This week brought record highs for US markets, with the Russell 2000 climbing 28 points (↑1.2%) even as durable goods orders slipped 0.2%. Meanwhile, Eurozone inflation ticked up to 2.3%, but core inflation held steady, defying expectations of a rise. Add in a surprise GDP slowdown in Canada (1% annualized), and the picture gets even more interesting. Here’s what these shifts mean for global investors.

🔍 Takeaway

This week’s data paints a picture of diverging economic realities. While the US hits record market highs, Europe grapples with mixed inflation signals, and China shows modest recovery amid persistent challenges. These contrasts underscore the complexity of navigating global markets in an evolving macro landscape.

United States: Small-caps hit record highs as the Russell 2000 climbed 1.2%, supported by strong consumer data (+0.6% income, +0.4% spending). Meanwhile, durable goods orders disappointed (-0.2%), and tariff threats weighed on automakers, highlighting a split economy.

International: Eurozone inflation ticked up to 2.3%, but core inflation held steady at 2.7%, fueling speculation of ECB rate cuts. Germany’s retail sales slump (-1.5%) contrasts with a resilient labor market, keeping the region’s growth outlook uncertain.

Emerging Markets: China’s PMI edged up to 50.3, signaling modest recovery, while India’s GDP slowed sharply to 5.4%, reflecting manufacturing weakness. These trends underscore the diverging paths of Asia’s two largest economies.

⭐️ Post of the week

Source: Alexander L Wolman - LinkedIn

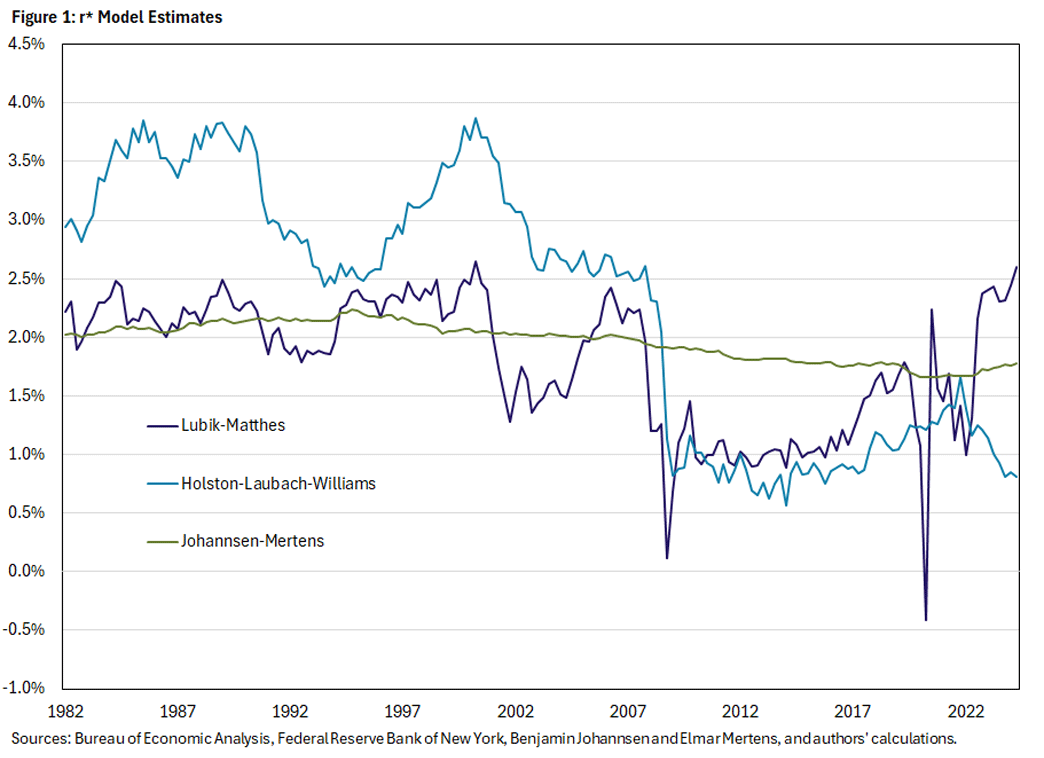

What if the interest rate that keeps the economy balanced wasn’t one number but three wildly different ones? Current estimates of the natural rate of interest (r*) vary significantly—from 0.8% to 2.6%—depending on the model used. This wide gap is sparking debates on which rate policymakers should trust as they navigate a post-pandemic economic landscape.

