's factories are humming while others struggle.

Services even stronger at 57.9. When both sectors are above 57, you know the economy's firing on all cylinders.

Companies are hiring at the fastest pace in years. This isn't just a temporary bounce - businesses are betting on sustained growth.

Quick Regional Updates:

Taiwan 🇹🇼: Retail sales up 3.2% - the best in three months. Tech equipment sales are leading the way, suggesting consumer confidence is holding up.

South Korea 🇰🇷: A tiny 0.1% growth in Q3, but hey, at least it's positive. Consumer confidence rising to 101.7 tells us Koreans are staying optimistic.