Fed Rate Cut Drives Yields Lower as Election Stirs Markets

Week Ending November 08, 2024

Last week, small-cap stocks led the rally with the Russell 2000 up 8.57%, highlighting renewed investor optimism following the U.S. election. Treasury yields dipped by Friday, reversing a post-election bond market selloff after the Fed’s 25-basis-point rate cut. With proposed fiscal policies signaling potential inflation risks, firms like BlackRock and JPMorgan caution that volatility may persist. Let’s break down what this means for the global landscape.

🔍 Takeaway

Last week painted a global picture of cautious optimism amid shifting economic policies. While U.S. markets rallied on election outcomes and renewed fiscal hopes, central banks around the world took action, reflecting mixed growth and inflation concerns. Emerging markets showed resilience, but contrasting narratives hint at ongoing challenges and opportunities.

United States: The Fed’s 25-basis-point rate cut grabbed headlines, pushing Treasury yields lower by week’s end. Investors also digested the impact of the election, weighing fiscal policy changes that could drive inflation higher. This mix of policy shifts may keep market volatility elevated as we approach year-end.

International: In Europe, the PMI climbed to a stagnation-indicating 50, and both the BoE and Riksbank opted to cut rates as economic growth slows. Germany and France saw notable softening, and central banks may need to keep easing policies into 2025 to support demand.

Emerging Markets: China’s exports soared 12.7% in October, a strong signal amid trade tensions, while Japan's stock market gained 3.8%, fueled by the Fed’s rate cut. South Korea’s inflation cooled to 1.3%, hinting that further rate cuts may be on the horizon as emerging markets adapt to shifting global demand.

⭐️ Post of the week

In a recent article shared by Clifford Asness from AQR, new insights reveal that machine learning models are outperforming traditional stock selection methods. By capturing complex patterns in data, these models show a promising edge in portfolio construction, achieving returns up to twice as high as conventional approaches.

Key Points:

Machine Learning Enhances Stock Selection: Traditional models often overlook intricate relationships in stock data, but machine learning identifies and leverages these complex patterns, offering a deeper level of precision.

Boosted Sharpe Ratios: AQR’s machine learning-driven models, tested across various strategies like Fama-French factors and momentum, reached Sharpe ratios up to 2.9—nearly double those of standard linear models.

Consistent Outperformance: Whether applied to value, momentum, or defensive strategies, machine learning models consistently outperform simpler approaches, providing more robust and diversified returns.

Investment Implications:

Immediate: Portfolios utilizing machine learning stand to capture nuanced opportunities that traditional methods miss.

Medium-term: Enhanced stock selection through machine learning could drive sustained performance advantages.

Long-term: Machine learning's potential to reshape portfolio construction suggests it may become a cornerstone in future investment strategies.

Bottom Line

Machine learning offers powerful tools for portfolio managers seeking smarter, more dynamic stock selection. This approach could be key to unlocking future growth in an increasingly complex market landscape.

