4.50% Yields Shake Markets Amid Fed’s Hawkish Outlook

Week Ending December 20, 2024

Treasury yields climbed to 4.50%, driving U.S. stocks lower this week as the Fed signaled a more cautious path for rate cuts in 2025. This surge, fueled by higher-than-expected core inflation of 2.8% and a reduction in projected 2025 rate cuts from four to two, amplified fears of prolonged monetary tightening. While robust 3.1% GDP growth and resilient consumer spending underscore economic strength, rising yields and hawkish Fed commentary suggest tighter financial conditions ahead, setting the stage for challenging market dynamics in early 2025.

⏱️ Global Markets in 10 Seconds:

🇺🇸 Treasury Yields 4.50% as Fed signals fewer 2025 rate cuts 🎯

🇪🇺 45.2 Manufacturing PMI highlights deepening industrial slump 🏭

🇨🇳 Retail Sales +3% slowest growth since August, consumer caution ⚠️

🇮🇳 60.8 Services PMI fastest growth since August, demand surges 🚀

🇯🇵 2.7% Core Inflation hits three-month high, BoJ holds rates steady 🏦

🔍 The Big Picture

This week highlighted a global economy navigating shifting dynamics. Central banks remain cautious, with mixed inflation trends and slowing industrial activity shaping monetary policy outlooks. While developed markets grapple with diverging sectors, emerging economies showcase stark contrasts in growth trajectories.

United States: Core inflation held steady at 2.8%, reinforcing the Fed’s cautious stance as it lowered 2025 rate-cut projections. Meanwhile, GDP growth surprised at 3.1% for Q3, boosted by consumer spending. The tension between robust growth and sticky inflation signals tighter financial conditions heading into the new year.

International: Eurozone manufacturing PMI remained entrenched in contraction at 45.2, reflecting continued industrial struggles, particularly in Germany and France. However, services PMI rebounded to 51.4, suggesting pockets of resilience in the bloc's economy. Policymakers face a delicate balance as inflationary pressures linger.

Emerging Markets: China’s retail sales slowed to 3%, highlighting weak domestic demand, while property investment fell 10.4%, underscoring structural challenges. In contrast, India’s services PMI soared to 60.8, marking the fastest growth in four months and showcasing the region’s standout momentum.

