Synchronized Growth and Market Surprises

Translating Global Economic Shifts into Smart Investment Plays

Hey everyone, welcome to MacroQuant Insights. Today, we're peering into the economic crystal ball, and let me tell you - it's showing some wild patterns.

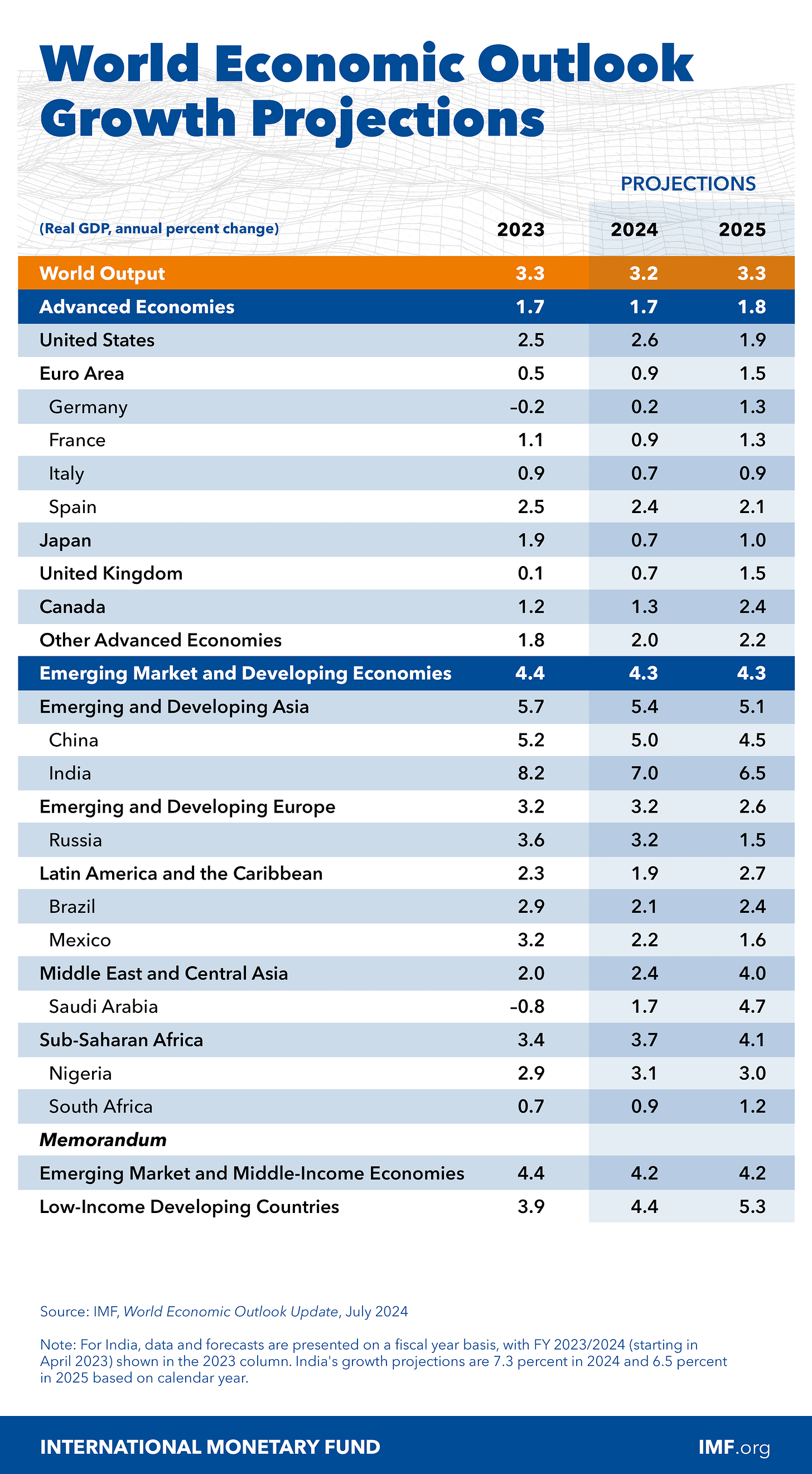

The IMF just dropped its latest World Economic Outlook, and while the headline numbers might lull you into a false sense of security, there's a storm brewing beneath the surface. This isn't just about dry economic figures; it's about anticipating the next big market moves before they happen.

Global growth projections are holding steady at 3.2% this year and 3.3% for next, but don't let those headline numbers fool you. There's a whole lot of action happening under the hood.

Here's the deal: major economies are starting to sync up, but our medium-term outlook is looking volatile. Why?

Let me break it down for you:

1️⃣ Growth alignment with a twist

The US is finally showing signs of cooling off after its 2023 hot streak, while the euro area is gearing up for a comeback. But here's the kicker - Asia's emerging markets are still the real MVPs of global growth. India and China are carrying half the team on their backs!

Yet, and this is a big yet, China's projected to slow down to 3.3% growth by 2029. That's like going from Usain Bolt to power walking in economic terms.

2️⃣ Inflation: The unwanted party guest that won't leave

We thought we'd shown inflation the door, but it's still hanging around in some advanced economies, especially the US. The IMF is pointing out that while the big inflation shocks have faded, we've got sticky services prices and wage growth keeping the party going. This could squeeze profit margins and reduce consumer purchasing power - a double whammy for stocks.

3️⃣ Fiscal challenges: The elephant in the room

Remember how we all went a bit wild with the spending during the pandemic? Well, the bill's coming due. Public finances are looking rougher than we thought, and the IMF is wagging its finger at countries not doing enough to rebuild those fiscal buffers.

They're particularly unimpressed with the US running expansionary fiscal policy at full employment. It's like maxing out your credit card when you've already got a full piggy bank.

4️⃣ Policy uncertainty: The plot thickens

It's not just about the money, folks. Our global trading system is looking shakier than a Jenga tower in the final rounds. More countries are going rogue with tariffs and industrial policies, and it's not exactly a recipe for shared prosperity.

Now, let's circle back to why all this matters for your portfolio.

Remember that economic crystal ball I mentioned? Well, here's where the patterns start to materialize into potential market strategies:

The synchronized growth we're seeing in major economies might seem comforting, but it could lead to some surprising market reactions. Sometimes, too much alignment can breed complacency - and that's when markets tend to throw curveballs. Keep an eye on cyclical strength indicators - they might predict equity, FX, and fixed income returns better than you'd think.

That stubborn inflation? It's not just an economic headache; it's a market wildcard. Keep a close eye on how different sectors respond to persistent price pressures. Some, like commodities and real estate, might actually benefit as inflation hedges.

The fiscal tightrope walk many countries are attempting could lead to some serious volatility in bond markets. This might create both risks and opportunities across various asset classes. Remember, bonds often outperform during economic contractions, so position accordingly.

And let's not forget the policy uncertainty. In a world where trade rules are increasingly up for debate, being nimble in your investment approach is key. Risk tolerance shifts with macroeconomic conditions, so be prepared to adjust your strategy as investor sentiment evolves.

The bottom line?

We're entering a phase where macro trends and market movements are going to be more intertwined than ever. It's not just about reading the economic tea leaves anymore; it's about understanding how these complex, global forces ripple through every corner of the financial markets. And remember, markets often price in future expectations, leading to some counterintuitive short-term relationships between macro variables and returns.

So stay sharp, keep your models flexible, and remember - in the world of MacroQuant, connecting these dots is what gives us our edge. Let's ride this wave of change together.

Source: IMF Blog - July 2024