Source: Clifford Asness - X

💼 Market Indicators

SPY Performance

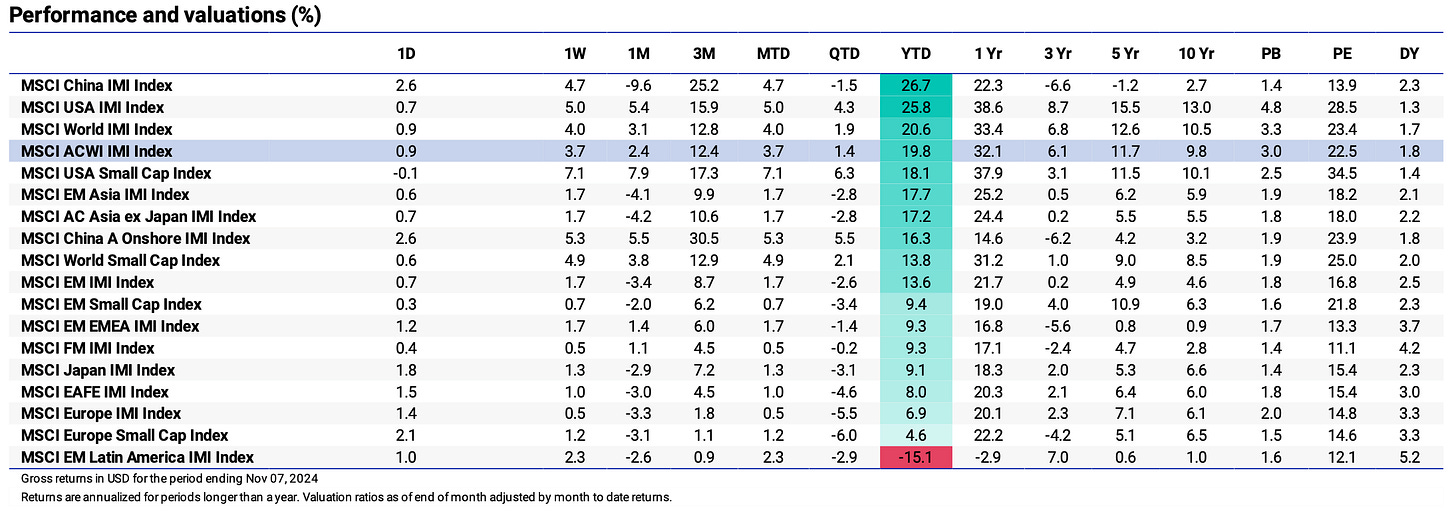

Performance and Valuations by Region

Source: MSCI

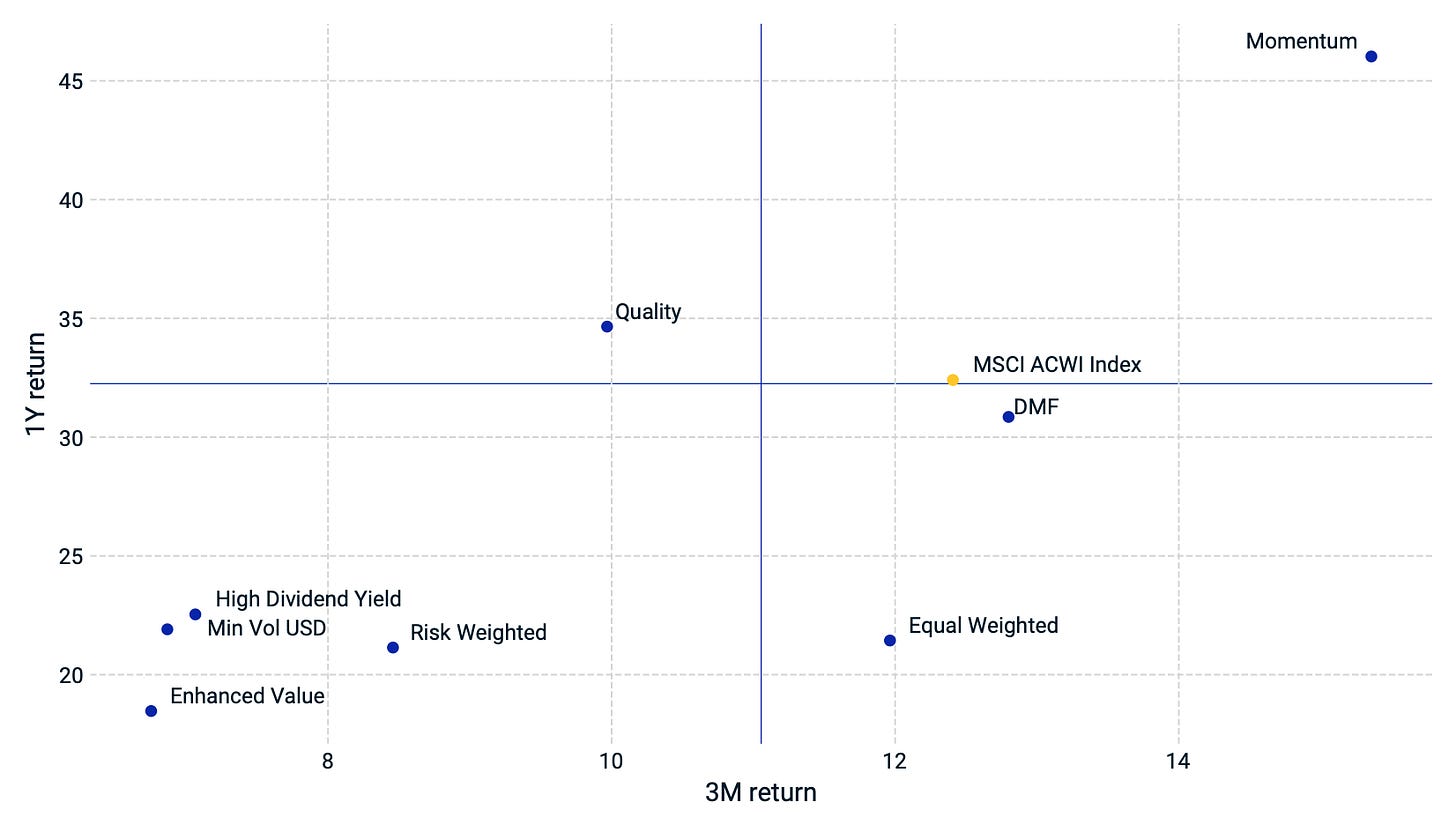

Momentum performance by Style

Source: MSCI

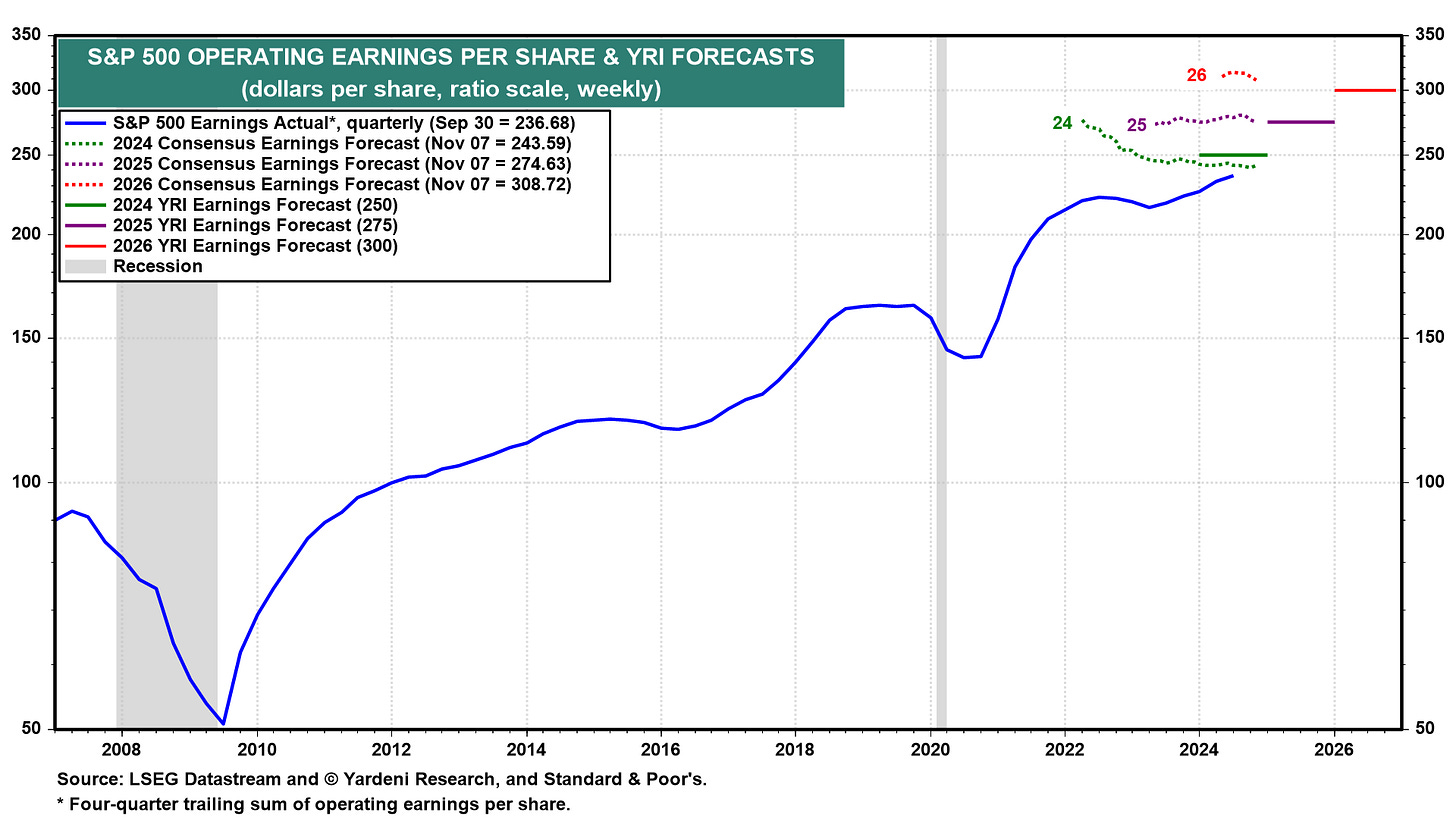

S&P 500 Earnings Per Share

Source: Yardeni Research

🗺️ Around the World in Detail

United States 🇺🇸: Balancing Growth Hopes with Fed’s Next Move

Fed Rate Cut lowered the federal funds target by 25 bps, taking it to 4.5%-4.75%. Powell emphasized a cautious, data-driven approach, leaving December’s rate direction open.

ISM Services PMI Jumped to 56.0 in October, marking the highest reading since August 2022. Strong services growth signals resilient consumer spending with easing price pressures.

Treasury Yields Drift Lower after the Fed’s rate cut and election-driven optimism, reflecting investor caution and potential pause expectations for December.

International 🌐: Policy Adjustments in a Mixed Growth Landscape