⭐️ Post of the week

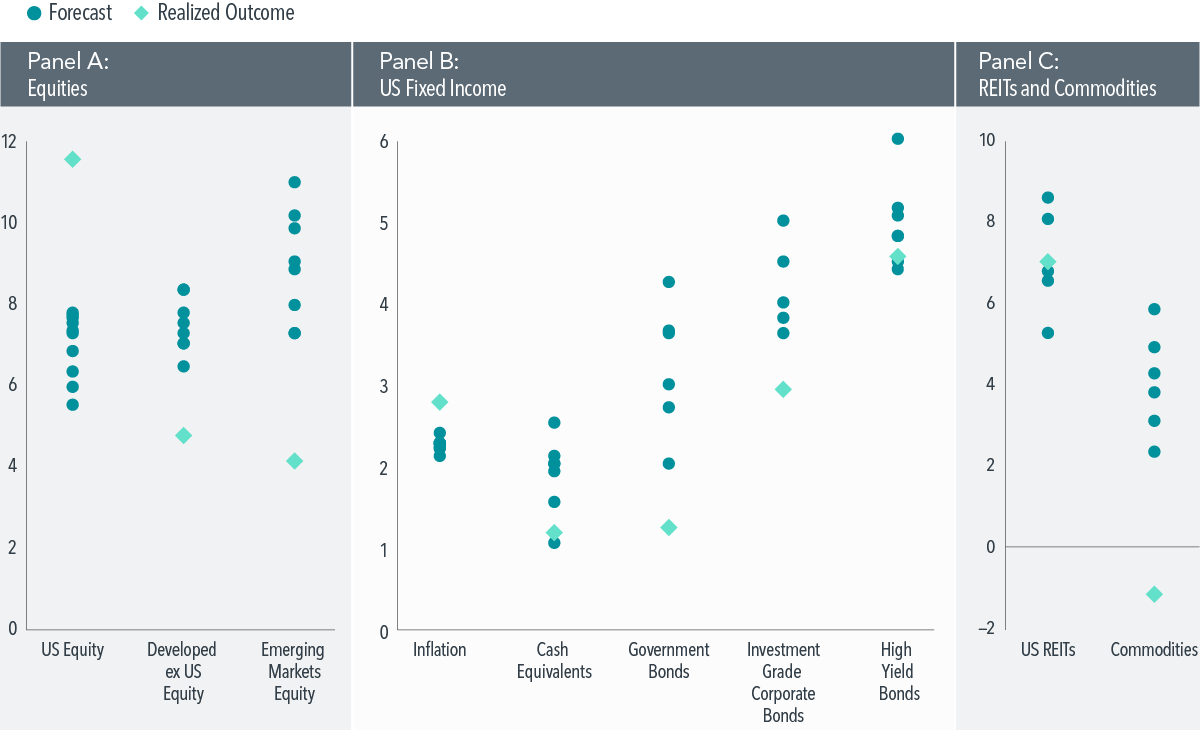

This week, Katie Hendrix from Dimensional Advisors highlighted a reality check on Capital Market Assumptions (CMAs) and how well they align with actual returns over a decade. Her analysis underscores the wide variability in forecasts and the importance of embracing uncertainty when planning long-term investment strategies.

Source: Dimensional Fund Advisors

Why This Analysis Matters

• Analytical Tool: Katie’s team compared 2014-2023 CMA return forecasts to realized outcomes across equities, fixed income, REITs, and commodities, showing the limits of long-term prediction tools.

• Challenge to Bias: It confronts the assumption that CMAs are precise predictors, showing average errors of 4+ percentage points in equities and 3+ points for commodities.

• Deeper Insight: This analysis reminds investors to use CMAs as guides for scenario planning, not definitive answers, highlighting the need for diversification and disciplined decision-making.

Supporting Evidence

• Equities: U.S. equity returns vastly outperformed CMAs, realizing 11.5% annually, compared to forecasts in the 5.5%-7.7% range. Emerging markets, however, fell below expectations.

• Fixed Income: Inflation consistently exceeded forecasts, while bond returns underwhelmed, emphasizing the challenge of predicting low-volatility assets over long horizons.

• Commodities & REITs: Commodities saw the largest forecast errors, with even the best predictions missing by over 3 percentage points, illustrating the difficulty of anticipating volatile asset classes.

Bottom Line

CMAs are invaluable tools for setting realistic expectations and planning for ranges of outcomes. However, as this analysis shows, they shouldn’t be used as a crystal ball. Investors are best served by focusing on broad diversification, goal alignment, and resilience to uncertainty rather than chasing precision in return forecasts.

For more details, read the full analysis here: Reality Check: Capital Market Assumptions vs. Actual Returns