Here's what stood out:

Diverging models, diverging rates: The Lubik-Matthes model pegs r* at 2.6%, emphasizing a statistical approach, while the Holston-Laubach-Williams model offers a more structured 0.8%, driven by trends in productivity growth. Johannsen-Mertens strikes a middle ground at 1.8%, focusing on long-term stability.

Policy implications are huge: A higher r* suggests today’s rates are too restrictive, while a lower one implies the Fed still has room to tighten. This makes understanding these differences crucial for calibrating monetary policy.

Trend or anomaly? The recent divergence stems from residual processes and factors like the U.S. Treasury’s “convenience yield,” complicating the picture further.

What this means for investors:

Immediate impact: Market sensitivity to interest rate decisions will increase as policymakers debate these conflicting signals.

Medium-term consideration: Bond markets may experience heightened volatility as central banks refine their interpretation of r*.

Long-term outlook: The r* debate underscores the need for adaptive investment strategies that account for shifts in monetary policy frameworks.

Bottom Line:

The natural rate of interest isn’t one size fits all. Understanding the models behind r* gives investors an edge in predicting central bank moves—and staying ahead of market surprises.

Discover more insights in Richmond Fed’s full analysis here

💼 Market Indicators

SPY Performance

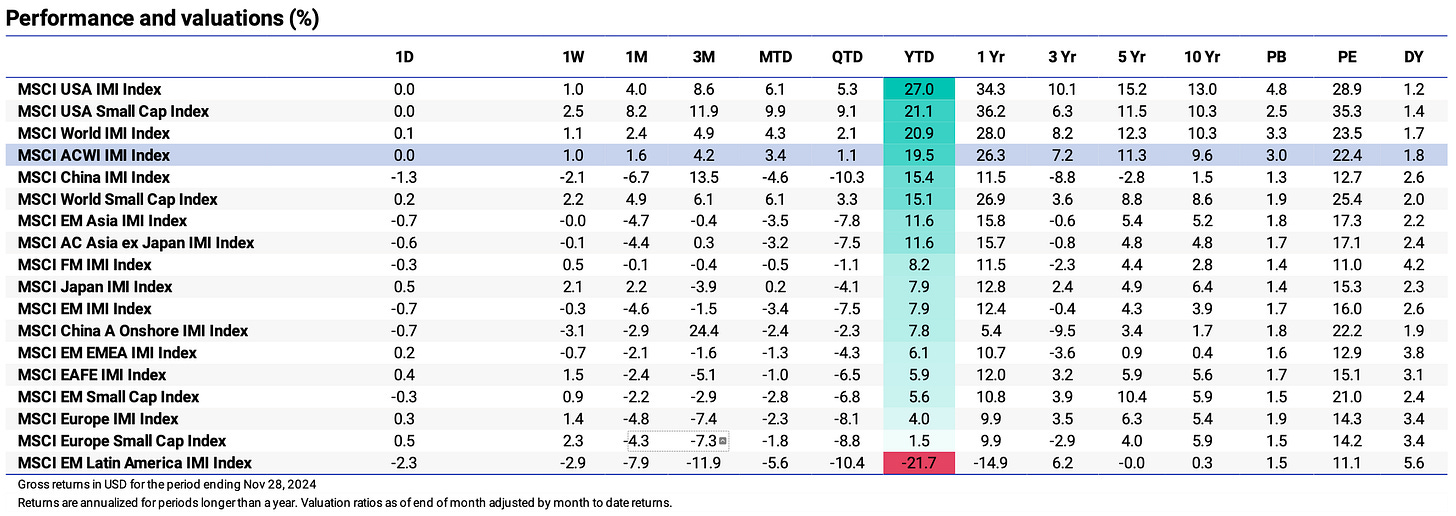

Performance and Valuations by Region

Source: MSCI

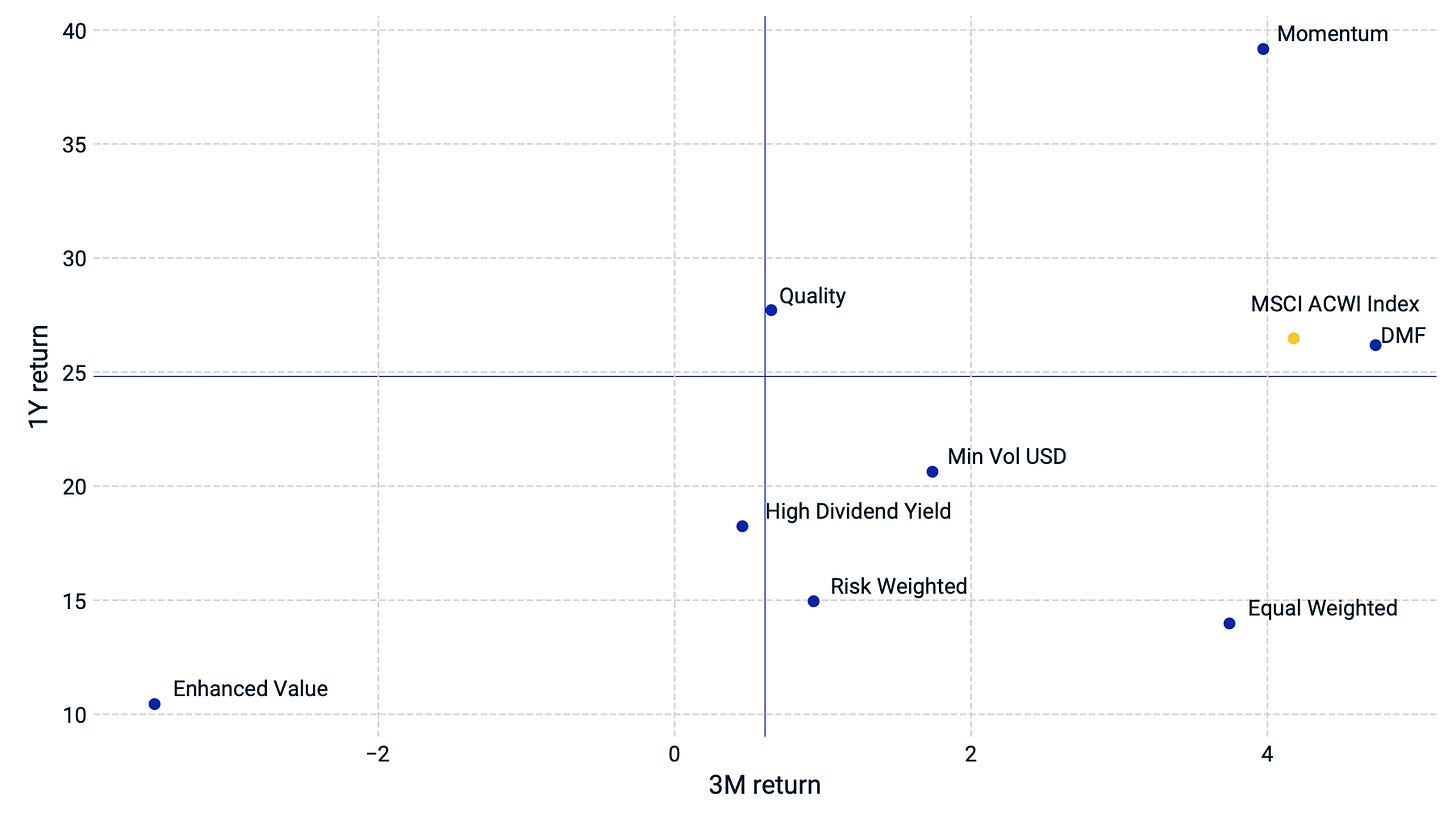

Momentum performance by Style

Source: MSCI

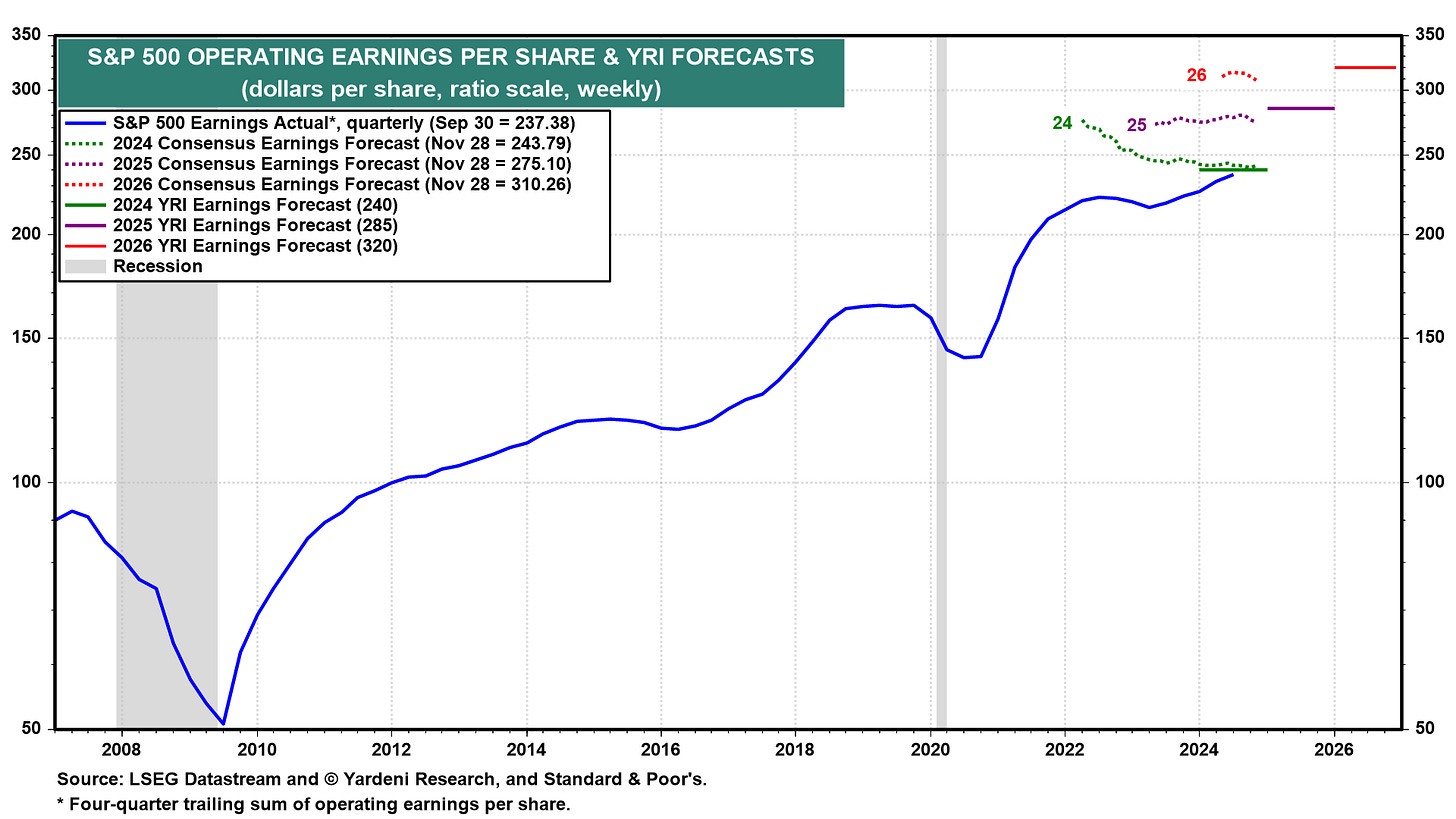

S&P 500 Earnings Per Share

Source: Yardeni Research

🗺️ Around the World in Detail

United States 🇺🇸: Resilience Meets Strain

Small-cap rally: The Russell 2000 surged 1.2% this week, hitting record highs for the first time in over three years. This shows investor confidence in the US economy's broader recovery.

