Global stocks plunged this week, with the S&P 500 posting a 13.7% loss, its worst weekly performance in over five years. This sharp selloff, triggered by the Trump administration's announcement of harsher-than-expected tariffs, sent the Russell 2000 Index tumbling to levels 30% below its all-time high. As countries including China and Japan quickly announced retaliatory measures, investors fled to safe-haven assets, pushing the 10-year Treasury yield below 4% for the first time since October amid growing expectations for multiple Federal Reserve rate cuts in 2025.

⏱️ Global Markets in 10 Seconds:

🇺🇸 S&P 500 -13.7% worst weekly drop in five years 📉

🇪🇺 Inflation falls to 2.2% as ECB weighs April cut 🎯

🇨🇳 Manufacturing PMI 50.5 amid retaliatory tariffs ⚠️

🇯🇵 Nikkei down 9% on 24% US tariff announcement 📉

🇨🇦 Employment falls by 33,000 first decline since 2022 💼

🔍 The Big Picture

The global economy faces its biggest test since the pandemic as new tariffs threaten to disrupt trade flows, increase inflation pressures, and potentially trigger a recession. Central banks that were preparing for a gradual easing cycle now face a complex policy dilemma as slowing growth collides with renewed price pressures. Markets have quickly recalibrated expectations, with investors fleeing to safe havens amid heightened uncertainty about global trade relationships.

United States: The 13.7% drop in the S&P 500 tells only part of the story - the real concern lies in the manufacturing PMI falling back into contraction at 49 while price pressures soared to 69.4, the highest since 2022. This toxic combination of weakening activity and rising inflation creates a nightmare scenario for the Fed, which must now weigh its mandate amid conflicting signals from the surprisingly strong jobs report showing 228,000 new positions in March.

International: Europe's remarkably low 2.2% inflation rate and record-low 6.1% unemployment would normally give the ECB confidence to cut rates, but policymakers are now considering pausing their easing cycle due to tariff uncertainties. The ECB's Christine Lagarde emphasized there's "still a bit of work to do" to reach the 2% inflation target, highlighting how quickly the global trade landscape has complicated monetary policy decisions worldwide.

Emerging Markets: China's resilient manufacturing PMI of 50.5 stands in stark contrast to its aggressive retaliatory response to US tariffs, including a matching 34% duty on American imports and targeted restrictions on rare earths and other strategic goods. The rapid escalation suggests China is preparing for a prolonged trade conflict that could reduce its GDP by 1-2% annually, though Beijing appears ready to deploy fiscal stimulus to offset these headwinds.

💼 Market Indicators

SPY Performance

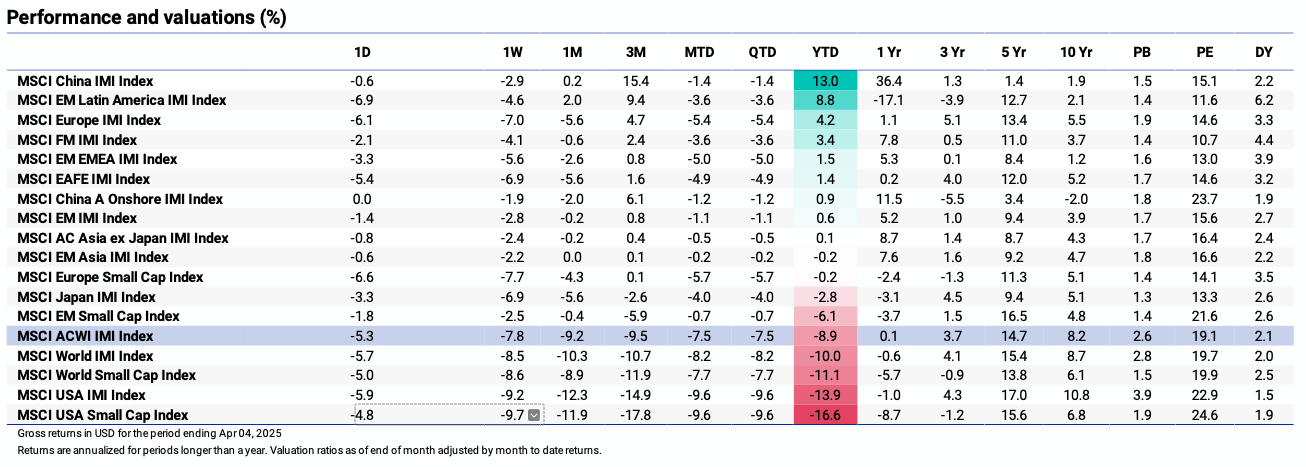

Performance and Valuations by Region

Source: MSCI

Momentum performance by Style

Source: MSCI

S&P 500 Earnings Per Share

Source: Yardeni Research

🗺️ Around the World in Detail

🇺🇸 United States: Trade Shock Tremors

Manufacturing PMI fell to 49 in March, the first contraction in three months. The tariff impact is already visible in the price index jumping to 69.4, the highest since 2022.