Source: Katie Hendrix - LinkedIn

💼 Market Indicators

SPY Performance

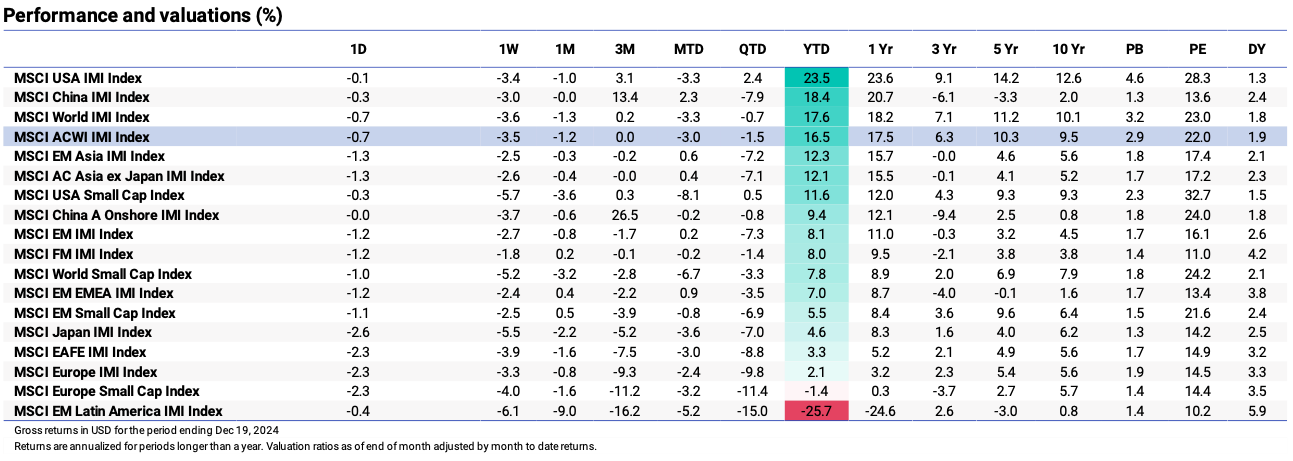

Performance and Valuations by Region

Source: MSCI

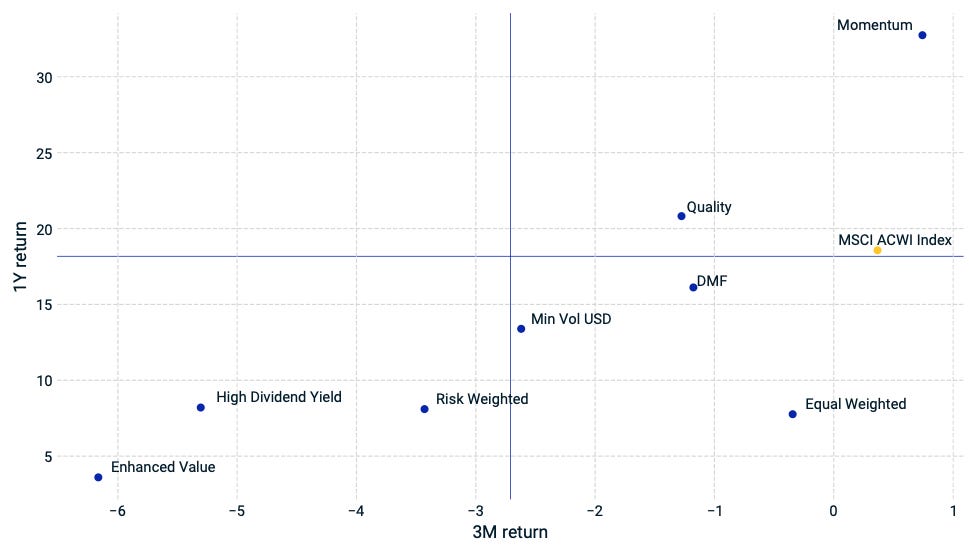

Momentum performance by Style

Source: MSCI

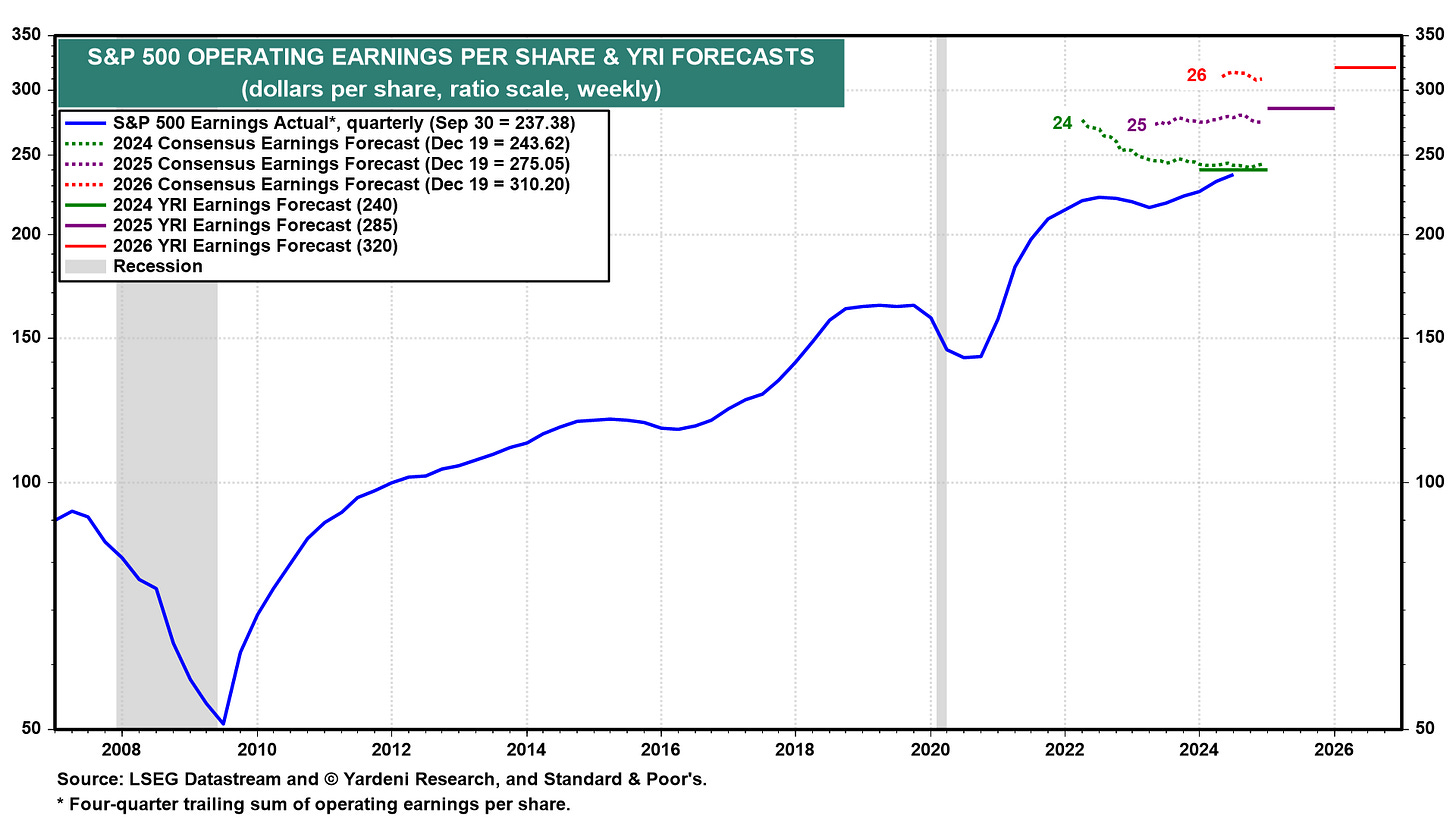

S&P 500 Earnings Per Share

Source: Yardeni Research

🗺️ Around the World in Detail

🇺🇸 United States: Growth vs. Inflation

• Core inflation held at 2.8% in November, signaling persistent price pressures that pushed the Fed to forecast fewer rate cuts in 2025. This raises concerns about prolonged tighter financial conditions heading into next year.

• GDP grew 3.1% annualized in Q3, beating earlier estimates of 2.8%. Consumer spending remains a key driver, showcasing resilience even amid higher borrowing costs.

• Retail sales jumped 0.7% in November, buoyed by strong auto sales (+2.6%). Holiday spending has stayed robust, easing fears of a pullback in consumer demand.

🌐 International Markets: Mixed Momentum

Canada 🇨🇦

• Inflation slowed to 1.9%, easing below market expectations of 2%. While this supports the Bank of Canada’s cautious stance on further rate cuts, sticky core inflation at 2.7% may temper policy flexibility.

• Retail sales flat in November, with auto sales offsetting declines in fuel and food. Consumer demand appears steady, but rising borrowing costs could weigh on future spending.

