Stocks Fall for Fourth Straight Week Amid 11% Consumer Sentiment Plunge

Week Ending March 14, 2025

U.S. stocks tumbled for the fourth consecutive week, with the S&P 500 declining 2.3%. This selloff, fueled by escalating trade tensions and an 11% drop in consumer sentiment, has pushed the S&P 500 from a lofty 22.5x forward earnings multiple down to 20x—right at its five-year average but still well above long-term norms. While February's inflation data offered a glimmer of hope with core CPI easing to 3.1%, investors remain fixated on the potential stagflation risks as tariff announcements continue to rattle markets and consumers increasingly brace for higher prices ahead.

The market's reaction mirrors what often happens when sentiment deteriorates faster than fundamentals—investors sell first and ask questions later. This pullback doesn't just reflect shifting asset prices but signals something potentially more concerning: consumers, who drive roughly 70% of economic activity, are rapidly losing confidence despite a labor market that continues to show surprising resilience with job openings increasing by 232,000 in January.

⏱️ Global Markets in 10 Seconds:

🇺🇸 Consumer sentiment falls 11% to 57.9, third straight monthly decline ⚠️

🇨🇳 CPI contracts 0.7% in February, deflation concerns intensify 📉

🇯🇵 Wage negotiations yield largest pay deal in three decades 💰

🇬🇧 Economy contracts 0.1% in January, production sector falls 0.9% 🏭

🇨🇦 BoC cuts rates to 2.75% amid US trade conflict concerns 🏦

🔍 The Big Picture

Markets are functioning like a nervous driver approaching a foggy intersection – slowing down dramatically despite green lights in some directions. The disconnect between improving inflation data and deteriorating sentiment highlights how policy uncertainty can override economic fundamentals. This growing divergence between what the data says and what market participants believe is creating both risks and opportunities across global markets.

United States: February's core inflation dropped to 3.1% (lowest since April 2021) while the University of Michigan's consumer inflation expectations jumped to 4.9% (highest since November 2022). It's like watching one person put out a fire while another stockpiles matches and gasoline – and markets are struggling to determine which view will prevail as tariff threats cast long shadows over future price stability.

International: The UK's 0.1% GDP contraction shows how fragile the recovery remains, with manufacturing taking the biggest hit (-1.1%) as global trade uncertainties compound domestic challenges. Meanwhile, Japan secured its largest wage deal in three decades during spring negotiations, potentially providing the sustained wage growth that the BOJ has been desperately waiting for before committing to further rate hikes.

Emerging Markets: China continues battling deflation with consumer prices falling 0.7% year-over-year while India's inflation plummeted to 3.62%, well below the 4% target and expectations. This creates a fascinating policy divergence – China preparing stimulus announcements to boost consumption while India enjoys the flexibility to continue its easing cycle from a position of unexpected price stability.

💼 Market Indicators

SPY Performance

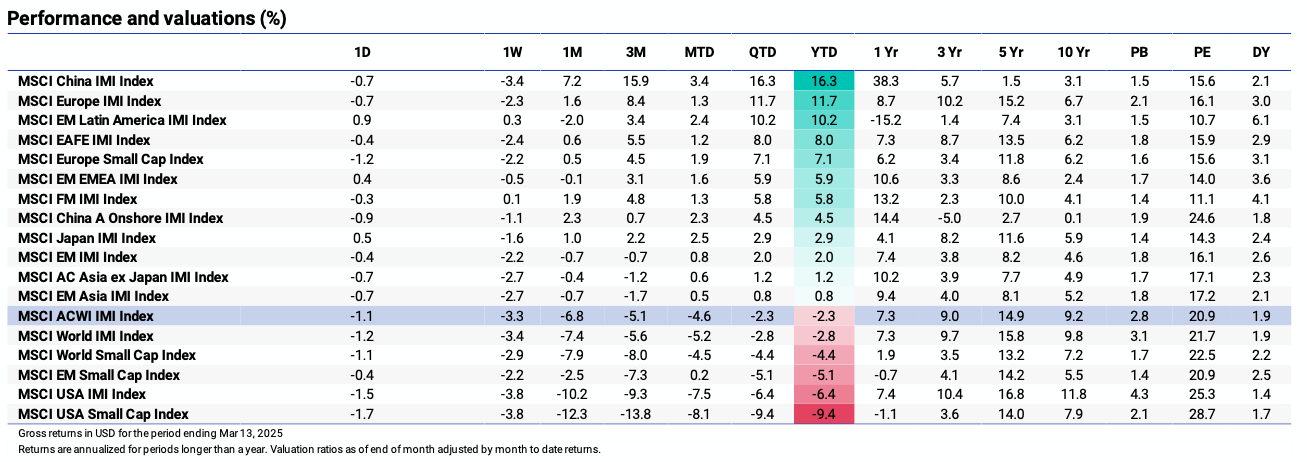

Performance and Valuations by Region

Source: MSCI

Momentum performance by Style

Source: MSCI

S&P 500 Earnings Per Share

Source: Yardeni Research

🗺️ Around the World in Detail

🇺🇸 United States: Sentiment vs Reality

Core inflation eased to 3.1% in February, its lowest level since April 2021 and below consensus expectations. Think of this as your fever finally breaking after a long illness – encouraging but not quite back to normal yet.