Services PMI dropped to 50.8 from 53.5, barely hanging in expansion territory. Businesses are reporting "significant cost increases due to tariff activity," suggesting inflation pressures could build quickly.

The economy added 228,000 jobs in March, significantly beating expectations of 135K. This labor market resilience contrasts sharply with the manufacturing weakness, complicating the Fed's potential response to tariff pressures.

Treasury yields plummeted with the 10-year falling below 4% for the first time since October as investors sought safety. Markets are now betting the Fed will be forced to cut rates more aggressively to counter growth concerns.

🌐 International Markets: Policy Dilemmas Intensify

Canada 🇨🇦

Employment fell by 33,000 in March, the first decline since January 2022, with the loss of 62,000 full-time jobs. This unexpected weakness could push the Bank of Canada toward more aggressive rate cuts.

Manufacturing PMI sank to 46.3, with firms noting clients have adopted a cautious approach due to uncertainty over US-Canada tariffs.

Europe 🇪🇺

Inflation eased to 2.2% in March, the lowest since November 2024, while core inflation fell to 2.4%, its lowest since January 2022. This would typically reinforce rate cut expectations.

The unemployment rate hit a fresh record low of 6.1% in February, highlighting the region's tight labor market despite slowing growth.

ECB policymakers are now considering pausing their rate cut plans given the pronounced uncertainty from US trade policies, with Bloomberg reporting hawks are gaining influence.

UK 🇬🇧

House price growth was flat in March, ending seven consecutive months of gains as buyers reacted to upcoming transaction tax increases.

Mortgage approvals fell to 65,481 in February, the lowest since August, signaling further cooling in the UK housing market.

Japan 🇯🇵

The Nikkei 225 plunged 9% for the week as investors reacted to the surprise 24% US tariff announcement targeting Japanese goods.

The yen strengthened to around 146 against the dollar as safe-haven flows increased, further pressuring Japan's export-heavy industries.

Market expectations for Bank of Japan rate hikes have diminished as officials assess both direct and indirect impacts of the US tariffs.

🌏 Emerging Markets: Diverging Responses

China 🇨🇳

Beijing announced a matching 34% tariff on all US imports starting April 10, along with restrictions on rare earth exports and other retaliatory measures.

Manufacturing PMI rose to 50.5 in March, the highest in a year, suggesting domestic stimulus measures were gaining traction before the trade war escalation.

South Korea 🇰🇷

Manufacturing PMI declined to 49.1 in March, the second consecutive month of contraction as domestic demand stagnated.

Inflation ticked up to 2.1%, slightly exceeding expectations as the Bank of Korea has cut rates by 75 basis points in the current easing cycle.

Taiwan 🇹🇼

Manufacturing PMI dropped sharply to 49.8 in March from 51.5, marking the first contraction in a year as global trade fears increased.

Companies continued cutting staff and adopted a more cautious approach to inventory management, though business confidence remains high for future output.

🔑 Key Takeaway

This week's market upheaval perfectly illustrates why portfolio diversification isn't just investment theory. While the S&P 500 crashed 13.7% and the Russell 2000 plunged 30% from its peak, Treasury yields dropped below 4% as bonds rallied during the equity sell-off. This negative correlation between asset classes—the cornerstone of modern portfolio theory—demonstrated its value in real-time during a crisis scenario. Think of diversification as financial insurance: you don't appreciate its value until your house is on fire, and this week, several market houses were definitely ablaze.

The dramatic divergence between regions further reinforces the case for geographic diversification. While US markets suffered their worst week in five years, China's manufacturing PMI actually strengthened to 50.5, showing expansion despite broader concerns. This isn't just about reducing risk—it's about capturing opportunity. A well-constructed portfolio acknowledges that we can't predict which asset class or region will outperform next, especially during policy shocks like tariff announcements. Just as you wouldn't put all your eggs in one basket when crossing a rocky stream, investors navigating today's turbulent markets need exposure across asset classes, geographies, and sectors to weather storms while positioning for the eventual recovery.

The content provided on MacroQuant Insights is for informational and educational purposes only and does not constitute financial advice. While every effort is made to ensure accuracy and reliability, all data, analysis, and opinions are based on sources believed to be trustworthy but are not guaranteed for completeness or timeliness. The views expressed are solely those of the author and do not reflect endorsements or recommendations for any specific investment, strategy, or action.

Investing involves inherent risks, including the potential loss of principal. Past performance is not indicative of future results. We strongly encourage readers to conduct their own research and consult with a qualified financial advisor or professional before making any financial decisions. MacroQuant Insights and its contributors disclaim all liability for investment decisions based on the information provided and make no warranties regarding the content’s accuracy or reliability.

Remember, all investments carry risks, and it is essential to understand these risks fully before acting on any information presented. Users are responsible for their own investment decisions. MacroQuant Insights assumes no responsibility for any outcomes resulting from the use of this information. Content is subject to change without notice.