Chicago PMI Plunges to 36.9, Manufacturing Slows Again

Week Ending January 03, 2025

Manufacturing sentiment in the U.S. deteriorated sharply in December, with the Chicago PMI plunging to 36.9, its lowest level since May and marking the 13th consecutive month of contraction. This steep decline, driven by collapsing new orders and fading business confidence, underscores the persistent challenges in the manufacturing sector amid high borrowing costs. While the U.S. labor market shows resilience with jobless claims hitting an 8-month low, the growing divide between robust employment and manufacturing weakness signals a complex economic landscape as 2025 begins.

⏱️ Global Markets in 10 Seconds:

🇺🇸 Chicago PMI 36.9, sharpest contraction since May 🏭

🇪🇺 Spain inflation 2.8%, fuels ECB hawks on gradual cuts 🎯

🇨🇳 Manufacturing PMI 50.1, growth slows amid weak demand ⚠️

🇨🇦 Manufacturing PMI 52.2, factory growth hits 10-month high 🚀

🇯🇵 Nikkei -1%, profit-taking caps strong year-end 📉

🔍 The Big Picture

Global economies entered 2025 with diverging trajectories. Manufacturing struggles persisted across major regions, highlighting the weight of higher interest rates, while select sectors and markets showed pockets of resilience. As policymakers balance inflation concerns with growth risks, this week’s data paints a complex but revealing picture for investors.

United States: Manufacturing remained under pressure, with the Chicago PMI falling to 36.9, its lowest since May, while the ISM Manufacturing PMI ticked up to 49.3, and the S&P Global Manufacturing PMI edged down to 49.4. All three indexes stayed below the critical 50 threshold, indicating contraction across the sector. The data underscores the persistent drag from high borrowing costs, even as the labor market shows resilience, with jobless claims dropping to an 8-month low of 211,000.

International: Inflation in Spain rose to 2.8%, up from 2.4%, fueled by higher energy prices and complicating the ECB’s case for rate cuts. This adds tension to Europe’s path toward balancing growth and inflation targets. Meanwhile, in Japan, the Nikkei dipped 1% on profit-taking but ended 2024 at a record high, supported by corporate reforms and a weaker yen. Rising bond yields and a cautious outlook for global demand pose challenges for early 2025.

Emerging Markets: In China, the official Manufacturing PMI slowed to 50.1, signaling weaker growth despite ongoing stimulus measures, while property sales showed tentative stabilization with a 24.2% monthly gain. The data highlights lingering headwinds for China’s economy despite policy support. Conversely, India’s PMI at 56.4 confirmed its status as a regional outperformer, with strong domestic demand fueling job creation and optimism for sustained growth into 2025.

⭐️ Post of the week

This week, Cliff Asness shared a thought-provoking retrospective from the imagined vantage point of 2035, reflecting on the lessons investors could learn from the 2025-2034 decade. By blending foresight and hindsight, the piece challenges today’s assumptions about valuations, diversification, and market trends, offering a creative forecast of potential outcomes.

Why This Analysis Matters

Forecasting with Valuations: Asness imagines a world where investing in U.S. equities at a CAPE of 30+ led to a decade of lackluster returns, underscoring the risks of ignoring valuation frameworks today.

Illusions of Stability: The piece forecasts private equity and private credit underperforming after fees, debunking the notion that these asset classes provide superior risk-adjusted returns.

Overlooking Diversification: Non-U.S. equities, long sidelined by investors, emerge as the surprise outperformer in the story, emphasizing the value of diversification even when U.S. markets dominate the narrative.

Key Takeways

Looking back from 2035, U.S. equities are imagined to have delivered just a few percentage points above cash over the decade, with CAPE declining to 20 despite continued earnings growth—showing how valuations can limit returns.

Private markets, while seen as a volatility hedge, are forecasted to track broader equity markets while underperforming net of fees, highlighting the costs of chasing stability.

International equities, often dismissed today, are forecasted to deliver 5-6% annual real returns, showcasing the long-term benefits of diversification as U.S. valuations normalize.

Bottom Line

Through the lens of 2035, Asness offers a creative reminder of the timeless principles of investing: valuations matter, diversification pays off, and perceived stability often comes with hidden costs. Adopting these insights into today’s analytical frameworks can help investors avoid the traps of complacency and overconfidence while staying resilient in an unpredictable decade ahead.