Consumer sentiment plunged 11% to 57.9 in March, now down 22% from December. This isn't just a minor mood shift – it's like watching restaurant patrons suddenly rush for the exits while the kitchen is still sending out perfectly good food.

Job openings increased by 232,000 to 7.74 million in January, exceeding expectations and showing particular strength in retail trade (+143,000) and finance (+77,000). The labor market resembles a sturdy foundation still supporting a house while the homeowners are frantically discussing whether to sell.

🌐 International Markets: Mixed Policy Paths

Canada 🇨🇦

The Bank of Canada cut rates by 25bps to 2.75%, marking 225bps in cuts since starting its easing cycle last June. Canada's central bank is navigating monetary policy like a kayaker paddling ahead of approaching rapids – moving decisively while eyeing the turbulence coming from its southern neighbor.

Europe 🇪🇺

ECB officials expressed doubts about an April rate cut just days after lowering rates for a sixth time since June. ECB President Christine Lagarde cited "exceptionally high uncertainty" that could make it harder to meet the 2% inflation target. Europe's central bankers appear increasingly divided – like a kitchen with too many chefs arguing over whether the soup needs more salt.

UK 🇬🇧

The British economy contracted 0.1% in January after growing 0.4% in December, with production falling 0.9% and manufacturing down 1.1%. The UK's manufacturing sector is struggling to find its footing – like someone trying to climb a ladder during an earthquake.

Japan 🇯🇵

Spring wage negotiations secured the largest pay deal in more than three decades, marking the third straight year of significant wage increases. This wage growth momentum is exactly what the BOJ has been waiting for – like a farmer finally seeing rain after years of drought.

Japan's GDP grew by 0.6% in Q4 2024, above the previous quarter's 0.4% and marking the third consecutive quarter of growth. The Japanese economy is gradually finding its rhythm – slow but increasingly steady, like a marathoner who starts conservatively but maintains pace while others fade.

🌏 Emerging Markets: Divergent Strategies

China 🇨🇳

Consumer prices fell 0.7% year-over-year in February, while core CPI declined 0.1% – its first decrease since 2021. China's deflation problem resembles a bicycle that's losing momentum – the longer it goes on, the harder it becomes to keep balance.

Officials announced a press conference on Monday focusing on boosting consumption, sparking a rally that pushed the CSI 300 Index to its highest level since mid-December. Markets are responding like parched plants to the mere forecast of rain – showing just how desperately investors want policy action.

Retail sales rose 3.7% year-on-year in December, accelerating from November's 3.0% and exceeding expectations. The consumer sector shows glimmers of life, but like a patient with occasional good days amid a chronic condition, sustainability remains the bigger question.

South Korea 🇰🇷

Unemployment rate dropped to 2.7% in February, its second consecutive monthly decline from 3.7% in December. South Korea's labor market recovery suggests the economy is regaining its strength after last year's brief disruption – like a boxer quickly getting back to form after a stumble.

India 🇮🇳

Annual inflation rate dropped dramatically to 3.62% in February, well below the 4% expectation and marking the first time in six months inflation fell below the RBI's 4% mid-point target. India's disinflation streak is arriving like an unexpected inheritance – a pleasant surprise that creates new opportunities.

🔑 Key Takeaway

This week's data reveals a precarious disconnect between cooling inflation and deteriorating sentiment, creating one of the market's most challenging valuation environments. The S&P 500's P/E compression from 22.5x to 20x forward earnings reflects not just price declines but growing concerns about future earnings revisions – a critical dynamic as analysts maintain optimistic projections of 10-12.5% growth through 2027 despite mounting headwinds. Consumer inflation expectations (4.9%) now dramatically outpace actual core inflation (3.1%), indicating psychology has overtaken fundamentals in driving market behavior. Meanwhile, central banks face divergent challenges: some cutting rates aggressively (Canada), others signaling caution (ECB), and some preparing for tightening (Japan) – creating a fragmented global policy landscape that compounds the uncertainty stemming from escalating trade tensions.

The content provided on MacroQuant Insights is for informational and educational purposes only and does not constitute financial advice. While every effort is made to ensure accuracy and reliability, all data, analysis, and opinions are based on sources believed to be trustworthy but are not guaranteed for completeness or timeliness. The views expressed are solely those of the author and do not reflect endorsements or recommendations for any specific investment, strategy, or action.

Investing involves inherent risks, including the potential loss of principal. Past performance is not indicative of future results. We strongly encourage readers to conduct their own research and consult with a qualified financial advisor or professional before making any financial decisions. MacroQuant Insights and its contributors disclaim all liability for investment decisions based on the information provided and make no warranties regarding the content’s accuracy or reliability.

Remember, all investments carry risks, and it is essential to understand these risks fully before acting on any information presented. Users are responsible for their own investment decisions. MacroQuant Insights assumes no responsibility for any outcomes resulting from the use of this information. Content is subject to change without notice.