The S&P 500 climbed 3.96% year to date, closing within 1% of its all-time high as investors digested hotter-than-expected inflation data and shifting Federal Reserve expectations. This rally, fueled by resilient corporate earnings and tempered rate-cut hopes, saw growth stocks extend their lead over value for the second time this year, while small caps struggled to keep pace. As inflation pressures persist and bond yields stay volatile, markets are recalibrating expectations for Fed policy, with rate cuts now seen as a late-2025 event rather than mid-year relief.

⏱️ Global Markets in 10 Seconds:

🇺🇸 S&P 500 nears record as rate cut bets fade 📈

🇪🇺 Eurozone GDP 0.9% as Germany contracts, UK surprises 🚀

🇯🇵 10Y JGB yield hits 1.35% on faster rate hike fears ⚠️

🇨🇳 Hang Seng +7.04% as tariff concerns ease 📊

🇮🇳 Inflation drops to 4.31%, boosting rate cut outlook 💰

🔍 The Big Picture

Markets surged this week, with the S&P 500 nearing record highs and global equities rising. However, sticky inflation and shifting rate expectations kept bond markets volatile. Investors are now recalibrating their outlooks, with the Fed and other central banks signaling caution on easing policy too soon.

United States: CPI rose 3.0% YoY, pushing Fed rate cut bets to late 2025. Meanwhile, retail sales plunged 0.9%, the worst drop since 2023, suggesting consumers are feeling the squeeze.

International: Eurozone GDP stagnated (0.0%), with Germany contracting again, while the UK surprised with 0.1% growth. The Bank of England remains cautious on rate cuts despite a softening economy.

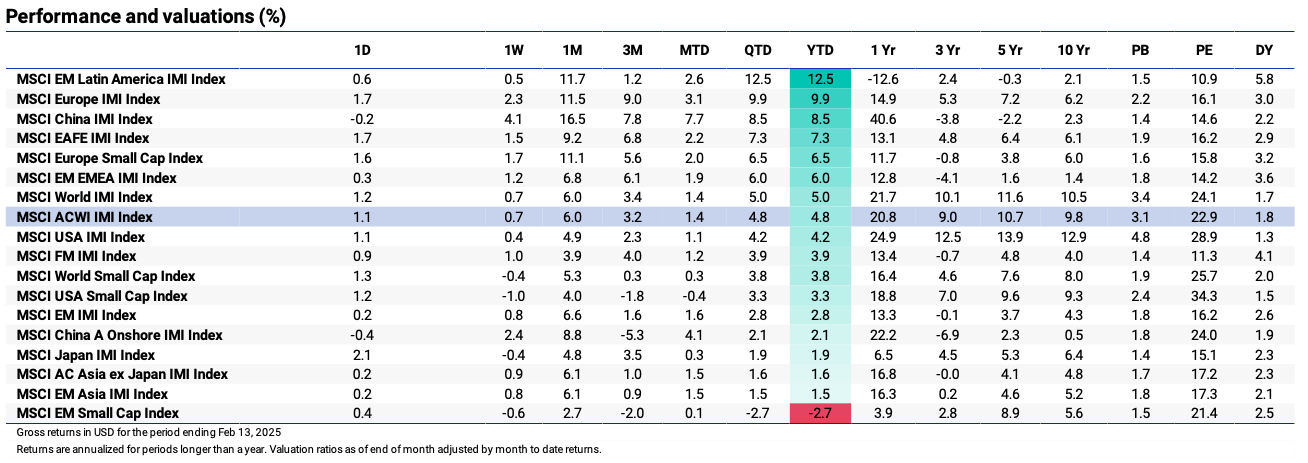

Emerging Markets: India’s inflation dropped to 4.31%, bringing it closer to the RBI’s target, boosting rate cut hopes. Meanwhile, China’s Hang Seng soared 7.04%, as trade tensions eased, but factory deflation remains a concern.

