Growth Stocks Surge 5.5% as Yields Slide Across Curve

Week Ending November 29, 2024

Growth stocks led global markets this week, surging 5.5% ahead of value - their strongest outperformance since March 2023. This rally, fueled by falling Treasury yields and strengthening rate-cut expectations, came amid a pronounced shift in monetary policy expectations. The contrast between robust U.S. job gains and weakening European manufacturing data highlighted the complex backdrop facing central banks heading into 2025.

🔍 Takeaway

Policy divergence emerged as a key theme this week, as central banks faced increasingly different domestic challenges. While the Fed weighs rate cuts amid cooling inflation, the ECB confronts stagflation risks, and Asian central banks navigate property sector challenges

United States: Growth stocks soared, outpacing value by 5.5%, as November’s 227K job gains exceeded expectations. Meanwhile, Treasury yields fell, fueling speculation of a 25bps Fed rate cut in December. Labor market resilience and softening inflation set the stage for pivotal policy moves.

International: Europe’s PMI slumped to 45.2, with Germany and France dragging the region’s manufacturing sector deeper into contraction. Political turmoil in France spiked bond spreads before easing, as markets eyed potential ECB policy shifts. This economic slowdown raises concerns for 2024’s growth outlook.

Emerging Markets: China’s 51.5 PMI signaled steady manufacturing growth, but a -6.9% YoY drop in home sales underscored property sector fragility. In contrast, India maintained robust activity with a 56.5 PMI, highlighting a rare divergence within Asia. These trends hint at uneven regional recovery paths.

⭐️ Post of the week

This week, BCA Research's European strategist shared a powerful chart that challenges one of investing's most tempting biases - the assumption that deep underperformance must eventually snap back.

Here's why this analysis matters for your investment process:

The chart visualizes 35 years of relative performance between European and US stocks, highlighting that mean reversion isn't guaranteed after significant divergences

Instead of relying on intuition ("it's fallen so much, it must bounce"), BCA's analysis forces us to examine historical patterns and their underlying drivers

The focus on structural factors (trade tensions, China's influence) rather than just price action demonstrates how deep fundamental analysis should inform mean reversion expectations

Last week's economic data reinforces the importance of this framework:

Manufacturing PMI at 45.2 and Services PMI dipping to 49.5 highlight how structural headwinds can create persistent underperformance

Even with unemployment at historic lows (6.3%), retail sales declining 0.5% shows how multiple data points need to be considered to build a complete picture

Price discounting in manufacturing despite cost pressures suggests complex dynamics that simple mean reversion theories might miss

Bottom Line: BCA's analysis offers a valuable lesson in market analysis - instead of assuming mean reversion, successful investors should examine historical patterns, understand structural drivers, and look for concrete catalysts.