For more details, read the full analysis here: 2035: An Allocator Looks Back Over the Last 10 Years

Source: Clifford Asness - X

💼 Market Indicators

SPY Performance

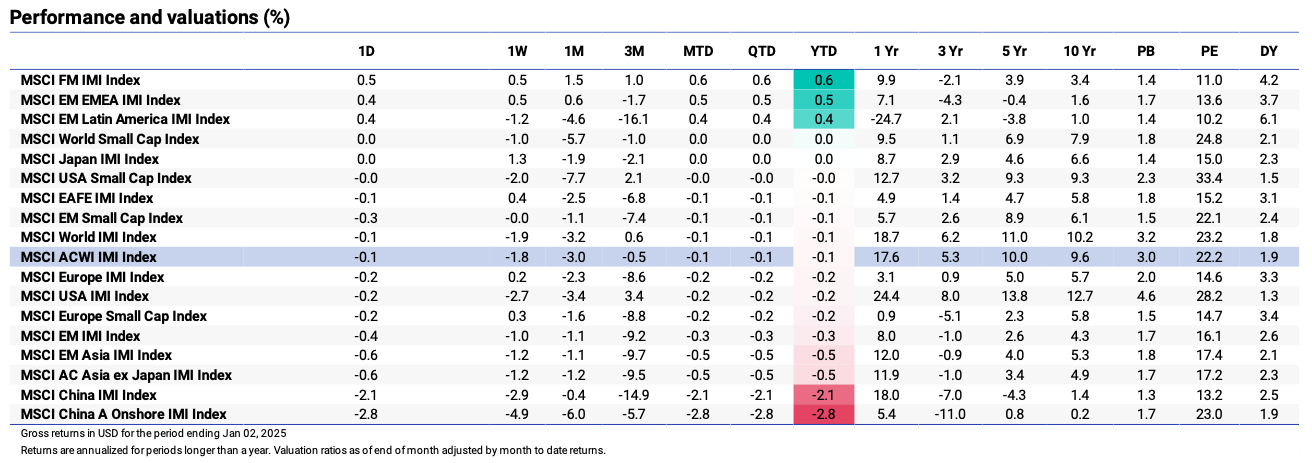

Performance and Valuations by Region

Source: MSCI

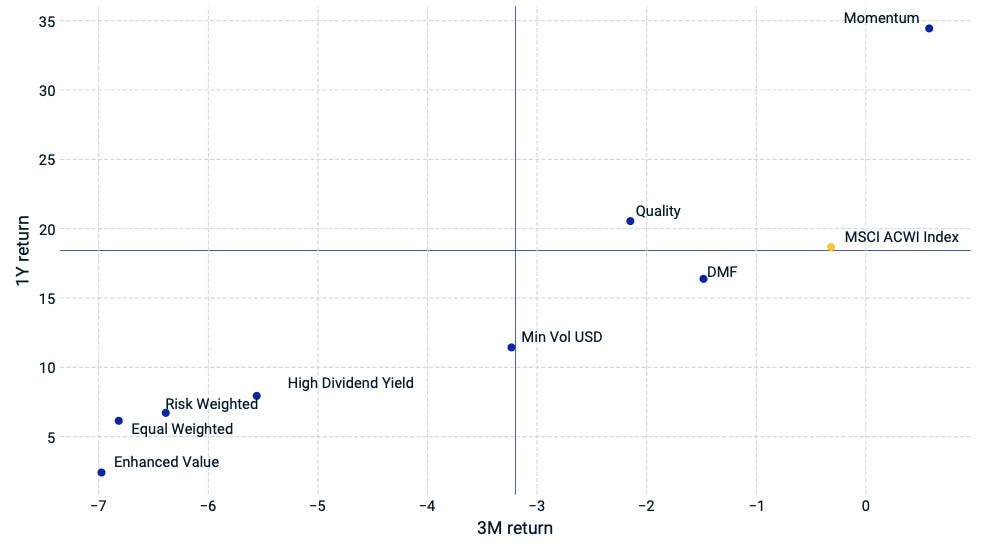

Momentum performance by Style

Source: MSCI

S&P 500 Earnings Per Share

Source: Yardeni Research

🗺️ Around the World in Detail

🇺🇸 United States: Manufacturing Under Pressure

Chicago PMI fell to 36.9, marking its lowest level since May and 13 straight months of contraction. Manufacturing struggles reflect ongoing high borrowing costs, a sharp contrast to the resilience seen in the services sector.

ISM Manufacturing PMI ticked up to 49.3, while S&P Global Manufacturing PMI slipped to 49.4. All major manufacturing indexes remain below 50, signaling contraction across the sector. This points to persistent industrial weakness despite modest improvements in new orders.