Europe 🇪🇺

• Eurozone manufacturing PMI stuck at 45.2, extending its contraction streak to two years. Germany and France remain key drags, highlighting persistent industrial weaknesses.

• Services PMI rebounded to 51.4, signaling growth after November's contraction. This suggests pockets of resilience, though optimism remains fragile amid inflationary pressures.

UK 🇬🇧

• Core inflation rose to 3.5%, driven by higher rents and service costs. With CPI at an eight-month high of 2.6%, the Bank of England kept rates at 4.75%, but a divided vote signals hesitation about future cuts.

• Retail sales edged up 0.2% in November, with Black Friday promotions likely boosting activity. However, weak clothing sales (-2.6%) underscore continued pressure on discretionary spending.

Japan 🇯🇵

• Core inflation climbed to 2.7%, a three-month high, raising speculation about policy tightening. The BoJ, however, maintained rates, citing the need for more data on wage growth and global risks.

• Yen weakened to 156 per USD, aiding exporters but prompting intervention warnings. Market expectations of slower BoJ normalization may delay any significant policy shifts.

🌏 Emerging Markets: Contrasting Paths

China 🇨🇳

• Retail sales slowed to 3% YoY, the weakest growth since August, reflecting subdued consumer sentiment. Industrial production (+5.4%) was a bright spot, but property investment (-10.4%) underscores ongoing structural challenges.

• Property prices dipped 0.1% in November, marking the 17th straight monthly decline. Beijing’s stimulus efforts show limited traction as policymakers seek to stabilize the sector.

India 🇮🇳

• Services PMI soared to 60.8, the fastest growth since August, fueled by robust new orders and job creation. The private sector continues to outperform peers, bolstered by resilient domestic demand.

• Manufacturing PMI hit 57.4, reflecting strong export and domestic demand. Rising inventories suggest optimism among businesses heading into 2025.

South Korea 🇰🇷

Producer inflation rose 1.4% YoY, driven by manufacturing costs rebounding to +0.5%. This points to rising input costs that could weigh on exports, already challenged by weak global demand.

Taiwan 🇹🇼

GDP growth revised up to 4.25% for 2024, as strong tech exports drive economic momentum. However, uncertainty around U.S. trade policy under the Trump administration looms as a key risk.

🔑 Key Takeaway

This week’s data underscores the shockwaves from the Fed’s revised outlook, cutting 2025 rate-cut expectations from four to just two. U.S. markets reacted swiftly, with Treasury yields climbing to 4.50% and stocks sliding amid renewed concerns about prolonged monetary tightening. While resilient 3.1% GDP growth and robust retail sales (+0.7%) signal underlying economic strength, the Fed’s hawkish tone weighed on sentiment. Globally, Europe’s industrial slump (PMI 45.2) and China’s fragile 3% retail sales growth highlight challenges in sustaining growth, while India’s soaring 60.8 services PMI remains a rare bright spot. The Fed’s pivot casts a long shadow over 2025, setting the stage for tighter global financial conditions.

The content provided on MacroQuant Insights is for informational and educational purposes only and does not constitute financial advice. While every effort is made to ensure accuracy and reliability, all data, analysis, and opinions are based on sources believed to be trustworthy but are not guaranteed for completeness or timeliness. The views expressed are solely those of the author and do not reflect endorsements or recommendations for any specific investment, strategy, or action.

Investing involves inherent risks, including the potential loss of principal. Past performance is not indicative of future results. We strongly encourage readers to conduct their own research and consult with a qualified financial advisor or professional before making any financial decisions. MacroQuant Insights and its contributors disclaim all liability for investment decisions based on the information provided and make no warranties regarding the content’s accuracy or reliability.

Remember, all investments carry risks, and it is essential to understand these risks fully before acting on any information presented. Users are responsible for their own investment decisions. MacroQuant Insights assumes no responsibility for any outcomes resulting from the use of this information. Content is subject to change without notice.