⭐️ Research of the week:

The Power of Joint Factor Investing

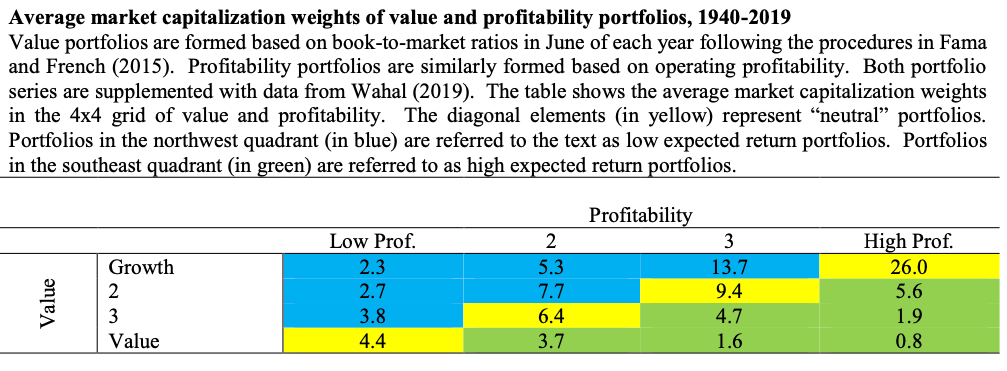

Researchers Sunil Wahal and Eduardo Repetto published findings on how combining value and profitability factors can enhance portfolio outcomes. Their work challenges the common practice of treating investment factors as independent building blocks that can be simply mixed together.

Why This Analysis Matters:

The research employs portfolio-level analysis rather than individual security screening, allowing clearer visualization of tradeoffs between value and profitability characteristics

Traditional factor investing often treats value and profitability as separate components that can be independently combined, potentially missing crucial interaction effects

The study demonstrates how targeting the joint distribution of factors, rather than layering them sequentially, can meaningfully improve risk-adjusted returns while maintaining high market correlation

Key Evidence :

Over 1940-2019, portfolios tilted toward stocks ranking highly on both value and profitability metrics outperformed the market by up to 10 basis points monthly with similar volatility

The approach maintained its edge even during 2000-2019 when pure value strategies struggled, highlighting the diversification benefits of considering factor interactions

Bootstrap simulations across 1-30 year periods showed improved outcomes across multiple metrics: higher average returns, lower probability of negative returns, and better risk-adjusted performance at longer horizons

Bottom Line:

Factor investing benefits from understanding and targeting the relationships between different characteristics rather than treating them as independent components. This research highlights how careful portfolio engineering that considers factor interactions can enhance outcomes while maintaining practicality around trading costs and capacity constraints.