Source: BCA Research - LinkedIn

💼 Market Indicators

SPY Performance

Performance and Valuations by Region

Source: MSCI

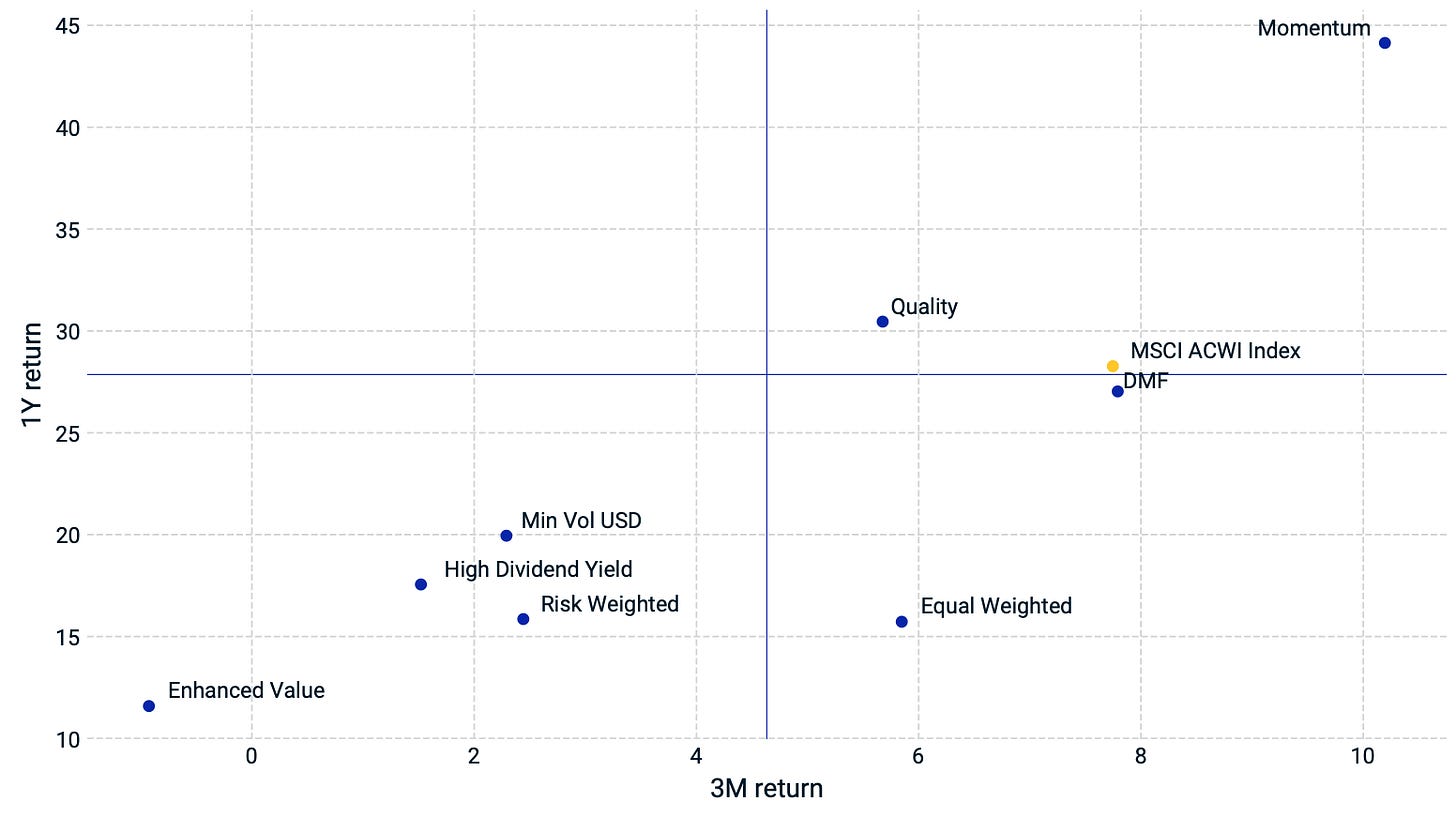

Momentum performance by Style

Source: MSCI

S&P 500 Earnings Per Share

Source: Yardeni Research

🗺️ Around the World in Detail

United States 🇺🇸: Growth vs. Restraint

Growth Stocks Shine: Growth stocks outperformed value by 5.5%, their largest margin since March 2023, as investors bet on tech and consumer discretionary sectors. This rally signals optimism about lower rates driving innovation-heavy sectors.

Jobs Surprise: The U.S. added 227,000 jobs in November, exceeding expectations, while unemployment ticked up to 4.2% as more people joined the workforce. A resilient labor market could influence the Fed’s rate-cut decision in December.

Manufacturing Still Struggles: The ISM Manufacturing PMI improved to 48.4, remaining in contraction but signaling a softer downturn. New orders rebounded, suggesting some stabilization heading into 2024.

International 🌐: Policy Pivots

Canada 🇨🇦

Labor Market Stays Strong: Employment rose by 51,000, while the unemployment rate climbed to 6.8% as more people entered the job market. This suggests resilience but highlights concerns about softening economic momentum.