Canada 🇨🇦

Job Gains of 14.5K fell short of the 25K forecast but indicate steady labor resilience, with the unemployment rate holding at 6.5%.

Unemployment Holds at 6.5% as the job market stabilizes, balancing broader economic softening concerns and supporting steady consumer activity.

Euro Area 🇪🇺

Eurozone PMI Revised Up to 50 for October, signaling stagnation rather than contraction. The update suggests that Europe’s recovery remains precarious amid slowing growth.

Consumer Confidence Drops Across Europe, driven by inflation concerns and policy uncertainty. Major stock indexes softened, with Italy’s FTSE MIB down 2.48% and France’s CAC 40 by 0.95%.

United Kingdom 🇬🇧

BOE Lowers Rates by 25 bps as inflation falls to a three-year low of 1.7%, signaling a continued easing cycle to support the economy amid softening price growth.

Services Inflation Drops to 4.9%, the lowest in two years, but remains elevated. This reduction aligns with a broader slowdown, impacted by the recent expansionary budget.

Japan 🇯🇵

10-Year Government Bond Yield Hits 1%, as markets anticipate a potential Bank of Japan rate hike in January. Rising yields reflect strengthening economic optimism as policymakers monitor global trends.

Nikkei Gains 3.8% as the U.S. election outcome and Fed rate cut buoy investor sentiment. The yen appreciated slightly, as Japan monitors potential impacts from U.S. policy changes.

Emerging Markets 🌏: Stimulus Sparks and Trade Surges

China 🇨🇳

Trade Surplus Surges to USD 95.27 Billion in October, driven by a 12.7% export increase, the fastest growth since mid-2022. Stimulus measures counterbalance weaker domestic demand.

Inflation Eases to 0.3%, marking rising deflation risks despite ongoing stimulus efforts. Consumer prices reflect continued non-food cost declines, underscoring economic challenges.

South Korea 🇰🇷

Inflation Falls to 1.3% in October, the lowest since January 2021, fueling expectations of a potential January rate cut as the Bank of Korea continues its easing cycle.