Source: On the Conjoint Nature of Value and Profitability

💼 Market Indicators

SPY Performance

Performance and Valuations by Region

Source: MSCI

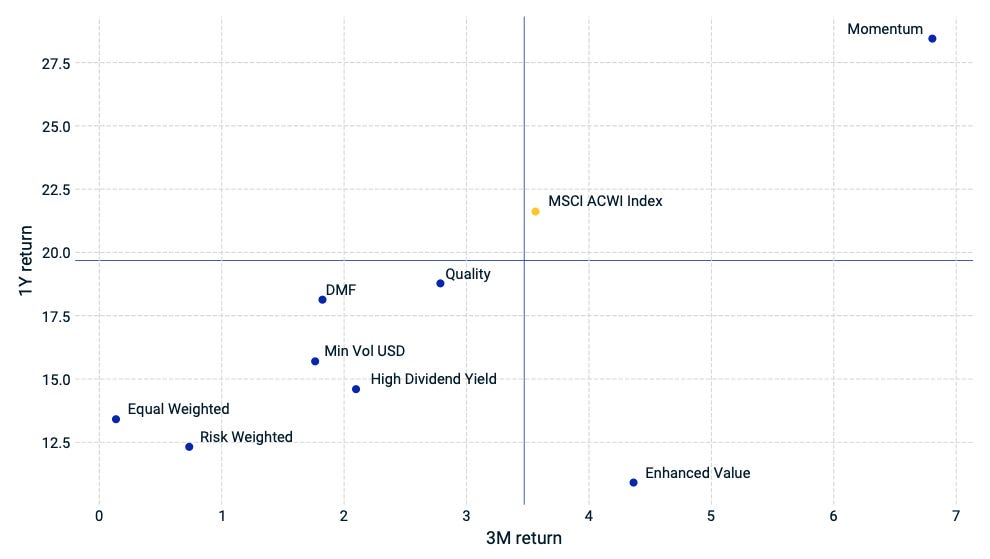

Momentum performance by Style

Source: MSCI

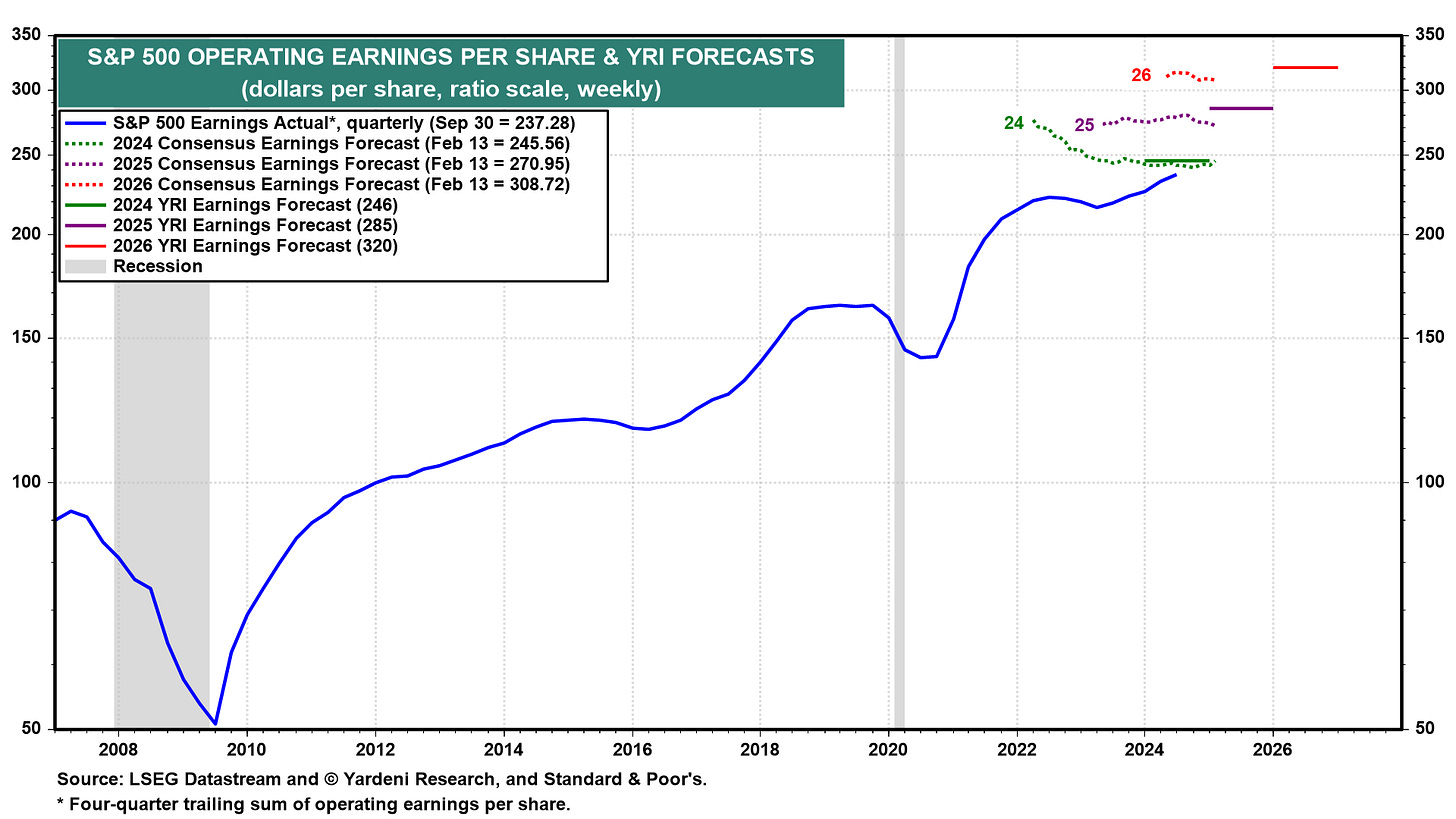

S&P 500 Earnings Per Share

Source: Yardeni Research

🗺️ Around the World in Detail

🇺🇸 United States: Inflation Stubborn, Markets Steady

CPI rose 3.0% YoY, with core inflation unexpectedly rising to 3.3%. Monthly inflation climbed 0.5%, fueling concerns that the Fed may need to keep rates higher for longer. Markets have now pushed the first rate cut expectation to December from September.