Consumer strength: Personal income jumped 0.6%, while spending increased 0.4%, both beating expectations. Strong consumer demand is driving market resilience despite global uncertainties.

Manufacturing struggles: Durable goods orders missed estimates, rising just 0.2%, with core capital goods down 0.2%. Weakness in industrial demand underscores ongoing sectoral divergence.

International 🌐: Inflation, Tariffs, and Growth

Canada 🇨🇦

GDP slows: Annualized Q3 growth cooled to 1%, dragged down by weaker business investment and declining exports (-0.3%). Domestic consumption (+0.9%) remains a bright spot, signaling uneven growth.

Tariff fears loom: Trump’s proposed 25% tariff on Canadian imports threatens key sectors like auto manufacturing, sparking investor concern over cross-border trade.

Euro Area 🇪🇺

Inflation steady, mixed outlook: Headline inflation ticked up to 2.3%, but core inflation remained flat at 2.7%. Markets expect the ECB to lower rates in December, though uncertainty persists.

Germany falters: Retail sales plunged 1.5% in October, far below forecasts, as consumer demand weakens. Yet, a stable labor market provides some optimism for Europe’s largest economy.

United Kingdom 🇬🇧

Mortgage approvals rise: The highest levels since August 2022 signal some housing market resilience. But weak retail sales and soft consumer credit growth paint a mixed economic picture.

Japan 🇯🇵

Yen strengthens: Safe-haven demand pushed the yen to JPY 150 against the dollar as geopolitical risks intensified. This added pressure on Japan’s exporters, leading to weekly losses in the Nikkei 225 (-0.2%).

Inflation heats up: Tokyo core CPI rose 2.2% YoY in November, raising speculation about an earlier-than-expected Bank of Japan rate hike.

Emerging Markets 🌏: Uneven Momentum

China 🇨🇳

Manufacturing recovers: PMI rose to 50.3, its highest since April, supported by government measures. However, weak foreign orders (48.1) and employment (48.2) highlight lingering headwinds for the economy.

Liquidity concerns: The PBOC’s RMB 900 billion injection provided relief but signaled tighter conditions ahead as Beijing ramps up bond issuance.

India 🇮🇳

GDP slows: Q3 growth dropped to 5.4%, below expectations of 6.5%, with manufacturing (+2.2%) dragging overall performance. Agriculture and services offered some stability, but the slowdown signals waning momentum.

South Korea 🇰🇷

Rate cut surprises: The Bank of Korea slashed rates to 3.0%, defying consensus. Lower inflation and weak exports are forcing policymakers to prioritize growth over financial stability.

Taiwan 🇹🇼:

Retail sales dip: October sales fell 0.5% YoY, marking the first contraction in over three years. Declines in key categories like vehicles and apparel signal softening consumer demand amid global trade pressures.

The content provided on MacroQuant Insights is for informational and educational purposes only and does not constitute financial advice. While every effort is made to ensure accuracy and reliability, all data, analysis, and opinions are based on sources believed to be trustworthy but are not guaranteed for completeness or timeliness. The views expressed are solely those of the author and do not reflect endorsements or recommendations for any specific investment, strategy, or action.

Investing involves inherent risks, including the potential loss of principal. Past performance is not indicative of future results. We strongly encourage readers to conduct their own research and consult with a qualified financial advisor or professional before making any financial decisions. MacroQuant Insights and its contributors disclaim all liability for investment decisions based on the information provided and make no warranties regarding the content’s accuracy or reliability.

Remember, all investments carry risks, and it is essential to understand these risks fully before acting on any information presented. Users are responsible for their own investment decisions. MacroQuant Insights assumes no responsibility for any outcomes resulting from the use of this information. Content is subject to change without notice.