Manufacturing Growth Returns: The PMI hit 52.0, its highest level since February 2023, driven by domestic demand. Rising input costs due to the strong U.S. dollar could pressure inflation further.

Euro Area 🇪🇺

Manufacturing Woes Deepen: The Eurozone Manufacturing PMI dropped to 45.2, led by declines in Germany and France. Weak demand forced businesses to offer steep discounts, reflecting a challenging fourth quarter.

Political Instability in France: The collapse of France’s government over its deficit-reducing budget widened French-German bond spreads to 90bps, their highest since 2012, before Macron’s intervention eased tensions.

Consumer Struggles: Eurozone retail sales fell 0.5% MoM in October, driven by weak non-food and auto fuel demand. Softening consumer activity could weigh on holiday-season spending.

United Kingdom 🇬🇧

Manufacturing Slumps: The PMI fell to 48.0, its worst reading since February, as output and orders tumbled. Rising input costs and prolonged supply chain issues add to the sector’s challenges.

Service Sector Resilience: Services PMI held above 50 at 50.8, though business confidence dropped due to concerns about rising taxes and weak consumer confidence.

Japan 🇯🇵

Manufacturing Weakness Continues: The PMI dipped to 49.0, marking its fifth straight month of contraction as export demand falters. Hopes for recovery hinge on a rebound in global trade.

Services Rebound: Services PMI edged up to 50.5, supported by strong domestic demand and rising employment, signaling cautious optimism despite international challenges.

Emerging Markets 🌏: Diverging Fortunes

China 🇨🇳

Manufacturing Expands: PMI climbed to 51.5, reflecting improving foreign demand and resilient domestic activity. However, a -6.9% YoY drop in home sales highlights ongoing property market weakness, keeping pressure on policymakers for further stimulus.

Policy Expectations: The upcoming Central Economic Work Conference could deliver fresh stimulus measures to shore up confidence and maintain economic stability.

India 🇮🇳

Strong Growth Signals: The Manufacturing PMI eased to 56.5, still signaling robust expansion driven by new domestic orders. Rising input costs pushed selling prices to a 10-year high, potentially pressuring inflation.

Policy Steady: The RBI held rates at 6.5% but cut the Cash Reserve Ratio to 4% to boost liquidity, reinforcing its accommodative stance amid softening growth.

South Korea 🇰🇷

PMI Back in Growth: Manufacturing PMI rose to 50.6, signaling stabilization after months of contraction, with renewed export orders driving optimism. Rising input costs remain a concern, though firms continue absorbing price pressures.

Inflation Moderates: Annual inflation ticked up to 1.5%, remaining below the central bank’s target, allowing room for further rate cuts.

Taiwan 🇹🇼:

Manufacturing Recovery: PMI increased to 51.5, reflecting the highest growth in output and orders since August. Export-driven demand lifted sentiment, though delivery delays persist.

Inflation Picks Up: Annual inflation rose to 2.08%, driven by higher food and housing costs. Persistent price pressures may limit policy flexibility.

The content provided on MacroQuant Insights is for informational and educational purposes only and does not constitute financial advice. While every effort is made to ensure accuracy and reliability, all data, analysis, and opinions are based on sources believed to be trustworthy but are not guaranteed for completeness or timeliness. The views expressed are solely those of the author and do not reflect endorsements or recommendations for any specific investment, strategy, or action.

Investing involves inherent risks, including the potential loss of principal. Past performance is not indicative of future results. We strongly encourage readers to conduct their own research and consult with a qualified financial advisor or professional before making any financial decisions. MacroQuant Insights and its contributors disclaim all liability for investment decisions based on the information provided and make no warranties regarding the content’s accuracy or reliability.

Remember, all investments carry risks, and it is essential to understand these risks fully before acting on any information presented. Users are responsible for their own investment decisions. MacroQuant Insights assumes no responsibility for any outcomes resulting from the use of this information. Content is subject to change without notice.