Consumer spending fell 0.9% in January, the worst drop since March 2023, as severe weather and high borrowing costs weighed on purchases. This pullback could signal early signs of a slowing economy.

The 10-year Treasury yield spiked to 4.66% after the CPI print before easing. While equities surged, the bond market’s reaction suggests investors are reconsidering how soon the Fed can ease policy.

🌐 International Markets: Mixed Growth, Policy Uncertainty

Europe 🇪🇺

Eurozone GDP flatlined at 0.0% in Q4, with Germany shrinking by 0.2%, reinforcing its position as the weak link in the bloc. Meanwhile, Spain grew 3.5%, showing economic divergence across the region.

The ECB remains cautious about cutting rates despite economic stagnation, as employment rose for the 15th consecutive quarter, keeping wage pressures intact.

The STOXX 600 hit record highs, gaining 1.78%, as optimism over an end to the Russia-Ukraine conflict lifted sentiment.

United Kingdom 🇬🇧

The UK economy grew 0.1% in Q4, avoiding contraction. Growth was driven by services and construction, though production remains weak.

BOE Chief Economist Huw Pill warned against premature easing, but some policymakers are pushing for bigger rate cuts given slowing consumer demand.

Japan 🇯🇵

The 10-year JGB yield rose to 1.35%, its highest in nearly 15 years, as inflation concerns mount. Markets are pricing in a potential rate hike by mid-2025.

The corporate goods price index rose 4.2% YoY, higher than expected. The Bank of Japan may have to tighten policy sooner than anticipated.

🌏 Emerging Markets: Inflation Eases, Markets Rally

China 🇨🇳

The Hang Seng Index surged 7.0%, as U.S. tariff concerns eased and investors piled into AI stocks. However, factory deflation remains a headwind, with PPI falling 2.3% YoY for the 28th straight month.

Moody’s downgraded China Vanke’s credit rating, raising default concerns. Beijing is reportedly crafting a $6.8 billion rescue plan, signaling selective intervention.

India 🇮🇳

Inflation dropped to 4.31%, cooling faster than expected and nearing the RBI’s 4% target, increasing odds of rate cuts later this year.

Consumer demand remains resilient, keeping growth steady despite global economic headwinds.

South Korea 🇰🇷

The jobless rate dropped to 2.9% from 3.7%, rebounding from last year’s labor disruptions. This suggests economic stability returning after recent turmoil.

🔑 Key Takeaway

This week's data reveals a complex interplay between market optimism and persistent inflation concerns, as the S&P 500 surged toward record highs despite hotter-than-expected inflation readings. The stark contrast between strong equity performance and deteriorating retail sales highlights the delicate balance between economic resilience and consumer strain, pushing Federal Reserve rate cut expectations significantly further into the future.

The divergence between regional performances – from the Eurozone's stagnation to India's cooling inflation and China's strong equity rally – underscores the importance of geographic diversification. This week's research on joint factor investing offers particularly timely wisdom: just as value and profitability factors demonstrate enhanced returns when considered together rather than independently, today's market requires investors to evaluate seemingly contradictory signals as interconnected parts of a larger whole. This becomes especially relevant as bonds and equities send opposing signals about economic health, suggesting that successful navigation of current markets demands a sophisticated understanding of how different market factors and regional trends amplify or moderate each other's effects.

The content provided on MacroQuant Insights is for informational and educational purposes only and does not constitute financial advice. While every effort is made to ensure accuracy and reliability, all data, analysis, and opinions are based on sources believed to be trustworthy but are not guaranteed for completeness or timeliness. The views expressed are solely those of the author and do not reflect endorsements or recommendations for any specific investment, strategy, or action.

Investing involves inherent risks, including the potential loss of principal. Past performance is not indicative of future results. We strongly encourage readers to conduct their own research and consult with a qualified financial advisor or professional before making any financial decisions. MacroQuant Insights and its contributors disclaim all liability for investment decisions based on the information provided and make no warranties regarding the content’s accuracy or reliability.

Remember, all investments carry risks, and it is essential to understand these risks fully before acting on any information presented. Users are responsible for their own investment decisions. MacroQuant Insights assumes no responsibility for any outcomes resulting from the use of this information. Content is subject to change without notice.