Jobless claims dropped to 211,000, an 8-month low, showing that the labor market remains strong. This divergence between labor market strength and manufacturing weakness creates a complex backdrop for policymakers heading into 2025.

🌐 International Markets: Diverging Paths

Canada 🇨🇦

Manufacturing PMI climbed to 52.2, the highest in 10 months, as output and new orders picked up. However, ongoing postal and port strikes have disrupted supply chains, increasing vendor delays and input prices.

Trade worries intensify as U.S. tariffs loom in 2025, creating uncertainty for Canadian exporters despite stronger domestic demand.

Europe 🇪🇺

Eurozone Manufacturing PMI fell to 45.1, extending its two-year contraction streak. Declining orders and workforce cuts in Germany and France highlight the region’s struggle to regain momentum.

Spain’s inflation rose to 2.8%, fueled by higher energy costs. This complicates the ECB’s plan to ease rates, with hawkish policymakers urging caution despite longer-term targets.

UK 🇬🇧

UK house prices jumped 0.7% MoM, the fastest growth since 2022, supported by tight supply and a weaker pound. Meanwhile, mortgage approvals slowed, reflecting affordability pressures as rates remain elevated.

Japan 🇯🇵

Manufacturing PMI improved to 49.6, the highest in three months, with new orders stabilizing. Rising input prices, however, weigh on profit margins, driven by a weaker yen and higher material costs.

Nikkei dipped 1%, closing the year at record highs, up nearly 20% in 2024. The profit-taking reflects global concerns about rising yields and volatility heading into 2025.

🌏 Emerging Markets: Recovery and Risks

China 🇨🇳

Official Manufacturing PMI slipped to 50.1, reflecting slower growth despite policy support. Property sales rose 24.2% MoM, signaling potential stabilization in the housing sector. Lingering headwinds, however, weigh on sentiment.

Non-Manufacturing PMI climbed to 52.2, highlighting strength in services but uneven recovery in broader economic activity.

India 🇮🇳

PMI edged down to 56.4, still one of the highest globally, driven by robust domestic demand and rising employment. Job creation hit a 4-month high, underscoring India’s resilience as a regional outperformer.

Policy outlook remains stable, with expectations of continued support for infrastructure investment to sustain growth in 2025.

South Korea 🇰🇷

Inflation rose to 1.9%, driven by higher food and transport costs, but remains below the Bank of Korea’s 2% target. This supports the central bank’s recent back-to-back rate cuts aimed at boosting growth.

Manufacturing PMI fell to 49, signaling renewed contraction due to sluggish domestic demand. Rising cost pressures add to concerns for South Korean manufacturers.

Taiwan 🇹🇼

Manufacturing PMI rose to 52.7, its highest since July, reflecting robust new orders and optimism for 2025. However, rising input costs suggest margin pressures may persist in the near term.

Export trends steady, supported by semiconductor demand, keeping Taiwan in a favorable position within the global supply chain.

🔑 Key Takeaway

This week’s data underscores the persistent strain of high interest rates on global manufacturing, contrasted with pockets of resilience in labor markets and services. U.S. manufacturing indexes remain mired in contraction territory, with the Chicago PMI plunging to 36.9, while jobless claims hit an 8-month low of 211,000, reflecting labor market strength.

In Europe, inflation in Spain rose to 2.8%, complicating the ECB’s plans for gradual rate cuts amid deepening manufacturing weakness (Eurozone PMI 45.1). Meanwhile, China’s 50.1 PMI signals a tentative recovery, supported by stabilizing property sales, but sluggish global demand remains a headwind. These interconnected dynamics highlight diverging economic paths, creating both challenges and opportunities for markets as 2025 unfolds.

The content provided on MacroQuant Insights is for informational and educational purposes only and does not constitute financial advice. While every effort is made to ensure accuracy and reliability, all data, analysis, and opinions are based on sources believed to be trustworthy but are not guaranteed for completeness or timeliness. The views expressed are solely those of the author and do not reflect endorsements or recommendations for any specific investment, strategy, or action.

Investing involves inherent risks, including the potential loss of principal. Past performance is not indicative of future results. We strongly encourage readers to conduct their own research and consult with a qualified financial advisor or professional before making any financial decisions. MacroQuant Insights and its contributors disclaim all liability for investment decisions based on the information provided and make no warranties regarding the content’s accuracy or reliability.

Remember, all investments carry risks, and it is essential to understand these risks fully before acting on any information presented. Users are responsible for their own investment decisions. MacroQuant Insights assumes no responsibility for any outcomes resulting from the use of this information. Content is subject to change without notice.